Friday, April 19, 2024

Local News

Lynnwood seeks solutions to Costco traffic boondoggle

Let’s take a look at the troublesome intersection of 33rd Avenue W and 30th Place W, as Lynnwood weighs options for better traffic flow.

Death of Everett boy, 4, spurs questions over lack of Amber Alert

Frito-Lay leases massive building at Marysville business park

Everett mom charged with first-degree murder in death of son, 4

Mountain Loop Highway partially reopens Friday

After long legal battle, Everett rewrites bikini barista dress code

Sports

E-W weathers Shorewood’s storm in battle of soccer unbeatens

Alex Plumis’ 72nd-minute goal completed the comeback as the Warriors topped the Stormrays.

New coach Macdonald wants his Seahawks to forge own legacy

The pictures of iconic moments from the Pete Carroll era have been removed from Seattle’s training facility.

Most Read

e-Edition

Food & Drink

Obsidian Beer Hall takes over former Toggle’s space in downtown Everett

Beyond beer, the Black-owned taphouse boasts a chill vibe with plush sofas, art on the walls and hip-hop on the speakers.

Oxtail stew and fufu: Heritage African Restaurant in Everett dishes it up

“Most of the people who walk in through the door don’t know our food,” said Fatou Dibba, co-owner of the new restaurant at Hewitt and Broadway.

Hey Honeycrisp, this new breed of apple needs a name

New pizzeria owner took the scenic route from Nepal to Marysville

Popsies offers kaleidoscope of popcorn flavors on Whidbey Island

Are potatoes vegetables? A national committee is hashing that out

How to make an Easter ham last all week — or longer by properly freezing it

Reader Poll

Opinion

Editorial: Move ahead with state forests’ carbon credit sales

A judge clears a state program to set aside forestland and sell carbon credits for climate efforts.

Life

Mountlake Terrace’s Lily Gladstone plays cop in Hulu’s ‘Under the Bridge’

The true-crime drama started streaming Wednesday. It’s Gladstone’s first part since her star turn in “Killers of the Flower Moon.”

The 1,500-pound Sasquatch: Bigfoot comes to life in woods near Monroe

A possibly larger-than-life sculpture, created by Terry Carrigan of Skywater Studios, will be featured at this weekend’s “Oddmall” expo.

Business

Simreet Dhaliwal wins The Herald’s 2024 Emerging Leaders Award

Dhaliwal, an economic development and tourism specialist, was one of 12 finalists for the award celebrating young leaders in Snohomish County.

New Jersey company acquires Lynnwood Land Rover dealership

Land Rover Seattle, now Land Rover Lynnwood, has been purchased by Holman, a 100-year-old company.

Northwest

Washington issues statewide drought declaration, including Snohomish County

Drought is declared when there is less than 75% of normal water supply and “there is the risk of undue hardship.”

Boeing fired lobbying firm that helped it navigate 737 Max crashes

Amid congressional hearings on Boeing’s “broken safety culture,” the company has severed ties with one of D.C.’s most powerful firms.

Orcas Island’s storied Rosario Resort finds a local owner

Washington will move to tougher limits on ‘forever chemicals’ in water

State: Contractor got workers off Craigslist to remove asbestos in Everett

Snohomish County organization rescues neglected llamas in Yakima County

Micro-apartments are back after nearly a century, as need for affordable housing soars

sponsored

Detached accessory dwelling units are changing lives

sponsored

Sunscreen? Check. Passport? Check. Charging cords? Got ‘em.

