EVERETT — During the winter holidays, Judy Matheson usually looks forward to the crush of shoppers.

But this year, the owner of J. Matheson Gifts, Kitchen & Gourmet in downtown Everett is worried: How will customers react if she has to raise prices next year?

About half the items the store sells are made in the U.S. The rest are imported.

Small businesses are “among those most vulnerable to the negative impact of tariffs,” according to the National Retail Federation, a nonprofit trade group.

In July, the Trump administration imposed tariffs on $250 billion in goods made in China. Tariffs on $200 billion of those items were scheduled to jump from 10 percent to 25 percent on Jan. 1, but President Donald Trump postponed the increase for 90 days while the two countries conduct trade talks.

Tariffs are putting the squeeze on the state’s business community, and small businesses in particular.

Since new tariffs were imposed, Washington businesses have paid an extra $100 million in tariffs, according to Trade Partnership, a Washington, D.C., economic consulting firm.

Small businesses are much more likely to be negatively affected than larger, more diversified businesses, which typically have deeper pockets and more flexibility to change their product mix, said James McCafferty, co-director of the Center for Economic and Business Research at Western Washington University in Bellingham.

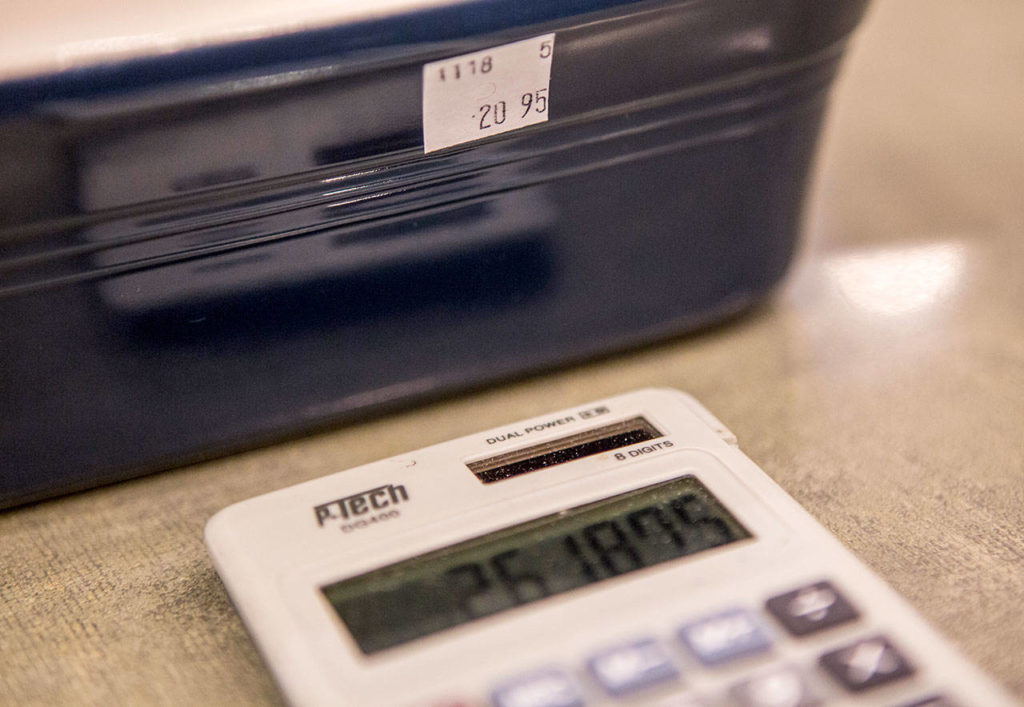

The pots and pans and ribbons and candles at J. Matheson are made in the U.S. Cheese graters, cherry pitters and other handy kitchen gadgets are made in China.

“I try hard to buy American,” Matheson said. “But some things you can’t find made in the U.S.”

She’s held prices down for the holidays — vital because 40 percent of the store’s annual sales are rung up from October to January.

When suppliers urged her to stock up ahead of the new tariffs, Matheson went on a buying spree.

Across the country, other vendors have done the same, the Retail Federation said.

“The threat of even higher tariffs in 2019 have created a mini-boom in imports,” said Ben Hackett, the founder of Hackett Associates, an international trade consultant.

But the strategy doesn’t work for everyone. Some firms simply don’t possess the capital or resources to stock up.

Gregg’s Cycle in Lynnwood has limited storage space. “We don’t have room to back-stock,” manager Ian Chivers said.

Tariffs on steel and aluminum, the stuff of bikes, have affected the whole industry, Chivers said.

“Most of what we deal with are complete bikes, so nearly all the components — the frame, wheels, tires — are affected,” he said.

With suppliers charging more, Gregg’s has had to charge more. If no agreement is reached next year, it could be facing another round of tariffs.

“If people ask about higher prices, we let them know what’s happening,” Chivers said.

Matheson, worried about what customers would think, took a more direct approach, posting this on the store’s Facebook Page:

“A number of vendors … have recently notified us that they will be raising prices from 15 to 28 percent due to the United States tariffs being enforced. I want to assure you that we will absorb as much of these increases as we are able, but unfortunately there will be some price increases on new products — subject to the tariff — as they arrive.”

Customer response has been “very positive,” said Matheson, who has been in business for 28 years.

“You will continue to see me,” customer Carolyn Allendoerfer wrote.

Melinda Bargreen wrote: “Of course you need to pass on higher wholesale prices to retail purchasers; that’s the rule for retailers who want to stay in business. And we REALLY want you to stay in business!”

Joel Perry, vice president of marketing at OceanGate, which builds and charters manned submersibles, including a sub that’s scheduled to explore the Titanic in the north Atlantic Ocean in the spring, said key components of the vessels the company just built were fabricated in the U.S.

“We do have plans to build other subs, but how they might be affected is unknown,” Perry said.

Matheson is trying to look on the bright side.

Sales at the downtown Everett store have picked up this year. Staff at the area’s new hotels regularly recommend the store to their guests, Matheson said.

Still, the tariff situation rankles. “I hope things get settled soon,” she said.

In response to U.S. tariffs, China placed tariffs on $110 billion of U.S. products. At the Port of Everett, imports and exports are down 14 percent by value this year, said Lisa Lefeber, port spokeswoman. Most of the value drop is in exports, particularly timber products and logs.

Estimated China-destined exports last year from Snohomish County totaled $18.3 billion. Non-aerospace exports accounted for about $2.2 billion, including sales of animal products, various food products and advanced machinery and electrical equipment, according to the Economic Alliance Snohomish County.

Janice Podsada; jpodsada@heraldnet.com; 425-339-3097; Twitter: JanicePods

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.