EVERETT — The Boeing Co., reeling from two crashes that led to the grounding of the new 737 model, will hold its annual shareholders meeting Monday morning in Chicago.

Meanwhile, a joint technical review of the Boeing 737 MAX also begins Monday. Experts from the Federal Aviation Administration, the National Aeronautics and Space Administration and international aviation authorities will begin evaluating the plane’s automated flight control system in an effort to identify needed changes, the FAA said in a news release.

Separately, the FAA will decide in coming weeks whether to return the MAX to service after Boeing modifies an innovation implicated in crashes of brand-new 737 MAX planes. A stall-prevention system called the Maneuvering Characteristics Augmentation System played a role in recent crashes in Indonesia and Ethiopia, which together killed 346 people.

The company has said it hopes to present a software fix to federal regulators in coming weeks, but a long approval process in the U.S. and elsewhere could mean it will be weeks more before the 737 MAX is allowed to fly again.

In releasing first-quarter financial results last Wednesday, Boeing said it expects to incur $1 billion in increased 737 MAX program costs due to the grounding.

In light of all that, the shareholders meeting will be closely watched.

As usual, shareholders are being asked to approve board of directors nominees and other items, including executive compensation.

Stockholders also will have the opportunity to vote on four proposals — all of which the company opposes.

One of the the more contentious ones, if approved, would split the duties of the chief executive officer and chairman of the board. Some analysts think that arrangement gives one person too much power.

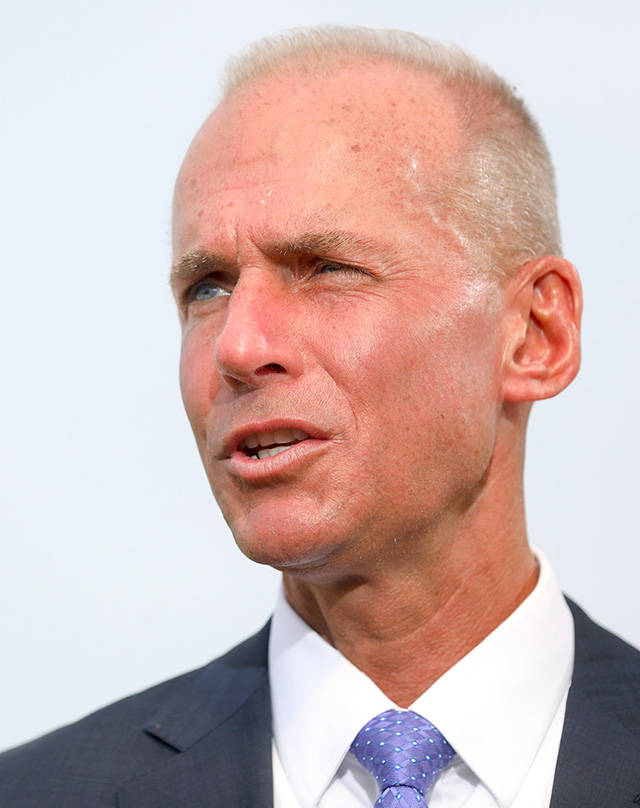

The measure would require that the jobs be filled by different people, but the proposed change would not apply to Boeing’s current CEO and board chair, Dennis Muilenburg.

In this year’s proxy statement, Boeing is urging shareholders to reject the measure, denouncing it as an “inflexible policy” that isn’t in the best interest of shareholders.

Another shareholder proposal would require Boeing to issue an annual report detailing direct and indirect lobbying efforts, along with payments around those activities.

The measure drew the attention of the Province of St. Joseph of the Capuchin Order, an order of friars within the Catholic Church. The Milwaukee-based friars filed a shareholders memo with the U.S. Securities and Exchange Commission urging investors to approve the resolution, claiming that the company risks further damage to its reputation if it doesn’t practice greater transparency.

Boeing’s board is urging shareholders to reject the resolution, saying that the company already files publicly available reports at the state and federal level that disclose lobbying, public policy positions and expenditures.

When matters of corporate governance are settled on Monday, executives will resume managing the 737 MAX crisis.

Along with regulatory scrutiny by aviation authorities, the Chicago-based aerospace giant is facing a criminal investigation of the design and certification of the MAX.

Boeing cut production of the 737, assembled in Renton, from 52 planes per month to 42 in mid-April. The company has said it is parking the MAX planes in the Puget Sound region, including on the crosswind runway at Paine Field in Everett.

Janice Podsada; jpodsada@heraldnet.com; 425-339-3097; Twitter: JanicePods

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.