By The Herald Editorial Board

“It’s always fascinating to me when we have these budget discussions,” said Gov. Jay Inslee, early in an interview this week with The Herald Editorial Board, “the first thing we talk about is how to pay for the good things we’re doing. When you guys go out to dinner and you order from the menu, do you look at the price or do you figure out what you want to eat first?”

The governor’s right about where, for most of us, our eyes go first on a menu, even if we’re just ordering take-out these days. But, when considering the state’s budget, we’re not the only ones picking up the check; so, yes, we’re scanning the prices for what we can all afford.

Not that there aren’t some appetizing choices offered at Chez Inslee, but let’s take a good look at the numbers to the right.

Much of the Legislature’s focus when its session begins next month will be on filling an estimated $3.3 billion hole in revenue that the covid-19 pandemic and its economic downturn bore into the state budget this year. Inslee’s budget calls for the use of about $1.7 billion of the state’s “rainy day” fund and other steps to run the state and support its recovery. But his budget also is looking past the next couple years to help continue the economic recovery while making needed progress on tax fairness, public health funding, climate change initiatives and other issues.

About the menu’s prices, Inslee has proposed:

A capital gains tax that would levy a 9 percent fee on the sale of stocks, bonds and other assets greater than $25,000 for individuals and $50,000 for those filing jointly, with exemptions for retirement accounts and sales of homes, farms and forestlands. The tax, with collections starting in mid-2022, is estimated to raise $1.1 billion for fiscal year 2023 and $3.5 billion over the next four years.

A tax of health insurers, managed care groups and others, based on each person covered by insurers, which is estimated to generate $203 million in its first year, and $343 million for the 2023-25 biennium. While paid by insurers, those companies would likely pass on the charge to customers, resulting in additional costs to state residents of about $3 a month for each person covered.

A cap-and-trade program for carbon emissions that would place a price on carbon by setting a limit on emissions, while slowly lowering the cap and reducing greenhouse gas emissions, but allowing polluters to buy and trade allowances, which could generate estimated revenue of $600 million to $1 billion a year.

The good news for the state’s budget diners, those entrees should be in our price range.

And as much for the revenue they can generate, Inslee’s tax proposals could also achieve some important policy goals.

This isn’t the first time Inslee and some Democratic state lawmakers have proposed a capital gains tax, even in the face of opposition from Republicans and others who criticize it as unnecessary and unconstitutional. Inslee believes it can pass constitutional muster before the state Supreme Court and can begin to address reforms to a state tax system that is profoundly regressive, leaving lower- and middle-income state residents to pay a far higher percentage in taxes than better-off Washingtonians.

That’s not just Inslee and Democrats making that claim.

