EVERETT — Snohomish County property owners may be in for a shock this week.

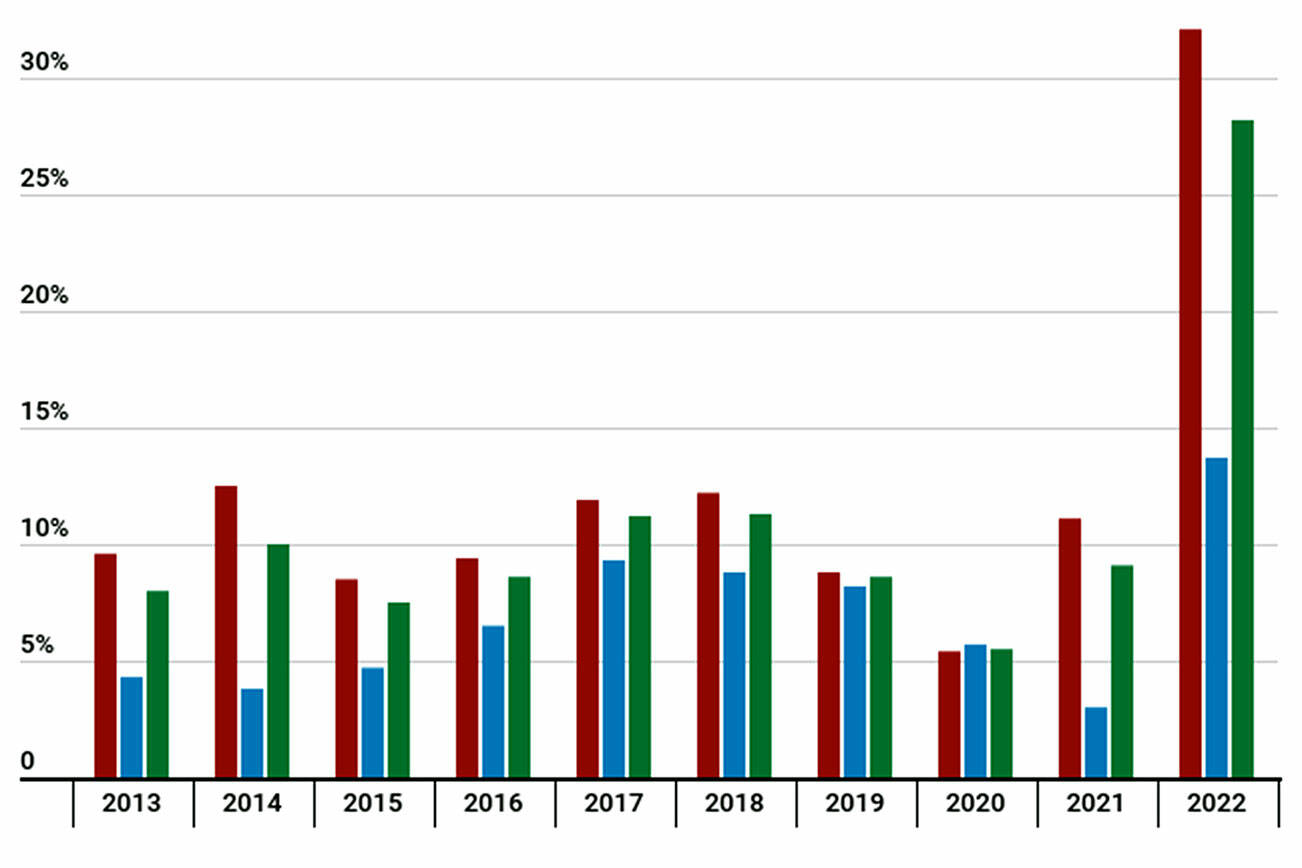

Home values in Snohomish County are up 32% on average, according to a Jan. 1 revaluation from the county assessor’s office.

Property values in all 15 of the county’s school districts have increased, ranging from 20% in Lakewood to a whopping 44% in Index. Meanwhile, commercial property values have climbed 14%.

Snohomish County Assessor Linda Hjelle said she has never seen increases this high in her 33 years with the assessor’s office.

The increases reflect surging home prices across the region. Values rose by 11% in last year’s assessment, fueled by a shortage of homes and strong buyer demand in 2020. The 2021 market brought out a frenzy, with bidding wars leading to offers tens of thousands of dollars over asking price in some cases.

“Inventory is way way down, and people want to come and live in Snohomish County,” Hjelle said.

The median home price grew by 27% from January 2021 to 2022, according to the Northwest Multiple Listing Service.

New assessments will be mailed to property owners Friday. Assessed values will determine next year’s property taxes.

Hjelle said taxes don’t necessarily increase because of higher assessed values. Taxing districts’ budgets and recent voter-approved measures determine how much tax is collected.

“I’m trying to reassure people they are not going to see a 30 to 40% increase in their taxes because the value has increased that much,” she said.

In 2021, there was an 11% increase in home values on average and a 7% increase in taxes, or an extra $331, according to the assessor’s office.

Property taxes may go up if a home increases in value at a faster rate than another property within a taxing district.

“Some of that tax load might be shifted to your property,” Hjelle said.

Taxes may also shift from commercial to residential properties, where values have increased at a much higher rate.

Hjelle said higher property values increase home equity, which can help you borrow money.

It’s bad news for housing affordability.

For example, values of mobile homes — typically a less expensive type of housing — have shot up. Hjelle said the assessor’s office has “seen extreme sale price increases for mobile homes in parks, particularly older mobile homes that have been remodeled.”

“Sale prices of these units are beginning to rival stick-built homes,” she said.

Hjelle said demand for recreational land and vacation homes has driven up property values in Index, with a population of 155.

The assessor’s office calculates a home’s value using market sales. It estimates how much you could have sold your property for on Jan. 1, 2022.

Hjelle encourages property owners to verify the accuracy of the assessments. They can check sales in their area by looking at an online interactive map at snohomishcountywa.gov/5414/Interactive-Map-SCOPI. They can also check market sales data on websites such as Redfin and Zillow.

“I want the public to have confidence that we are representing what the market is showing what you could sell your property for,” Hjelle said.

Those with questions should call the assessor’s residential appraisal department at 425-388-6555 or commercial department at 425-388-3390. Property owners can appeal their assessed values.

The assessor’s office will know the final tax rate at the end of the year, after taxing districts set their budgets and ballot measures are passed. Tax bills are sent out in February.

There are tax exemptions available for low-income senior citizens and people with disabilities. Those who own their own residence and were 61 or older by Dec. 31, 2022, or are retired because of a disability, may qualify for an exemption. The 2022 household income limit is $55,743 to qualify for a property tax reduction in 2023.

Jacqueline Allison: 425-339-3434; jacqueline.allison@heraldnet.com; Twitter: @jacq_allison.

Correction: An earlier version of this story featured incorrect dollar amounts in a table graphic listing property values by school district.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.