By Aaron Gregg and Christian Davenport / The Washington Post

Boeing’s 737 MAX jet found a sweet spot for the company’s growing base of customers around the world: It’s a best-selling workhorse with low costs, minimal upkeep and an ability to cram in more passengers. The airplane would prove perfect for midrange flights that could maximize profits for carriers.

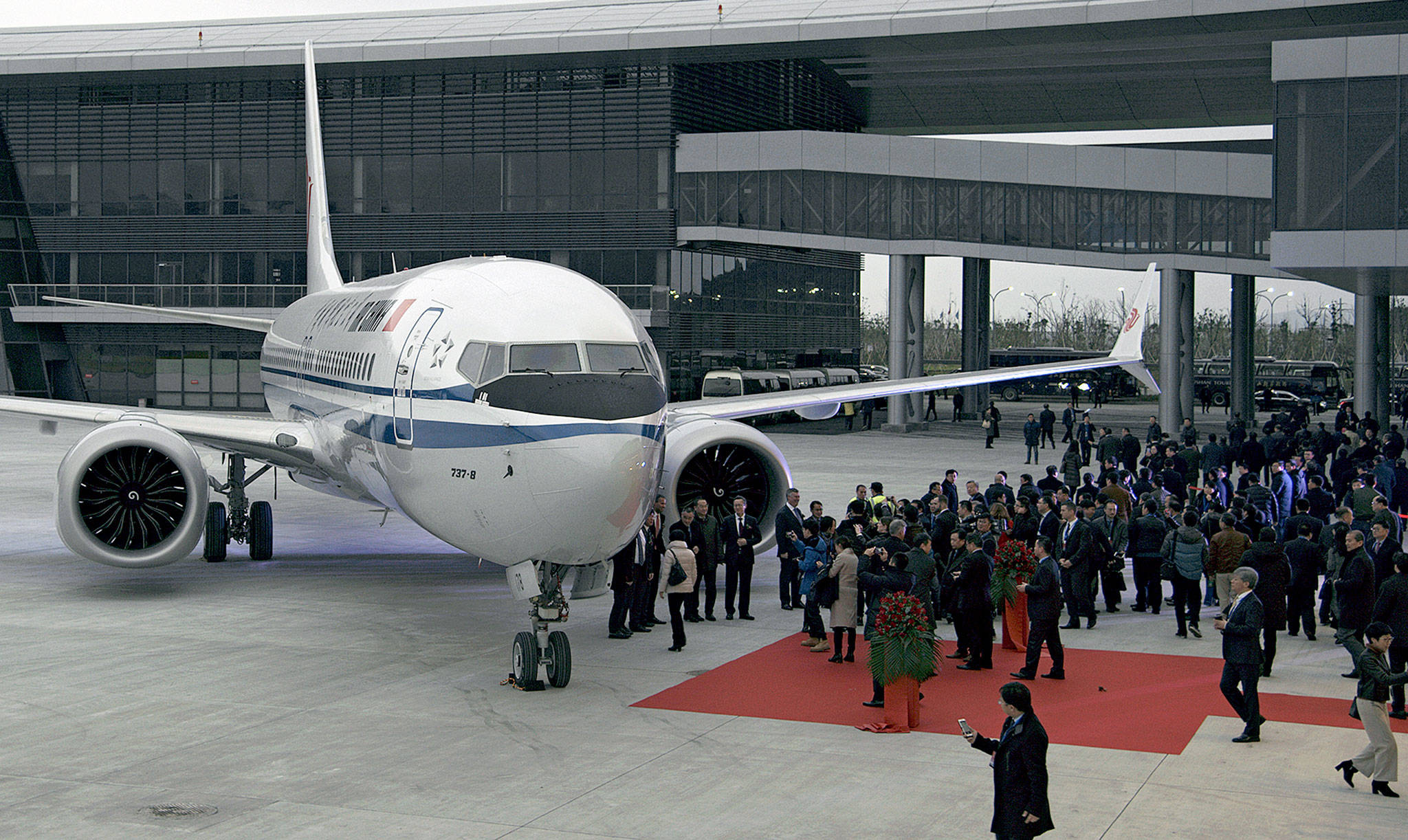

As it boosted production, Boeing boasted that pilots didn’t even need additional flight simulator training to fly the new MAX 8 jets. That helped the Chicago-based aerospace giant sell thousands of them, deepening relationships with China and fast-growing markets like Indonesia and Ethiopia. Ultimately, it powered a stock rise that added billions to the company’s value.

“We aspire to be an enduring global industrial champion,” CEO Dennis Muilenburg told shareholders in a 2017 address commemorating the company’s 100th anniversary, “a top performer in every aspect of our business, delivering superior value to our customers, employees, shareholders, communities and partners.”

