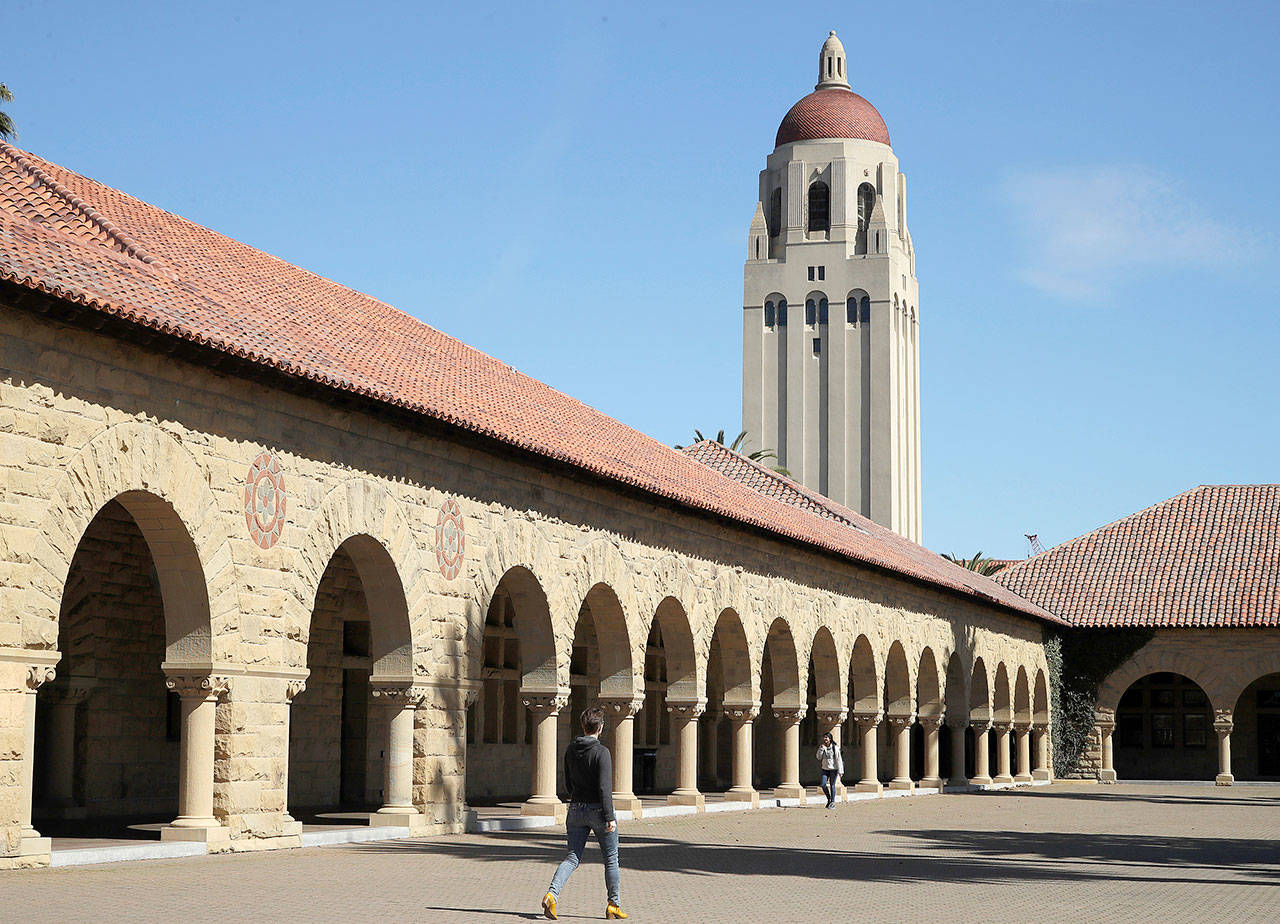

By Ryan Lane / Associated Press

Grants and scholarships are the best ways to pay for college because you don’t have to repay them. But if you chose a college because it offered you the most free money, your final bill might end up bigger than you thought.

More than 72% of college students ages 18 and younger received scholarships, grants or other free money in 2015-16, according to the latest data from the National Center for Education Statistics. For students ages 19 to 23, that percentage is less than 65%.

Here are some reasons your free money might disappear after freshman year and how you can prepare.

Some scholarships aren’t renewable

All of the scholarships listed on your financial aid award letter might not be available to you next year.

For example, some schools award incoming freshmen a one-time scholarship for visiting the college’s campus or interviewing with the school, says Tori Berube, vice president of college planning and community engagement at The NHHEAF Network Organizations, a nonprofit agency based in Concord, New Hampshire.

Other scholarships are renewable if you meet specific requirements. These could include maintaining a particular grade-point average, choosing a certain major or following the school’s code of conduct.

Review your scholarships to see which are renewable, and make sure you meet their terms — even if that means doing “handstands in the quad on Tuesdays,” Berube says. You should be able to find this information in your award letter, on the school’s website or by calling the financial aid office.

Financial situations change

Typically, schools aspire to maintain overall awards from year to year, says Stacey MacPhetres, senior director of college finance for College Coach, an educational adviser located in Watertown, Massachusetts. But the types of financial aid within that award could change.

For example, students have higher federal student loan limits after their first year in school. To account for this, a college could replace a grant with a loan of an equal amount for your sophomore year.

“I think a lot of families see that as a pretty significant bait and switch,” MacPhetres says. She believes that is not necessarily the case because the student still receives the same total amount of aid. Still, scholarships and grants are always more desirable than financial aid you have to pay back, like student loans.

Other changes to your financial circumstances could lead to you losing aid altogether. For example, say your older sibling graduates or moves out of your parents’ house while you are enrolled. The financial aid calculation now sees your family as having more available income, which increases the amount you’re expected to pay out of pocket.

When you submit the Free Application for Federal Student Aid, or FAFSA, be aware of changes to your income. If these are one-time events — like your parent taking a stock or a retirement distribution — MacPhetres says you should ask the financial aid office to treat this money as an asset, instead of income. Assets have a smaller impact on your ability to receive financial aid.

Tuition and fees increase

Even if you receive the same amount of aid year after year, it might feel like less because your college’s costs increased. On average, tuition and fees have risen roughly 3% annually over the past 10 years, based on data from the College Board.

Mark Salisbury, the founder of TuitionFit, a website aimed at increasing transparency around college pricing, offers this example: A school with a cost of attendance of $40,000 might offer you a $20,000 scholarship. The cost of attendance then rises each year, while the scholarship doesn’t.

“By the time the student graduates, tuition is $48,000 and they end up having to pay substantially more,” Salisbury says.

Planning ahead is the best way to prevent these additional costs from catching you by surprise. To help predict future tuition and fee increases at your own school, look it up on the College Navigator website.

College is a multiyear investment. If you can’t make the numbers work long term, be honest with yourself. Transferring to a less-expensive college might feel drastic, but it won’t necessarily hurt your education.

“What you do in college matters far more than where you go,” Salisbury says. “Go to a place that is less expensive, and then go in and make the most of it.”

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.