OLYMPIA — In the future, we could pay for filling potholes and repaving roads by how many miles we drive, not the gallons we buy.

Pay-per-mile taxes are a key contender for replacing the gas tax, whose cash-cow status is slowly drying up as cars get more fuel efficient — and as more cars skip gas entirely.

Even Washington state, which keeps ratcheting up its gas tax and now has the second-highest in the country, expects to see gas tax revenues fall by an estimated 45 percent within 18 years.

“And we have massive population growth going on — losing almost half of what we have is unthinkable,” said Reema Griffith, executive director of the Washington State Transportation Commission.

The federal government has pumped money into pilot projects across the country to test different aspects of pay-per-mile taxes, whose official names include road usage charges and vehicle miles traveled fees. Washington is the latest to join that hive mind.

In the coming weeks, planners hope to round up 2,000 drivers — including some from Snohomish County — to test drive its ideas, making us the country’s largest per-capita pilot effort to date.

“It’ll be a really rare and kind of unique opportunity for people to get involved and impact how we’re going to deal with our transportation future in terms of funding,” Griffith said.

The state hopes to see about four times more people sign up than it actually needs for the pilot, because the final pool must be representative of state demographics.

The project itself is expected to start in early 2018, pending an expected federal grant. The simulation will last a year.

Selected volunteers would agree to pick one of four mileage reporting methods, from no-tech to high-tech. They could switch halfway through. They would review simulated balance sheets. There also would be periodic surveys. No real money will exchange hands.

In particular, the Washington pilot program will test the use of smartphone apps for tracking and billing drivers’ miles — considered a promising method for making the program work. University of Washington students are helping on that one.

The state pilot also will test how the program could work across borders with Oregon, Idaho and British Columbia.

Why usage charges?

“We’re all paying by the mile today — we just don’t think of it that way,” Griffith said.

Paying at the pump follows a “user pays, user benefits” philosophy, except that not every user is paying. The goal is to create a more stable revenue source, while at the same time ensuring everyone pays their fair share.

