Wednesday, April 17, 2024

Local News

Lynnwood seeks solutions to Costco traffic boondoggle

Let’s take a look at the troublesome intersection of 33rd Avenue W and 30th Place W, as Lynnwood weighs options for better traffic flow.

Death of Everett boy, 4, spurs questions over lack of Amber Alert

Frito-Lay leases massive building at Marysville business park

To combat fentanyl, Snohomish County trickles out cash to recovery groups

Second trial begins for man accused of stomping Everett woman to death

New Jersey company acquires Lynnwood Land Rover dealership

Sports

Prep roundup for Tuesday, April 16

Prep roundup for Tuesday, April 16: (Note for coaches/scorekeepers: To report results… Continue reading

Vote for The Herald’s Prep Athlete of the Week for April 8-14

The Athlete of the Week nominees for April 8-14. Voting closes at… Continue reading

Most Read

e-Edition

Food & Drink

Oxtail stew and fufu: Heritage African Restaurant in Everett dishes it up

“Most of the people who walk in through the door don’t know our food,” said Fatou Dibba, co-owner of the new restaurant at Hewitt and Broadway.

Hey Honeycrisp, this new breed of apple needs a name

Enter a naming contest for WA 64, a hybrid apple with the same baby daddy as Cosmic Crisp.

New pizzeria owner took the scenic route from Nepal to Marysville

Popsies offers kaleidoscope of popcorn flavors on Whidbey Island

Who takes the cake? The best bakery in Snohomish County

Are potatoes vegetables? A national committee is hashing that out

How to make an Easter ham last all week — or longer by properly freezing it

Reader Poll

Opinion

Editorial: Apple-naming contest fun celebration of state icon

A new variety developed at WSU needs a name. But take a pass on suggesting Crispy McPinkface.

Life

Downward cat? At kitten yoga in Everett, it’s all paw-sitive vibes

It wasn’t a stretch for furry felines to distract participants. Some cats left with new families — including a reporter.

2024 Ford Maverick compact pickup undergoes a switch

The previous standard engine is now optional. The previous optional engine is now standard.

Business

New Jersey company acquires Lynnwood Land Rover dealership

Land Rover Seattle, now Land Rover Lynnwood, has been purchased by Holman, a 100-year-old company.

Szabella Pasztor: Change begins at a grassroots level

As development director at Farmer Frog, Pasztor supports social justice, equity and community empowerment.

Northwest

Boeing fired lobbying firm that helped it navigate 737 Max crashes

Amid congressional hearings on Boeing’s “broken safety culture,” the company has severed ties with one of D.C.’s most powerful firms.

Orcas Island’s storied Rosario Resort finds a local owner

Founded by an Orcas Island resident, Empower Investing plans” dramatic renovations” to restore the historic resort.

Washington will move to tougher limits on ‘forever chemicals’ in water

State: Contractor got workers off Craigslist to remove asbestos in Everett

Snohomish County organization rescues neglected llamas in Yakima County

Micro-apartments are back after nearly a century, as need for affordable housing soars

