Boeing’s endless ‘doom loop’ gives no respite to CEO Ortberg

Published 2:00 pm Monday, October 14, 2024

By Julie Johnsson / Bloomberg

As Boeing lurches from one crisis to the next, there’s been one constant for the embattled planemaker: Its predicament appears to be only getting worse.

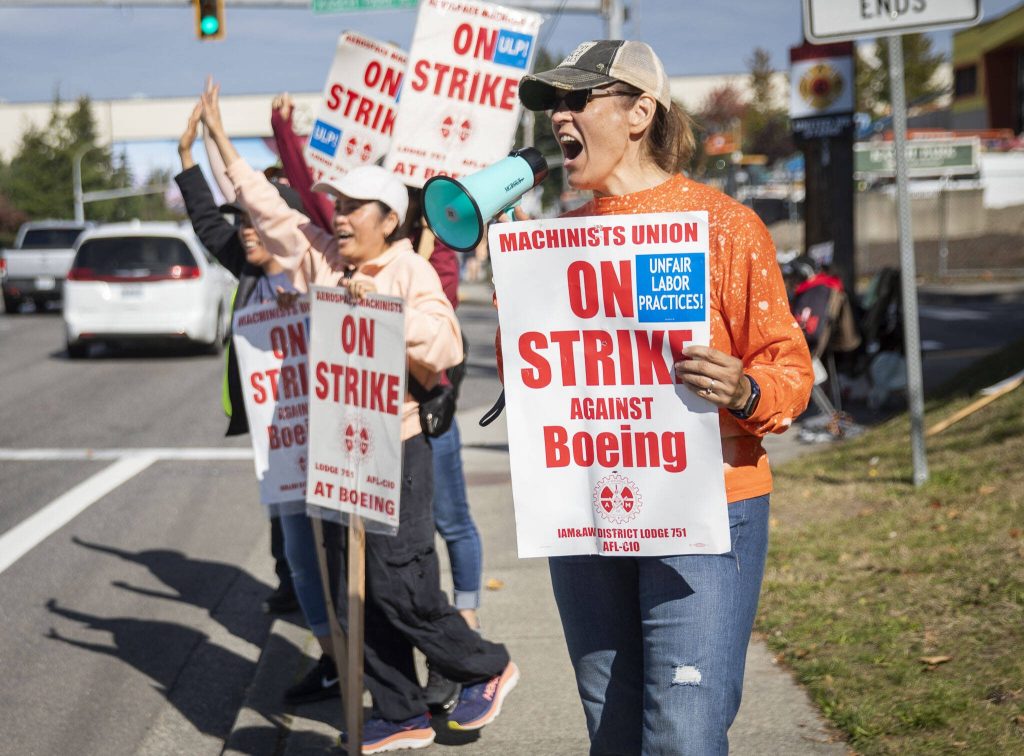

From a freak accident that blew a door-size hole into the fuselage of an airborne 737 Max to revelations of sloppy workmanship and now a crippling strike entering its second month — the icon of U.S. manufacturing has been beset by trouble since the first days of January. Cash is dwindling, plane production is anemic and the stock is heading for its worst annual performance since the financial crisis in 2008.

Now, the planemaker is making another dramatic move by cutting 10% of its workforce, equivalent to about 17,000 people. But it’s a maneuver fraught with risk, given Boeing is in the middle of testy labor negotiations and union workers show no sign of giving in. Also left unanswered were details on where the cuts will occur, what they might cost in terms of severance — and if indeed the step is enough to stem the financial bleeding.

“It’s all getting a bit hand to mouth,” said Nick Cunningham, an analyst at Agency Partners LLP in London. “It is not a coherent plan as such, it is just another quarter of large charges, all of a kind the previous management would have had to make anyway, as they reflect existing and developing problems and are not part of a restructuring as such.”

Boeing’s shares fell 1.34% on Monday, the first trading session since the cuts were announced. The stock had declined 42% this year through Friday’s close, the second-worst performer in the Dow Jones Industrial Average behind Intel.

In his announcement of the job cuts, new Chief Executive Officer Kelly Ortberg tucked in a hint that yet more dramatic action might be needed to get the company back on course.

“We need to be clear-eyed about the work we face and realistic about the time it will take to achieve key milestones on the path to recovery,” the Boeing chief wrote in the Friday memo to workers. “We also need to focus our resources on performing and innovating in the areas that are core to who we are.”