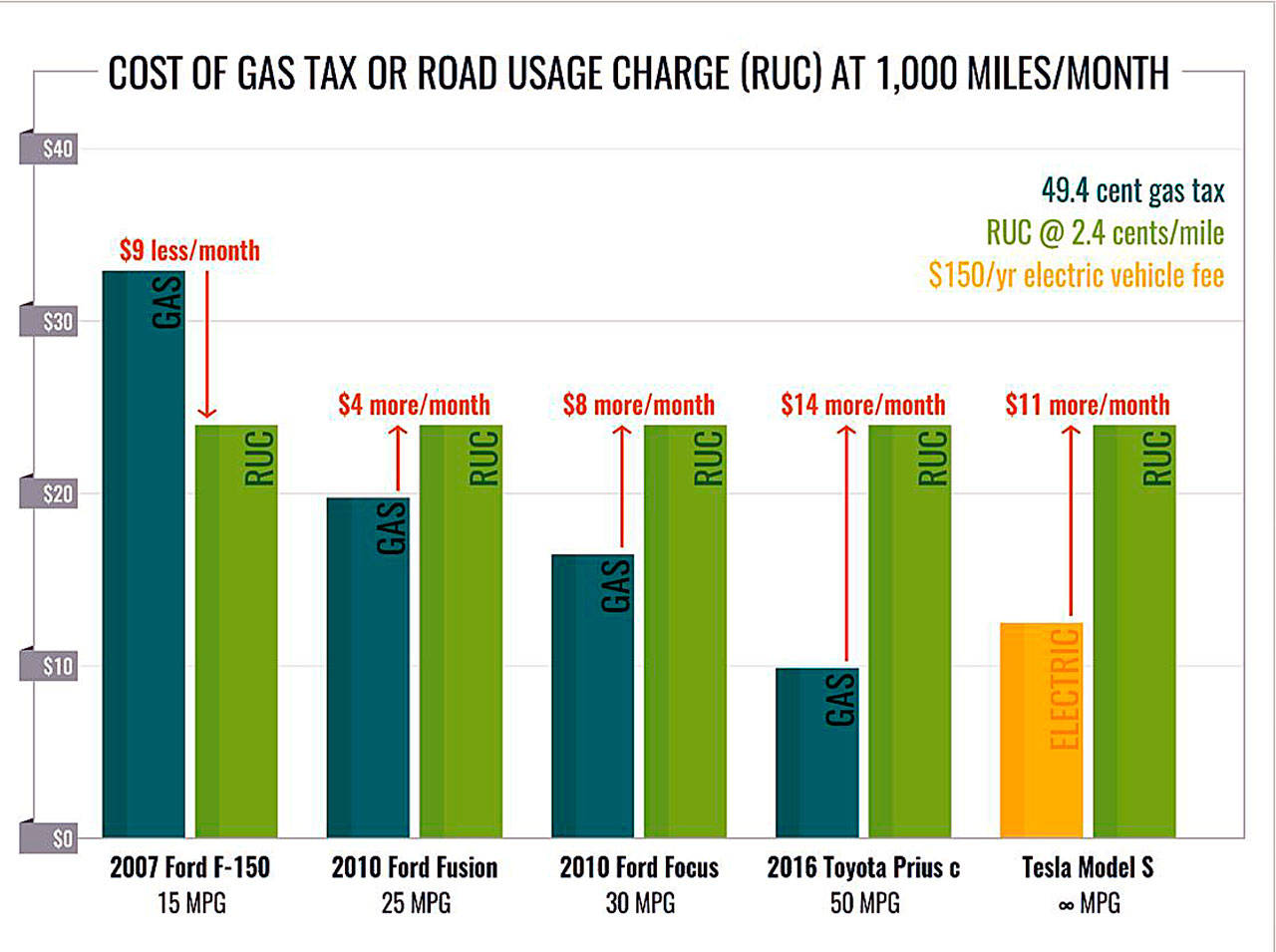

Electric vehicle owners currently pay a $150 annual fee, with $100 of that going toward state transportation coffers, to help offset the loss of gas tax revenue. That’s the equivalent of $12.50 per month, regardless of how many miles they drive.

By comparison, the owner of a Ford F-150 getting 15 miles per gallon pays over twice that in gas tax at 1,000 miles per month, according to state charts.

At 1,000 miles, the pickup driver is still paying more for gas than an all-electric vehicle owner is paying for kilowatts. But a pay-per-mile system would ensure both drivers at least pay the same amount in taxes for those 1,000 miles.

Some still worry that rural drivers will get dinged.

Before leaving his post as a state representative, John Koster called on his constituents to join the state’s road usage charge pilot program to provide a skeptic’s eye. He now leads the County Road Administration Board, a small state agency that distributes gas tax dollars for road projects.

“I think particularly for our rural counties … where people have to travel long distances to shop or go to church or whatever, they’re going to be impacted quite a bit,” said Koster, who has a long history in Snohomish County politics.

Oregon studied urban-rural driving patterns as part of its pay-per-mile tax efforts. It found that while rural drivers tend to drive longer distances, urban drivers tend to make more trips overall, narrowing that gap. Griffith calls it “the Starbucks effect.” The same was true for higher-income and lower-income households.

Costly to operate

Besides equity, the cost to operate a pay-per-mile tax program is a key concern among decision-makers here.

A pay-per-mile tax could cost up to 10 percent of collections to administer, compared to less than 1 percent to collect the gas tax, according to our state’s estimates.

In a full tax switch, that means the state would need to haul in far more in revenue just to have the same amount of money to pay for its current project commitments.

That doesn’t sit well with lawmakers like state Sen. Curtis King, R-Yakima, chairman of the Senate Transportation Committee.

