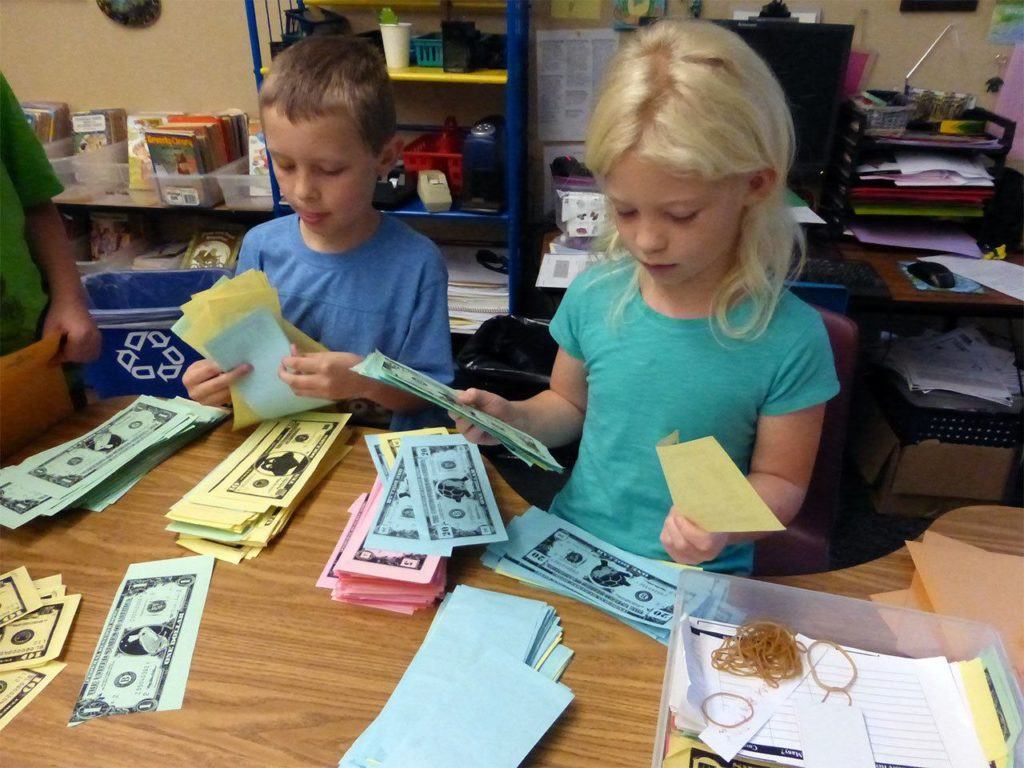

LAKE STEVENS — It was payday in Lisa Holland’s classroom at Mount Pilchuck Elementary School.

Two young bankers handed out colorful slips of currency bearing the image of a stately frog.

Students were paid in the Froggy dollars according to their Pond 20 workplace expectations, such as coming to school on time.

In a few months, they’ll use those earnings to become entrepreneurs. They’ll write business plans. Jockey for prime real estate. Hire employees. Follow health codes. Advertise their wares. Pay taxes.

The only thing they can’t do in this classroom economy — which Holland has developed over the last five years — is get a loan.

“In third grade, I want them to learn that money comes from hard work,” she said. “It’s not getting into debt at 8 years old.”

One of her ultimate goals? To equip these kids with financial savvy so they don’t get into weighty debt when they’re 28 years old either.

Expect more programs that share Holland’s goals to start appearing in area classrooms following the passage of the state’s first-ever financial education standards.

The new standards were announced in recent weeks. Many teachers are only just hearing of them.

Financial education is not required — like math and reading — and it’s up to individual schools or districts how to address them. But high schools will need to start offering students access to financial literacy lessons if they don’t already.

Several teachers had not heard of the new standards until reached by The Herald.

“That said, my reaction is ‘it’s about time,’” said Hank Palmer, a 19-year veteran who teaches fifth grade at Marshall Elementary School in Marysville. “It’s as if we expect citizens to learn all of this through the air. In reality, finance is complex and challenging.”

The Great Recession played a role in pushing the state forward.

“Students need to understand financial terms. They need to know what interest is, how to calculate taxes, when to begin investing. Giving them those tools may help us avert the next financial crisis,” State Superintendent Randy Dorn said in a statement.

Washington now is one of 45 states with personal finance education standards. Few test the subject, though 17 states require high school students to take a course.

Expect a slow roll-out

The standards were written by the Financial Education Public-Private Partnership, which was tasked by the state Legislature for the job.

The six topic areas are based on existing national standards for spending and saving; credit and debt; employment and income; investing; risk management and insurance; and financial decision-making.

Tests eventually will be added. But complete roll-out plans are pending.

“It’s a very long time coming, and it’s going to be longer being implemented,” said Pam Whalley of the Center for Economic and Financial Education at Western Washington University, a key player.

Right now the focus is on training. Fewer than 20 percent of teachers have training in the topic, “a distressing number,” she said.

High school is the first target. But Whalley stressed the learning goals are for elementary and middle schools, too. There are standards for each grade level, so skills build over time.

“In most cases we wait until high school to teach personal finance,” she said. “Yet our saving and consumer habits are set by the time we are 7 or 8 years old.”

The standards naturally fit math and social studies. Yet other classes also can incorporate them. For example, Whalley cites an art teacher whose motto is “no more starving artists.”

From farm to BizTown

While the standards are new, the concepts behind them are not.

“The Classroom Marketplace” was written in 1979 by what was then known as the Washington State Council on Economic Education. In 2016, there’s still much to draw from its typewritten pages for fourth-grade teacher Tori Lyman, who uses a variety of sources for a marketplace unit at Sunnyside Elementary School in Marysville.

“I think most of the out-of-date pieces are the examples and the fact that most of the lessons are lecture style and worksheet,” Lyman said. “I try to use more hands-on, videos, games — things like that to teach topics.”

Along with teaching methods, financial education also has evolved with the U.S. economy.

Basic lessons started with 19th century home economics efforts to “keep” house, and with 20th century 4-H programs that sought to equip future farmers with life skills.

More formal classroom lessons were sparked by business leaders who saw a need.

Junior Achievement is one of the best-known names in financial education. The group was founded in 1919 by the heads of American Telephone & Telegraph and Strathmore Paper Co. By 1975, its ideas entered many middle schools.

Several local elementary schools use Junior Achievement’s program, which culminates in a field trip to Auburn where students can move about in a simulated city called JA BizTown.

Business still a driver

Even now, the state’s education office relies on outside financial support to carry the new standards forward.

Money comes from the state Department of Financial Institutions and from companies in the financial sector.

Much of the work, though, has been done by volunteers, said WWU’s Whalley.

Like others, Whalley would like to see the standards become required. It’s about lifelong learning, she said, not producing a legion of stock brokers.

“We talk about wanting our students when they graduate high school to be college or career ready. And they’re not if they can’t handle their money,” she said.

School is an ideal place to start those lessons, where it’s safe to make mistakes and learn from them, said Holland, the Lake Stevens teacher.

“My goal is to give them as many real-world experiences as I can in a safe environment,” Holland said. “I want you (as a student) to come back to me when you’re 40 and say, ‘Remember when I was in third grade and sold this? Look at me now!’ ”

Melissa Slager: mslager@heraldnet.com, 425-339-3432

More info: Financial Education Public-Private Partnership, www.feppp.org

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.