FBI tells passengers on 737 flight they might be crime victims

sponsored

How the equity in your home can help your money work harder

sponsored

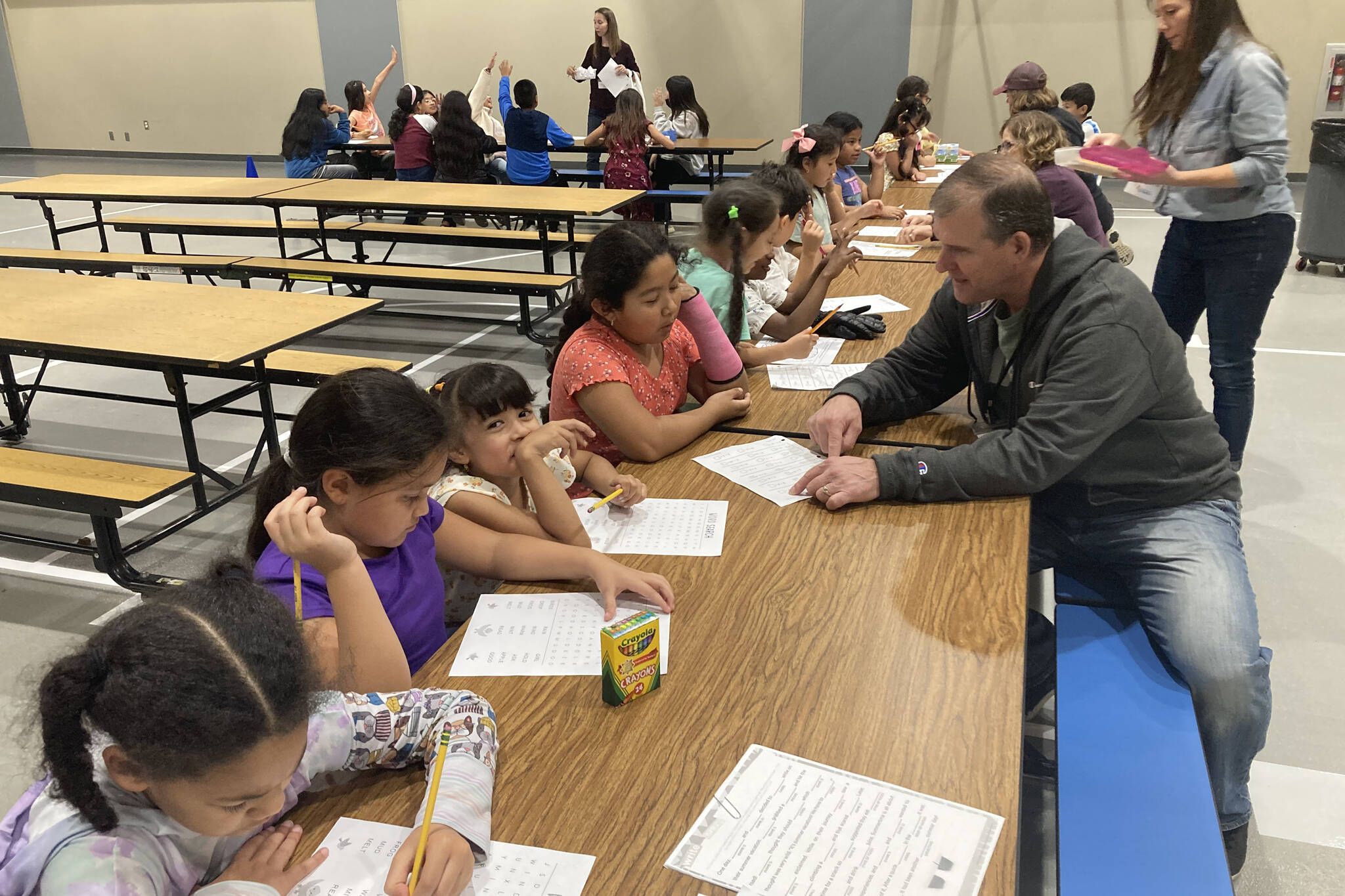

There’s something special that happens at Monroe Rotary Field on Saturdays every…

sponsored

Let’s talk about sex.

sponsored

Check out the new spring tire-swap offer from Fast Eddie’s Tire Pros…

sponsored

For Jim Spane, owner of Mount Vernon’s Spane Buildings, being there for…

sponsored

Comprehensive care approach fuels three decades of dedicated surgical service

sponsored

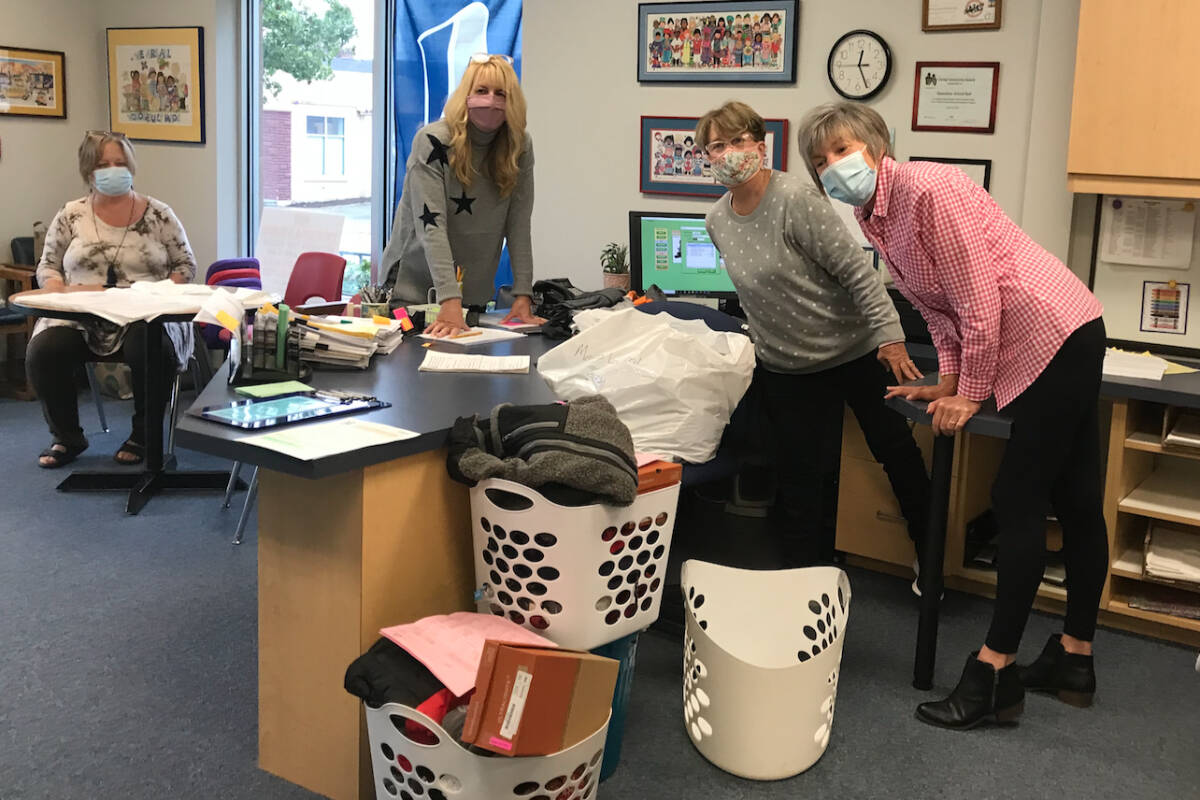

Innovative community programs foster resilience among families in need

sponsored

Organization offers a variety of programs to help children thrive