But the crash of a 737 MAX 8 in Ethiopia on Sunday — the second in less than five months — threatens to undermine Boeing’s reputation around the world for safety and reliability. China, the company’s most important foreign market, was among many nations that quickly grounded the 737 MAX 8. Analysts said Boeing would need to get to the bottom of what caused the crash soon or face a backlash from potential customers and investors.

It is not clear why Ethiopian Flight 302 fell from the skies six minutes after takeoff Sunday on its way to Nairobi. The investigation has just begun. But the crash, which killed all 157 people on board, puts the spotlight on Boeing, which already faced scrutiny for an October crash in Indonesia. A Lion Air flight plunged into the Java Sea shortly after takeoff from Jakarta, killing all 189 passengers and crew members. Investigators said the autopilot, responding to a faulty sensor, apparently pointed the nose down while pilots struggled to get the plane to climb.

In a statement Monday, Boeing said no new safety guidance is planned as of now: “The investigation is in its early stages, but at this point, based on the information available, we do not have any basis to issue new guidance.”

The FAA endorsed the MAX 8 on Monday, issuing an “airworthiness notification” but saying that it would “continuously assess” its safety performance.

While investigators descended on the crash site to determine what happened, investors battered Boeing’s stock, which fell more than 12 percent in early trading Monday before rebounding and finishing the day down 5.3 percent, a resurgence indicating investor confidence in the stalwart company.

But analysts at Jefferies investment bank estimated that the worst-case scenario — a software problem causing a full grounding and halt to deliveries of the 737 MAX 8 — could cost Boeing about $5.1 billion, or 5 percent of the company’s annual revenue, within two months. The Renton-based 737 program is expected to generate about $32 billion for Boeing in 2019, Jefferies estimated, making it one of the company’s largest sources of business.

“This is clearly a fluid situation and one that may have serious repercussions for Boeing over the short and long terms,” Value Line, an investment research firm, wrote in a note for its clients. “For now, we are leaving our financial estimates unchanged, but there is clearly a large cloud of uncertainty here.”

For Boeing, the largest U.S. manufacturing exporter, there is no foreign market more crucial than China. The 737 is a key part in Boeing’s plans there and beyond. In 2018, Boeing increased 737 production to 52 planes a month in Renton. And nearly half of the 580 units it delivered last year were from the MAX family version of the plane.

Of the 43,000 new aircraft it plans to sell in the next 20 years, Boeing expects that Chinese airlines will buy nearly 20 percent. To cement what executives hope will be a fruitful relationship for years to come, Boeing recently built a completion center there.

And in a recent speech, Muilenburg reportedly stressed how key China is to the bottom line, saying that while the company “is doing well there,” it remains “important that we have a productive relationship.”

In an earnings call earlier this year, he said the company views “China as a long-term growth market for us.” And he said the country “needs the airplanes for growth to fuel their economy and to meet their passenger growth and cargo growth needs.”

The decision to ground the planes was an extraordinary one, especially in China, where it created headaches for travelers, disrupted the economy and caused at least a temporary rupture in relations with the American aerospace behemoth.

“China is going to be ticked by having to ground those airplanes,” said Mike Boyd, the president of Mike Boyd International, an aviation consulting firm. “That will hurt the Chinese economy. China isn’t exactly rushing off to Wall Street to buy Boeing stock, but they are going to have to do business with Boeing.”

Boeing has nearly 3,000 orders for the MAX 8 version of the plane, according to Boyd’s analysis, with China expected to be a significant purchaser. But now “they could lose some of that business,” Boyd said. “Everybody has a lot on the line. Boeing needs China. China needs Boeing, too.”

And it comes in a tumultuous global trade environment as the Trump administration and Chinese officials go round and round on a long-term trade agreement.

“All of this comes at a delicate time for Boeing because of everything else that’s going on,” said Kevin Michaels, an aerospace analyst with AeroDynamic Advisory, a Michigan-based consultancy. “There were no new orders of 737 last year (in China), and it’s possible that was because of trade issues.”

Though the Ethiopia investigation is in the early stages, the similarities between the two crashes have prompted carriers around the world to take added precautions.

In December, Muilenburg, the Boeing CEO, told CNBC that the “airplane is safe. We’re very confident in that.” He touted the aircraft, which he said was designed so that additional training would be kept to a minimum on it.

“What we wanted to accomplish was seamless training and introduction for our customers,” he said. “We purposefully designed the airplane to behave in the same way” as previous models.

The crash comes as Boeing’s commercial business has been surging, even after the October crash. With a backlog of 5,900 airplane orders, or about seven years of production, that is valued at $412 billion, Boeing predicted continued growth in 2019.

The Washington Post’s Thomas Heath contributed to this report.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.