By Paul Roberts / The Seattle Times

SEATTLE — Even as Boeing inches closer to a fix for its grounded 737 MAX, industry analysts say the aircraft may not fly until October, a delay that could cost the company nearly three fifths of the cash it expected to generate in 2019.

On Wednesday morning, investors and analysts will get their first look at the financial impacts of the grounding when Boeing releases its first-quarter results — the first such report since a second fatal crash of a MAX aircraft on March 10 led to its worldwide grounding.

Boeing still can’t say how long it will take to fully implement a fix for the automatic flight control software implicated in the crashes, or to get the fix approved by regulators around the world. Also unclear are the potential costs from civil lawsuits and potentially criminal charges resulting from the crashes, which caused 346 deaths.

But analysts say the aircraft is unlikely to return to service before Oct. 1.

That would be a huge problem for Boeing, which is counting on the MAX for a large fraction of the company’s cash flow — the money Boeing generates from operations after subtracting capital investments.

In just the first quarter of 2019, which ended March 31, the MAX grounding could cost Boeing about $1 billion in cash flow, according to a JP Morgan estimate — and that’s from just a few weeks of lost MAX deliveries in March. Starting in April, each full month the MAX remains grounded will bring another $1.5 billion to $1.75 billion in lost cash flow, according to various analysts’ estimates.

If the grounding lasts through September, Boeing could lose $10 billion in cash flow, or nearly 60 percent of the $17 billion Boeing itself anticipated for 2019 across all company operations. With the grounding, some analysts expect Boeing may barely break even on cash flow in both the second and third quarters.

Cash flow is a key metric that Boeing and Wall Street use to judge the financial health of the aerospace giant. So cash flow affects everything from the price of Boeing’s shares to the size of its executive pay packages.

Analysts at Credit Suisse say the grounding could lead to a 20 percent drop in Boeing’s earnings per share for the first quarter alone. That’s not good news for Boeing’s once-high-flying share price, which has already fallen nearly 16 percent from a high of $446, shortly before the March 10 crash of an Ethiopian Airlines MAX, to $375 by Monday’s close.

The MAX crisis is hammering Boeing’s bottom line in two ways. Even while the company forgoes around $550 million a month in cash earnings from MAX aircraft that it can’t deliver, it is spending around $1.1 billion each month to produce the aircraft, according to JP Morgan.

To avoid disrupting its supply chain, Boeing is still building the MAX at its Renton plant, albeit at a reduced rate of 42 a month, down from 52 before the crash. That means Boeing must still pay workers and buy parts from suppliers, many of which are still producing components at the 52-per-month rate.

Wichita-based Spirit AeroSystems, for example, continues to produce MAX fuselages at the rate of 52 every month. Further, Boeing will pay Spirit AeroSystems for the 10 fuselages a month that Spirit is producing but not delivering to Renton, according to a Securities and Exchange Commission filing.

Even if the grounding ends Sept. 30, the financial impacts of the crisis will carry over into 2020 as Boeing works to clear its inventory of built-but-not-delivered MAX aircraft, analysts say.

There is good news. Because CFM International, which makes the MAX engine, has struggled to keep up as Boeing ramped up MAX production before the crash, the lowered production rates at Renton will “allow the engine suppliers to get fully caught up,” according to JP Morgan.

In normal years, the company returns most of its free cash flow to investors via dividends or share buybacks. But this year, analysts say, Boeing will probably suspend share buybacks to conserve cash — though the company is expected to borrow around $1 billion in order to pay dividends, according to Bloomberg.

The company’s stock price — still up for the year, overall — shows investor confidence that Boeing eventually will get the cash-generating MAX back into the skies, many analysts say.

The real question is how many months that takes, especially given that the MAX recertification process has become mingled with politics.