“That was my problem with (road usage charges) from the beginning,” he said Thursday. “How do you implement a program that costs you 10 percent more than the old one and not saying you’re raising taxes?”

Having more states come on board will help, Griffith said. “The theory is if this advances at a multi-state level, those cost factors start dropping quite a bit.”

For groups like the Washington Policy Center, based in Seattle, it all points to a problem that’s bigger than revenue — expenses.

“Messaging points about fairness are emotionally moving, but do not tell a complete or necessarily accurate story of why public officials want more revenue from drivers who already pay the second highest gas tax in the nation,” wrote Mariya Frost, director of the free-market think tank Coles Center for Transportation.

The group echoes other conservative groups, such as the anti-tax policy group Americans for Tax Reform, which in a January 2015 letter to Congress called for first things first — have the federal Highway Trust Fund spend its money only on traditional road projects and get rid of Davis-Bacon wage requirements that increase project costs compared to market rates.

State lawmakers hold the answers to these and other touchy questions, such as whether mileage tax revenue would be distributed in the same way as the gas tax, with counties and cities getting a cut. Congress also plays a role, including whether to require manufacturers to start installing metering technology in vehicles.

There is a unique opportunity here, says Bob Poole, a fellow at the Reason Foundation.

Poole, who lauds both tolling and mileage taxes, sees in pay-per-mile an opportunity to reset the system.

“Changing the way we pay for our highways and bridges (by shifting from per-gallon to per-mile) offers a once-in-a-century opportunity to rethink how this vital infrastructure is managed, as well as how it is paid for,” he writes.

The goal is “de-politicizing the process, making it more like all the other utilities we use.”

There just may be a whole lot of politicizing to ultimately get there.

Oregon experience

Oregon knows about the politics first-hand. The state was the first to levy a gas tax, in 1919, and in 2015 it became the first to levy a pay-per-mile tax.

OReGO is an all-volunteer program. It’s limited to 5,000 participants but is in no danger of reaching that cap any time soon, with fewer than 1,000 drivers taking part.

The new tax has put some money into Oregon coffers, though nothing significant. As a small, all-volunteer program — and the only one — it can’t expect to do any better, said Michelle Godfrey, an Oregon Department of Transportation spokeswoman.

A bill in the Oregon House that would have required all fuel-efficient vehicles starting with model year 2026 to join the program did not move out of committee.

Instead, Oregon lawmakers passed a transportation budget that included a gas tax hike, a tax on new car sales, and vehicle registration fee surcharges based on fuel efficiency. They added a new tax on the sales of adult bicycles, and a new payroll tax for public transit. They also tried for rush-hour tolls near Portland.

In short, pretty much everything except pay-per- mile.

OReGO isn’t going anywhere.

But a one-year report on the program conceded there are a number of hurdles to overcome, even as it found pay-per-mile to be a feasible taxing method. The hurdles include the costs to collect the tax. Technology that’s nearly moot. Preventing cheaters. Giving non-tech-savvy folks a way to participate. And overcoming perceptions about inequity.

Those mirror national studies of the challenges.

Cart before horse?

Despite the hurdles and the debates and the worries, pay-per-mile tax boosters remain enthusiastic — because they still see it as the best route forward.

“I’m still thinking this is the greatest idea since sliced bread,” said Robert Atkinson, president of the Information Technology and Innovation Foundation. Atkinson chaired the National Surface Transportation Infrastructure Financing Commission, which issued its final report in 2009 calling for pay-per-mile taxes.

If Congress makes its own key decisions to move forward, Atkinson said the path to a pay-per-mile tax would be relatively swift and easy in an era where “most new cars are essentially traveling cellphones.”

Pilot projects like Washington’s could help set the stage.

This story has been modified to more precisely define the added cost of administering a pay-per-mile tax.

Herald writer Jerry Cornfield contributed to this report.

Melissa Slager: streetsmarts@heraldnet.com, 425-339-3432.

More info

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.