sponsored

How the equity in your home can help your money work harder

sponsored

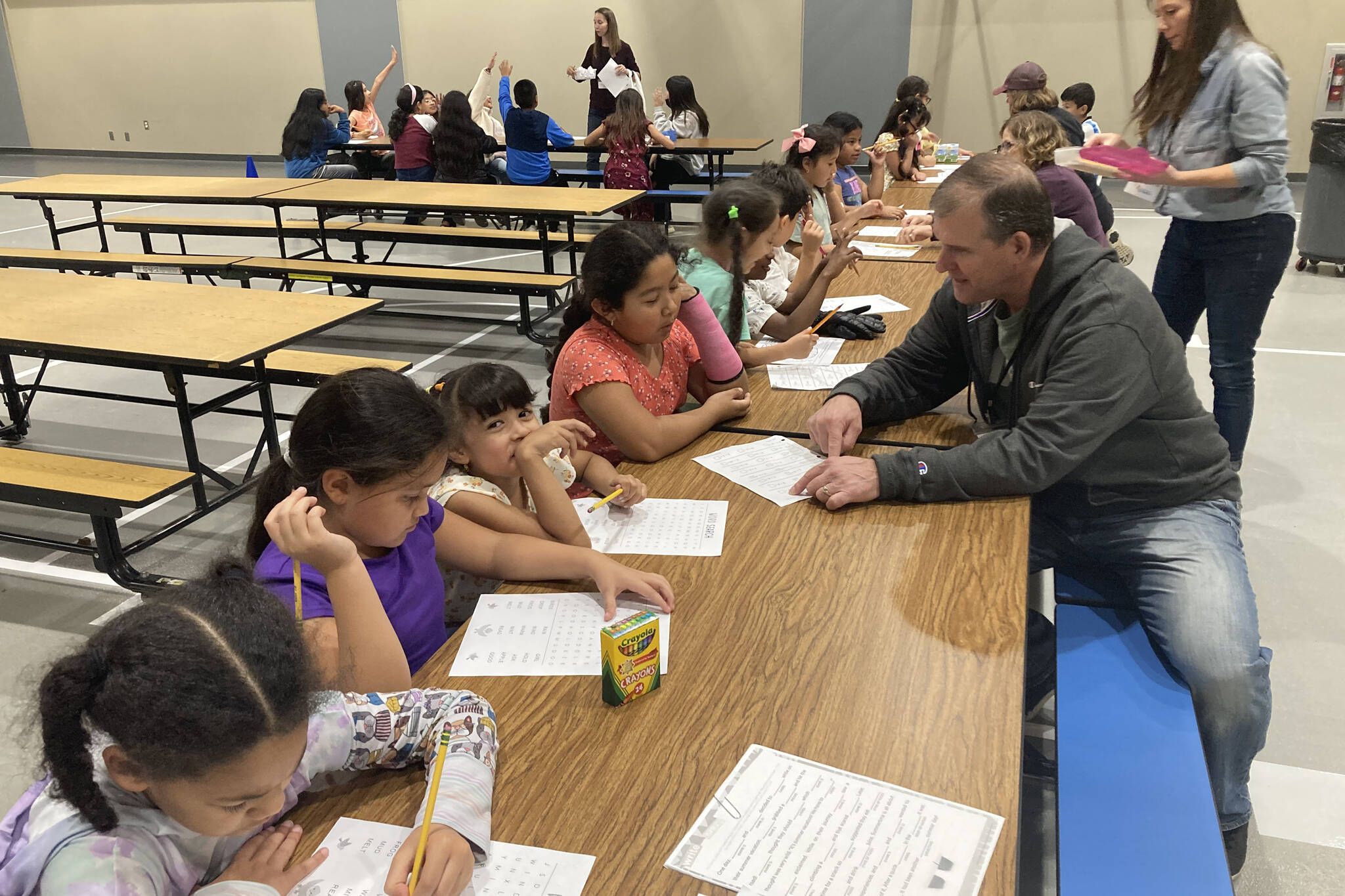

There’s something special that happens at Monroe Rotary Field on Saturdays every…

sponsored

For Jim Spane, owner of Mount Vernon’s Spane Buildings, being there for…

sponsored

Comprehensive care approach fuels three decades of dedicated surgical service

sponsored

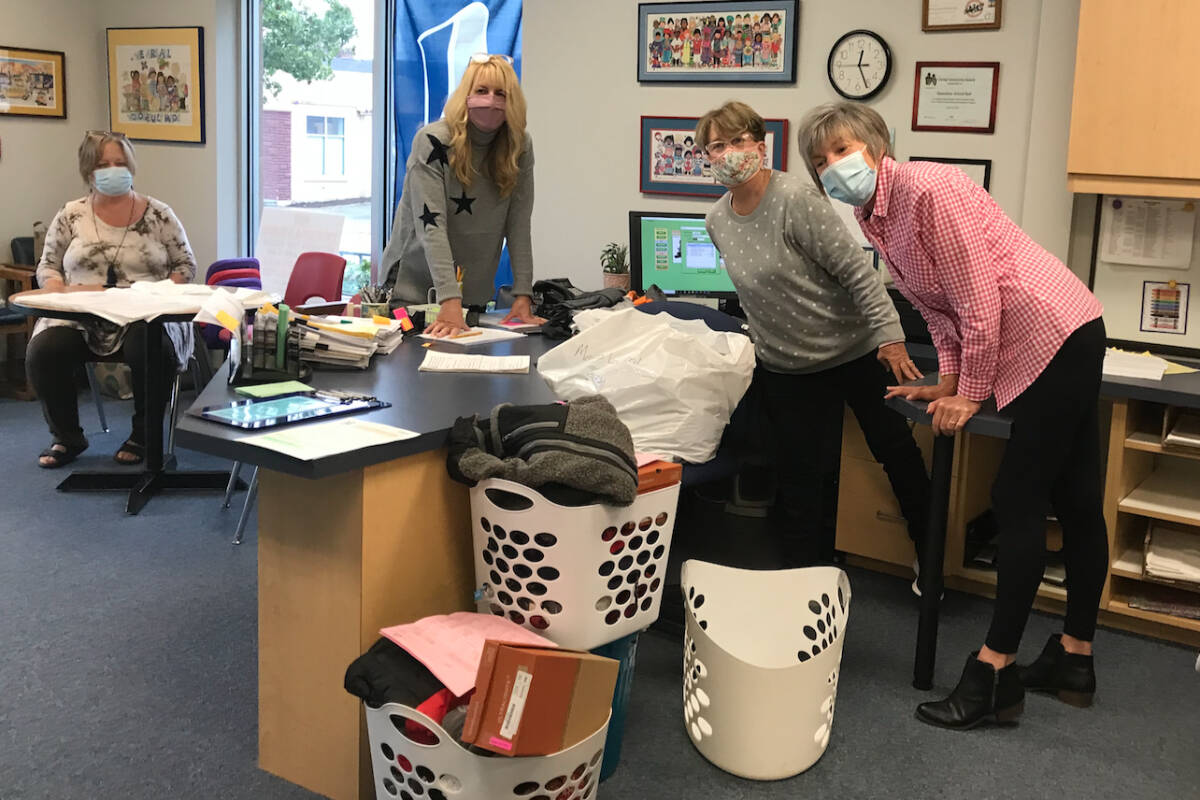

Innovative community programs foster resilience among families in need

sponsored

Organization offers a variety of programs to help children thrive