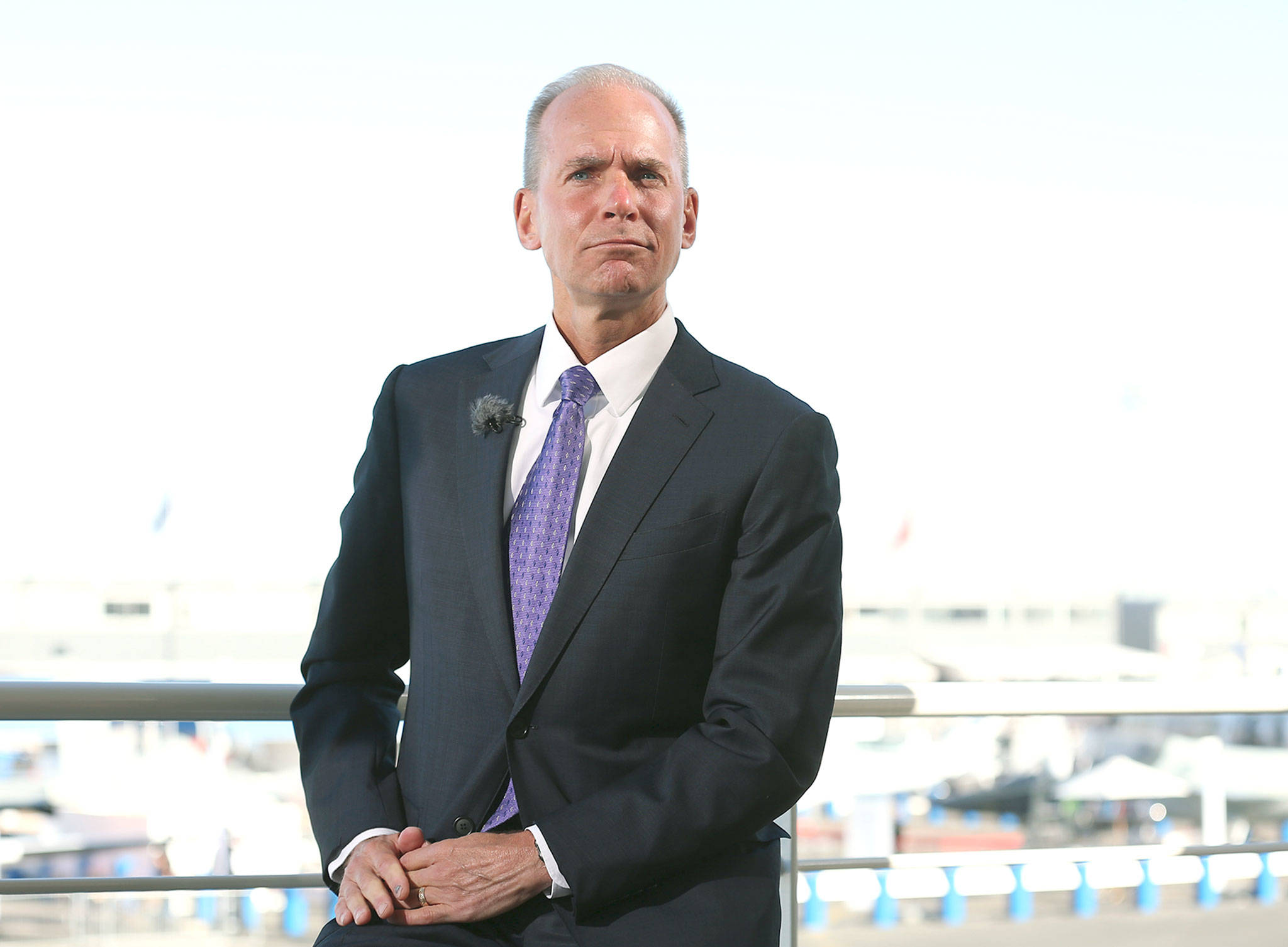

Some industry analysts worry that concerns about the initial certification of the MAX — coupled with reports that CEO Dennis Muilenburg personally lobbied President Donald Trump to delay the MAX grounding — may cause foreign regulators to slow down their own recertification of the aircraft. Last week, for example, Canada rejected a recommendation by the U.S. Federal Aviation Administration that pilots would need only computer-based training on the fixed 737 MAX software.

That concern is behind the FAA’s recent creation of a panel of experts from nine international aviation regulators to look into the MAX certification process.

But certification politics will also probably be a subtext in Wednesday’s earnings call, where analysts expect Muilenburg to try to assure foreign regulators that the company is committed to a transparent certification process.

“It’s ostensibly a call for investors,” says Seth Seifman, an aerospace analyst at JP Morgan. “But I’m sure there’s going to be a lot of public interest, and a lot of media interest, and a lot of regulatory interest in what the company has to say.”

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.