How fortunate we are that now there are many platforms that could help you with emergency loans for bad credit. Compared to conventional loans, these online loans are much quicker and easier due to their straightforward procedure.

You can find countless websites claiming to provide instant loans. However, not all of them are reliable and trustworthy enough. There are many factors to consider when choosing a platform to apply for loans, such as the loan types, repayment terms, interest rates, ease of procedure, and many other things.

Out of so many platforms available on the Internet, here are the websites we highly recommend to get the best emergency loans for bad credits.

1: WeLoans – Most Secure Website for a Variety of Emergency Loans

2. US Bad Credit Loans – Instant Approvals for Small Emergency Loans

3: iPaydayLoans – Highly Flexible Platform for Online Emergency Loans

4: CocoLoan – Best Long-term Emergency Loans of The Year

Each platform has its advantages and disadvantages. You should look into each one of these websites to decide which one is the most suitable for you to get your fast cash.

WeLoans

To get your emergency loans immediately, WeLoans is the platform you should consider visiting. Sometimes, the funds from your agreed loans may arrive at your bank account within the same day of the application. This platform also boasts top-notch security measures to keep all your activities on the platform private and safe.

Pros

- Many loan types to choose from, including personal loans that are available for up to $35,000

- Advanced security protocols to guarantee your privacy and data safety

- Low chances of getting rejected

Cons

- Loans are restricted in some states

- Some lenders may charge an origination fee

Why We Choose It

Most lenders in WeLoans run soft credit checks. Besides making the process even quicker, this method also creates a big chance for applicants with bad credit to get approved. Also, this platform has a high approval rate of more than 90% for its payday loans with no credit check.

If you need more money, you can opt to apply for personal loans instead. There are also many other loan types you can look into and consider. While some loans may take days to get the funds transferred to you, most of them can be ready in no more than 24 hours after your application.

Get Your Emergency Loans Quickly on WeLoans Today!

US Bad Credit Loans

From $50 to $35,000, US Bad Credit Loans is ready to facilitate your instant loan application. The platform connects to a large number of direct lenders that are ready to provide fast approvals and interesting offers. Many of them are even welcoming applicants with bad credit scores.

Pros:

- Plenty of variations of loan types to choose

- No hard credit check to make it possible for bad credit loans

- Offering up to $35,000 for personal loans

Cons:

- Interest rates may be relatively higher than other platforms

- May only cater for small loans with a total amount is no more than $5,000

Why We Choose It

The platform has a high level of security protocols protecting its website. It also has a large board of direct lenders to process your loan applications.

Available loan types may vary on different platforms. Each comes with different policies, terms, and conditions. Hence, you can find one that benefits you the most based on your unique situation.

While there are limitations, this platform is still helpful if you only need small loans for your emergency. People with bad credit scores are less likely to get rejected because most lenders do not take credit scores as the main factor to measure your creditworthiness. Even better, you may improve your credit score to a higher level as you pay back your debts in time.

Apply for Your Emergency Loans on US Bad Credit Loans Now!

iPaydayLoans

With so many options of loan types to choose from, people can easily find the loans they feel comfortable with on iPaydayLoans. The website looks simple and easy to use, yet is already protected with advanced measures of security. Even the loan offers that you may receive from various lenders will disclose all the information regarding the loan contract, so you can make a thoughtful decision that you will never regret.

Pros:

- Various types of loans to cater different needs

- Trustworthy lenders with no hidden fees or policies

- Bad credit loans are available

Cons:

- Some loans may have high-interest rates

- The services are not available in some states

Why We Choose It

iPaydayLoans has many loan types to offer and flexible terms to suit your current financial situation. While most of those are small loans, you can still borrow up to $35,000 by applying for personal loans. You don’t even need to have good credit or valuable collateral to get approved.

Applying for loans on this platform is very easy. It wouldn’t take much time to fill out the application form and wait for the lenders to send you offers. Some loans are even possible to get the cash deposited to your account within the same day, so you can use it as emergency money.

Visit iPaydayLoans to Get Your Loans Now!

CocoLoan

Anyone needing emergency same-day loans can visit CocoLoan to get short-term loans. Your funds can instantly be available within 24 hours or even less. In this platform, you can apply up to $35,000 of loan amount with flexible repayment terms ranging from 7 days to 12 months.

Pros:

- Flexible repayment terms, even for the smallest loans

- All loan offers to disclose complete information regarding the terms, conditions, and all policies regarding the contract

- Having an extensive network of reputable direct lenders

Cons:

- APR can be relatively high

- The website may offer other credit-related services, such as debt relief or credit monitoring

Why We Choose It

CocoLoan takes only a few minutes to forward your online loan application to its lenders. You will then receive multiple offers with disclosed terms and conditions to compare between one another before deciding which one to take. If you decide not to take any loan, there will be no fee for you to pay.

The amount of money you can borrow from short-term loans is $35,000, which is big enough to cover various expenses. With flexible repayment terms, it would be easy for you to manage your finances so you can pay off your debts in time without feeling the burden of it.

Apply for Emergency Money on CocoLoan Now!