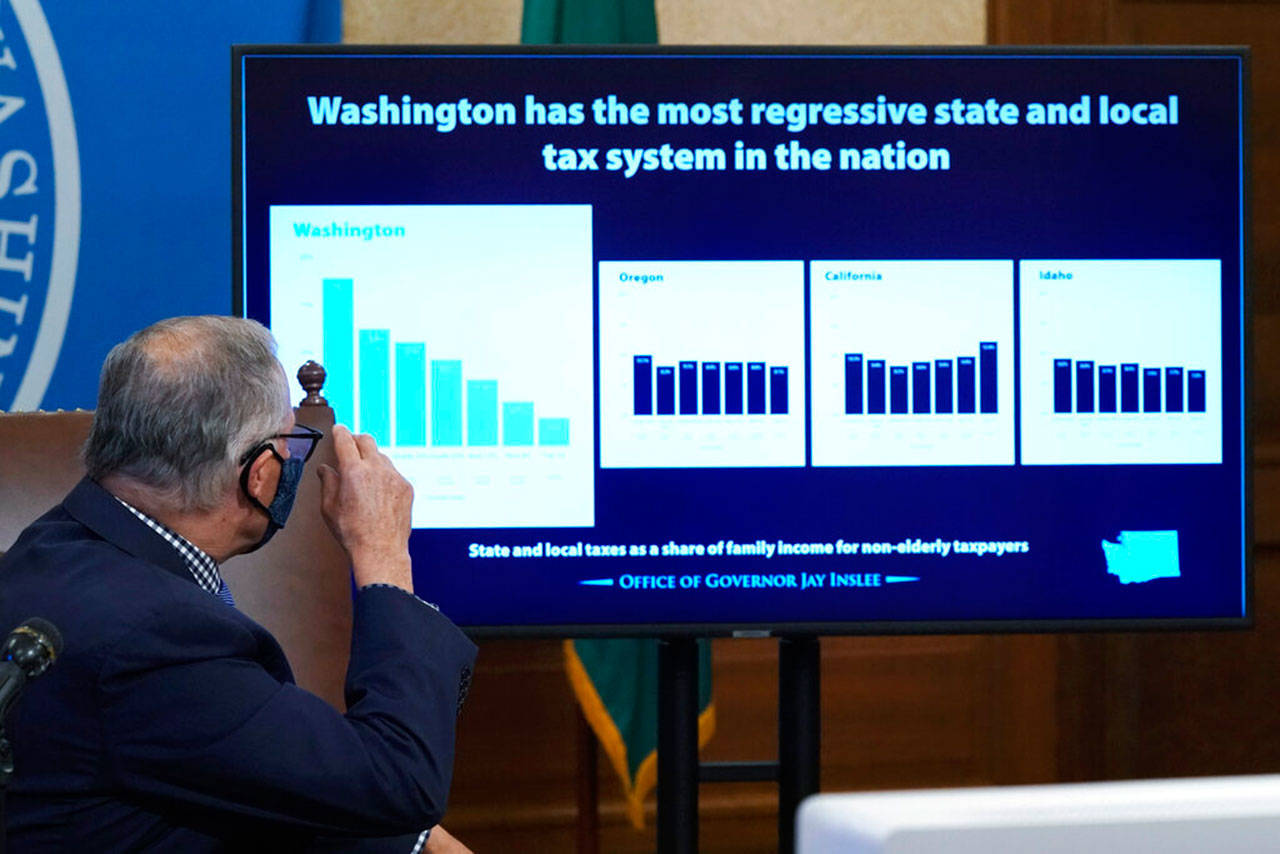

For several years running, Washington state has been listed as having the most regressive tax structure in the nation, according to the Institute on Taxation and Economic Policy in its most recent edition of its state-by-state examination of state tax policy, “Who Pays?”

For Washington state, the state’s lowest-earning 20 percent pay 17.8 percent of their family income as state and local taxes. On the other end, the state’s wealthiest 20 percent, those making $116,300 a year or more, pay no more than 7.1 percent of their income as taxes; the state’s top 1 percent, those who make more than $545,900 annually, pay only 3 percent of their income as state taxes.

That inequity is the result of the state’s heavy reliance on revenue from sales and excise tax and property taxes and its lack of a state income tax. The state’s nearest neighbors have more equitable tax structures; in Oregon for example, the lowest 20 percent pay a little more than 10 percent of their income as tax, the top 1 percent pay 8.1 percent, according to ITEP.

The capital gains tax, as proposed, would apply to an estimated 2 percent of the state’s residents, and could begin to provide better equity as well as more revenue for the state’s general fund.

Regarding the tax on heath insurers, Washington state has underfunded public health needs and the county-level public health agencies for years. For the Snohomish Health District alone, its revenue has dropped 40 percent since 2006, even while the county population has increased by 14 percent and the county and state have been rocked first by a measles outbreak in 2019 and then by the covid pandemic.

During the same time, many of the state’s health insurers have posted profits or added to their reserves. The three nonprofit insurers in Washington state — Premera, Regence and Kaiser Permanente — have amassed reserves that as of 2018 totaled $4.4 billion, up from $2.4 billion in 2012. That’s money that represents the difference between the premiums paid by insurance customers and the claims paid by the companies, money held even as insurance rates have increased. Those insurers are required to have healthy reserves on hand, but as of 2018, Kaiser’s was a little less than 600 percent of its required reserve, Regence’s was more than 1,300 percent, and Premera’s was above 1,500 percent of the minimum.

Likewise, it’s well past time that the state place a price on carbon emissions. Along with encouraging efforts to reduce emissions, Inslee’s proposed cap-and-trade plan would support clean energy development and also fund programs to aid communities of color who are often disproportionately affected by air pollution and the effects of climate change.

Importantly, Inslee’s plan would provide funding for the Working Families Tax Credit, similar to the federal Earned Income Tax Credit, a program created by the Legislature in 2008 but so far left unfunded by state lawmakers. The tax credit would provide a tax rebate to lower-income families, again helping to better balance the state’s regressive tax system.

The governor will have to excuse our habit of checking out the menu prices, but in bolstering and more fairly providing for the state’s general fund, ensuring long overdue support for public health and encouraging clean-energy innovations, Inslee’s menu looks good.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.