The comments suggest Boeing under Ortberg may double down on the field for which it is best known: commercial aviation. The unceremonious departure of Ted Colbert as head of the defense and space business put those subsidiary’s shortcomings into sharp relief — made more glaring still on Friday when Boeing said the unit would have about $2 billion in charges in the third quarter.

The episodes bedeviling Boeing have exposed quality lapses at Boeing and its supply chain, alongside a corrosive culture a quarter-century in the making, where pressure over costs and schedule permeated decision-making. Earlier this year, customers finally revolted and the board shook up leadership, hiring Ortberg in August out of retirement to fix the beleaguered manufacturer.

There’s broad agreement by observers that the company will need more time to regain its footing — the Federal Aviation Administration’s top official has said it’s a matter of years, not months, before Boeing is stabilized. When Ortberg, 64, hosts his first earnings call as CEO on Oct. 23, investors will want more detail on how he intends to comprehensively lead one of the toughest revivals in corporate America, rather than just putting out fires.

Rating agencies have put Boeing on notice with a warning that it may slip below investment grade, a move that would make the planemaker the biggest so-called fallen angel in corporate U.S. history. The company has only a small buffer on top of the $10 billion of cash and short-term securities that it needs to avoid slipping to junk status. The toll from the strike increases the urgency to tap markets sooner rather than later for fresh financing.

Continuous loop

“For every problem that’s come to a head, then severed, more problems sprout up,” Ron Epstein, an analyst with Bank of America, wrote in a note to clients. “The issues all feed into each other, creating a continuous doom loop while compounding the negative impacts.”

All told, Boeing will record $5 billion in combined charges for its two largest businesses when it formally reports third-quarter earnings, the company said Friday evening in a surprise announcement. Besides the defense and space charges, Boeing will book additional costs for pushing back its 777X model once more, leaving its largest wide-body aircraft with a delay of about six years.

Much is unclear about Boeing’s turnaround efforts. The ramp-up in production that was supposed to help cash flow has been undercut by the recent strike, and the defense and space business continues to hemorrhage money.

The company still needs to buy back Spirit AeroSystems, which it had hived off in an ill-fated move almost two decades ago, only to see manufacturing quality at its key supplier suffer as a result.

Longer-term, Boeing may need to make some tough calls on unprofitable areas like its space endeavors. The division made global headlines a few weeks ago when its Starliner capsule returned to earth without humans on board. It was an ignominious end to its first crewed mission to orbit after NASA decided not to risk putting two astronauts back into the glitch-prone spacecraft.

Ortberg hasn’t done any media interviews since taking over, although he’s reached out to customers, regulators, Pentagon officials and toured Boeing factories. An engineer by training, Ortberg spent most of his career at what is now known as Collins Aerospace, a well-regarded avionics equipment manufacturer that’s a key supplier to Boeing.

As CEO, Ortberg has appealed to a sense of camaraderie and shared destiny with the workforce. He made a point about relocating to Seattle from West Palm Beach, Florida, in a departure from his predecessor, who largely ran the company from the other side of the continent.

Cash drain

When the strike started in mid-September, the CEO urged workers to embrace the future and not hold grudges, a nod to a 2014 contract that cost them their pensions. Senior management took solidarity pay reductions when Ortberg announced furloughs to preserve cash, and the latest job cuts will also include executives and management, he said.

But with so-called touch labor accounting for less than 5% for the total cost of a commercial aircraft program, some observers wonder why Boeing isn’t moving with more urgency to end the work stoppage that’s adding to its financial distress.

“It’s not a needle mover in terms of Boeing profitability,” said Ken Herbert, analyst with RBC Capital Markets. “What are we waiting for here? Every day that goes by, it’s more disruptive and more of a cash drain.”

With the job cuts, Ortberg wants to instill a sense of urgency and shared sacrifice, said George Ferguson, an analyst with Bloomberg Intelligence. But the move threatens further antagonizing the very workers Boeing needs to restart jetliner production, at a time when skilled mechanics are in high demand.

Even before Friday’s announcement, the war of words had intensified. Both Boeing and the union filed formal complaints accusing the other of breaching the protocol for labor negotiations.

“He can’t win without the union,” Ferguson said of Ortberg. “He needs their heart and soul when they come back to the floor. If there was a honeymoon for the CEO, it seems to be over.”