BadCreditLoans

Another online loan platform to consider if you have bad credit scores is BadCreditLoans because there is no minimum credit score on its eligibility requirement. There are several loan types available to pick with amounts ranging from $100 to $1,000. You can adjust your repayment terms between 3 to 72 months with an APR of 5.99% to 35.99%.

Pros:

- Fair APR even for applicants with bad credit scores

- Wide flexibility of repayment terms to adjust as you find convenient the most

- Board a network of lenders to offer you loans

Cons:

- Some states may restrict the availability of the loans

- There may be ads for other non-credit products

Why We Choose It

BadCreditLoans offers ultimately flexible repayment terms for the small loans they provide, which can make the loans affordable for people in financial struggles. With an extended network of lenders, you will have more opportunities in getting approval.

Loan repayment terms and APR on this platform are still at a reasonable level. Plus, the website also guarantees data privacy and security. You wouldn’t even need to pay a dime only to use the website.

Come to BadCreditLoans Now to Get Your Funds!

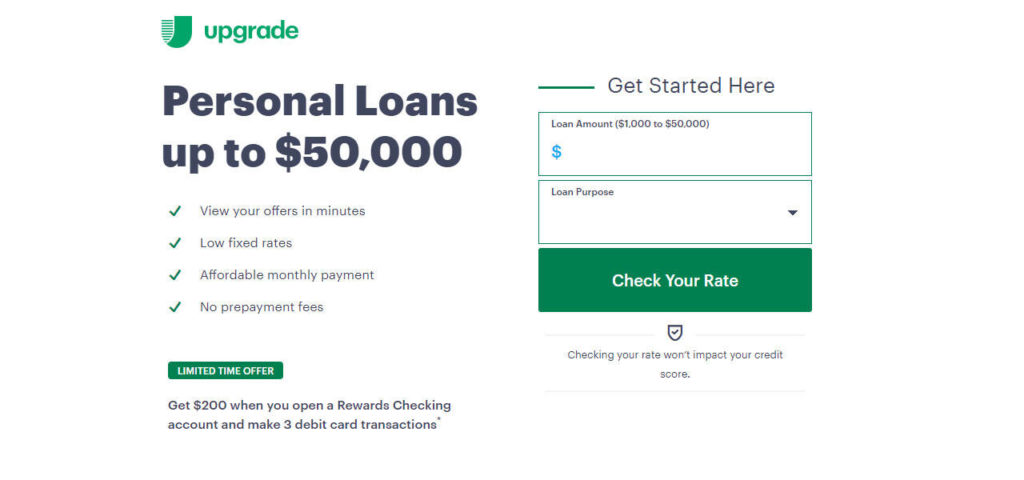

Upgrade

If you are looking for a high amount of loans, you can visit Upgrade and submit your application there. This platform offers up to $50,000 for loans for you to repay in 24 to 84 months. The APR ranges from 5.94% to 35.97%, including an origination fee of up to 8%. Loans are available in all 50 states, except for the District of Columbia.

Pros:

- Offering small to big loans

- Long repayment terms are available to make the loans more affordable

- Available almost in every state in the US

Cons:

- You have to pay an origination fee

- People with credit scores lower than 550 are not eligible for unsecured emergency loans

Why We Choose It

People in financial struggles can significantly benefit from these flexible loans to get them out of their difficult situations. With long terms and reasonable APR, people can get loans with high amounts without feeling the burden of paying everything back as quickly as possible. If you have valuable possessions, you might even be able to apply for secured loans to get a lower APR for your repayments.

Lenders will process your application in a few minutes. After signing a loan contract, you may expect your money to be available in one business day, more or less.

Visit Upgrade to Get Your Loans Now>>

Upstart

Offering loans of up to $50,000, Upstart has built an impressive reputation as a platform for online loans. You can choose to have your repayment term in either three or five years, which you can still prepay with no penalties. However, you need a good credit score to get approved for emergency loans.

Pros:

- Long repayment term reduces the burden of high installments

- Fair interest rates and APR of less than 36%

- No penalty for early repayments

Cons:

- Bad credit borrowers are not eligible for the emergency loans

- Some states do not allow their loans

Visit Upstart to Apply for High Loans Now!

