Comment: Trump’s tariffs could ground aerospace’s rebound

Published 1:30 am Tuesday, June 10, 2025

By Thomas Black / Bloomberg Opinion

The captains of the aerospace industry will gather in Paris next week for the marquee aircraft show and, while order announcements usually grab the headlines, the real driver of value the year will be the further recovery of the pandemic-battered aerospace supply chain, though a new obstacle has emerged.

The world wants more aircraft. Airlines want to expand fleets and replace older aircraft that are more costly to operate. Airbus SE and Boeing Co. want to build more planes. The only hang-up has been the recovery of the aerospace supply chain, one of the hardest hit by covid-19 and the slowest to recover because of its unique structure.

Just as the specialized machine shops that make complex parts have started to regain their footing and prepare for Boeing’s large production increases, the industry now faces upheaval from tariffs that could drive up costs and create scarcity of some materials, such as rare earth elements.

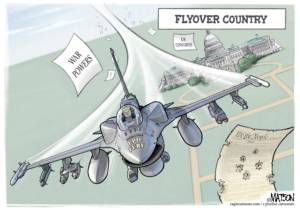

It doesn’t make much sense for the global aerospace sector to be caught up in President Trump’s attempt to restructure world trade. The U.S. aerospace industry, including defense, is the only significant manufacturing activity that runs an annual trade surplus; to the tune of about $75 billion. It’s dominated by North American and European companies and is one of the few in which Asia, especially China, plays a small role. That means building planes isn’t a national security problem like building ships is. To the contrary, the commercial aerospace supply chain also feeds a robust military sector, making it a security asset.

As airlines, plane manufacturers and investors count on a production ramp-up, suppliers face 50 percent tariffs on steel and aluminum. In addition, in a letter to the Commerce Department, the Aerospace Industries Association lists 27 critical materials, such as graphite, cobalt and titanium, that could become scarce or costly if China cuts off shipments.

The Commerce Department just closed public comments for a Section 232 trade investigation on imports of commercial aircraft and parts that’s aimed at the European Union. The purpose of the probe is unclear, given the aerospace trade surplus and the need to hire more U.S. workers to keep up with the pending production increases.

Furthermore, the North American and European aerospace industries are closely intertwined. Just look at the Leap engine that’s popular on both the Airbus and Boeing narrow-body aircraft. This jet engine is made by CFM International, a successful joint venture between Ohio-based GE Aerospace and Paris-based Safran SA. Besides, the US and Europe already went down this road of slapping reciprocal tariffs on Boeing and Airbus aircraft in a 17-year dispute that began in 2004. An agreement was finally reached in 2021 to end the constant finger-pointing over subsidies and damaging levies.

Airbus has been eating up market share for large airliners since 2019, but that’s mostly Boeing’s fault. The U.S. planemaker’s most popular jet — the 737 Max — was grounded in March 2019 after two fatal accidents. A near miss in January last year, when a door plug blew out of aircraft in flight, caused the FAA to cap its production. An almost two-month strike at the end of 2024 mostly shut down manufacturing.

Boeing suppliers were already reeling from the 737 grounding when covid-19 hit in March 2020. Unlike the mass production of autos or refrigerators, the number of large commercial aircraft built each year is just north of 1,000. Some of the planes have more than 1 million parts, Boeing Chief Executive Officer Kelly Ortberg said recently.

This structure of small specialized parts makers left the aerospace supply chain particularly vulnerable to the pandemic. Experienced workers left the industry. It can take years to bring new suppliers on board because of the strict rules for FAA certification of parts. Aircraft makers and large suppliers resorted to creating teams to provide support — technical, financial and even labor — to keep these manufacturers in business amid the demand shock and brain drain. In 2020, large commercial aircraft deliveries plunged to 723 from a peak of 1,606 in 2018.

The damage from the pandemic lingers, but the chain is improving. Suppliers that were problematic for GE are now meeting their delivery commitments 95 percent of the time, which is twice the rate as last year, GE CEO Larry Culp said in a May 28 webcast of a Bernstein conference. “There’s no one bottleneck out there,” Culp said. “It’s a thousand, and it changes.”Safran and Pratt & Whitney, the engine unit of RTX Corp., suffered from plant strikes earlier this year, adding to production pressures. Airlines are still reeling from a parts recall on Pratt’s GTF engines, which require expensive shop time to replace.

Suppliers are complaining about tariffs driving up costs, Safran CEO Olivier Andries said during an April 25 earnings conference call. “There are some of them telling us that basically they would like us to absorb the extra cost, and even some of them threatening to stop deliveries,” he said.

The engine makers’ struggles have caused Airbus to pile up 17 aircraft waiting only for engines, which CEO Guillaume Faury derisively calls gliders.

“This situation will continue until the summer with a likely increased number of gliders due to missing CFM engines,” Faury said in an April 30 earnings conference call.

Engines aren’t the only hiccups in the supply chain. A fire in February destroyed an aerospace fastener plant in Pennsylvania operated by Berkshire Hathaway Inc.’s Precision Castparts unit. Snags are also impeding FAA certification for first-class seats, which is holding up plane deliveries. In an extreme move to improve quality and reliability of fuselage shipments, Boeing agreed to purchase Spirit AeroSystems for more than $8 billion, including debt. Airbus is acquiring the Spirit assets that supplied it with plane body parts.

Boeing will drive the production increases just because it is coming off such a low base. The company delivered only 348 aircraft last year compared with 766 for Airbus. Boeing had been leading the delivery competition until the calamities began in 2019.

The supply chain needs to be able to trust Boeing to provide a steady cadence of planes as Ortberg attempts to revamp the manufacturing culture and reestablish the company as the leading commercial aircraft producer, said Kevin Michaels, a managing director at AeroDynamic Advisory. Ortberg, hired by Boeing in August, has experience on the supplier side; he rose through the ranks to become CEO of Rockwell Collins, which makes cockpit systems.

“Kelly has stopped the erosion of confidence in Boeing,” Michaels said. “There’s a growing sense of optimism that Boeing is heading in the right direction.”

The aerospace industry, a cornerstone of U.S. manufacturing, is poised for a production take off that will boost US aircraft exports. Let’s hope Trump’s tariff war doesn’t clip those wings.

Thomas Black is a Bloomberg Opinion columnist writing about the industrial and transportation sectors. He was previously a Bloomberg News reporter covering logistics, manufacturing and private aviation. ©2025 Bloomberg L.P., bloomberg.com/opinion.