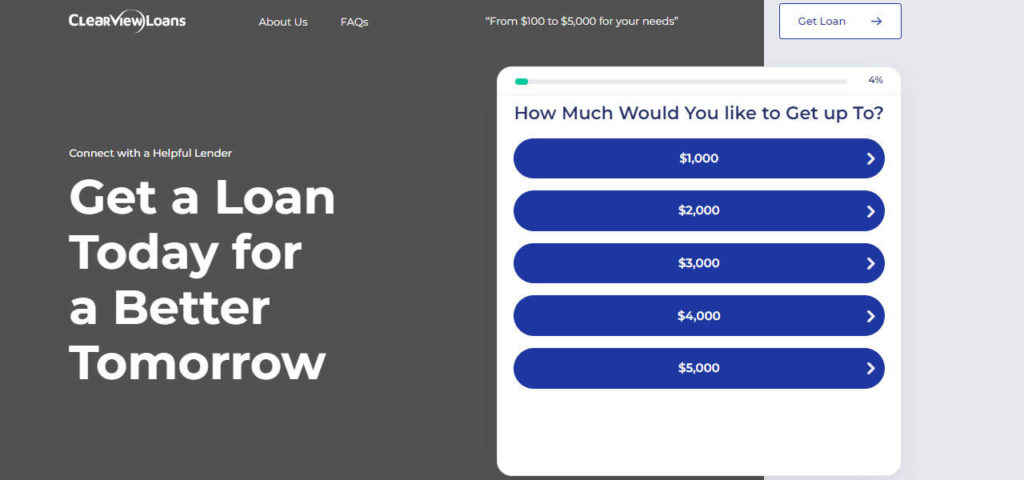

ClearViewLoans

With one application in ClearViewLoans, you can connect to many lenders that will send you their offers in a few minutes. Once you agree on a loan contract, your funds will be deposited into your account in approximately 24 hours. The whole process is online, making it ultimately convenient for anyone who wishes to apply for loans.

Pros:

- Efficient procedure to save your time and energy

- Funds will most likely be ready in one business day

- Full disclosure of terms and policies on every loan contract offered

Cons:

- The service is not available in all states

- Lack of loan types to choose

Quickly Get Your Loans from ClearViewLoans Today!

BestEgg

For loans with high amounts, BestEgg can be one of the best options to consider for its fair APR while you can borrow from $2,000 to $50,000. Repayment terms are flexible to adjust between 36 to 60 months. After finishing your loan contract signup, you shall wait for 1-3 business days to get your funds to arrive.

Pros:

- Wide range of loan amounts

- Reasonable APR and term flexibility to pay off the big loans

- Secured loans are available as options

Cons:

- No small-term emergency loans are available

- Does not accept applicants with bad credit scores

Apply for Your Loans on BestEgg Now!

RocketLoans

With loan amounts ranging from $2,000 to $45,000, RocketLoans can make your funds ready within the same day of your application. It is even very easy and fast to get your application done within minutes. Loan terms may not very flexible because you can only choose either 36 or 60 months. However, you are still free to repay all of your debts earlier without having to pay additional fees.

Pros:

- Possible for same-day emergency loans

- No extra charge for early repayments

- Relatively lower APR compared to other platforms

Cons:

- Term options are limited to either 36 or 60 months

- Charges origination fees of 1-6%

Go To RocketLoans to Get Your Emergency Loans Immediately!

How Do I Choose an Emergency Loan?

Applying for an online loan will give you offers from various lenders. To get the most benefits from your emergency loans without having to deal with difficult consequences, you need to consider your options carefully before choosing a loan contract to sign. Here are several factors you better look into:

Loan Amount

Not all offers can lend you money as much as you ask for. Lenders have minimum and maximum amounts that they can lend you. The exact amount they can offer you depends on your financial capability and credit scores. Hence, make sure they offer you enough for you to settle your emergencies.

- Speed of Funds

Most online loans can get your money ready in 24 hours. Yet, it is still necessary to make sure of it because some loans may take days or even weeks to process. On the other hand, some lenders can transfer the funds to you within the same day of your contract signup.

- Term Flexibility

While you might want to finish it as soon as possible, you also need your term to be reasonable enough because missing your due dates will put you in a more difficult financial situation. Besides choosing the loan offers with terms you feel comfortable with, it is also necessary to look at whether your lender will charge penalties for early repayments.

- Rates and Fees

Online loans usually come with extra charges such as interest rates, APR, origination fees, late payment fees, etc. Those fees may add up, especially if your loan is long-term. Fortunately, every loan offer from reputable loan platforms will show you these fees in detail. You just need to look carefully and calculate to decide if the loan is worth taking or not.

Tips to Get an Emergency Loan with Bad Credit

Having a bad credit score will make it difficult for you to get approved for loans because you carry the risk of missing repayments. The available options are likely to have higher interest rates. To increase your odds of getting approved with lower rates, you can consider several options as below:

- Use Collaterals

If you have valuable possessions such as properties or cars, you have at least one of those as collateral. With collaterals, lenders may consider your application less risky so they will be more likely to approve you for loans. Also, secured loans usually have lower interest rates. However, make sure to pay back your loans on time to avoid losing your possessions.

- Get A Co-Signer

If you have someone with a good credit score who trusts you, they can help you with your loans by being a co-borrower or co-signer of the loan contract to improve your chance of getting approved. However, bear in mind that this person will get asked to pay by your lenders if you fail on your repayments. Thus, take this option only if you are sure you can manage your repayments well.

- Consider Other Platforms

Before signing any online loan contract, you should try looking into other options first. Try visiting your local bank or credit union. Many of them also offer small-dollar loans at much lower rates than the online brokers. This option might be a more friendly alternative to emergency loans.

Conclusion

Having bad credit scores is already difficult, let alone having emergencies when your money is tight. Getting emergency loans for bad credits is not easy. While many offers are coming in, not all of them are worthy enough to take.

To get the best solution in such a difficult situation, you need to spare your time to look into all the options you have. Compare and consider all the factors stated in the loan contracts. Eventually, you will be able to determine which website and which lender can give you the best deals.