STANWOOD — Rick Flores dreams of one day owning a home he can pass on to his daughter.

He has been on-and-off house hunting since his wife learned she was pregnant in March 2020, but his student debt has stood in his way of purchasing, he said.

“I have a decent credit score. I have a decent income. But I can’t get a home loan above $200,000 because of my student debt,” said Flores, 28, a diversity, equity and inclusion director at Skagit Valley College. He owes about $78,000 in federal student loans.

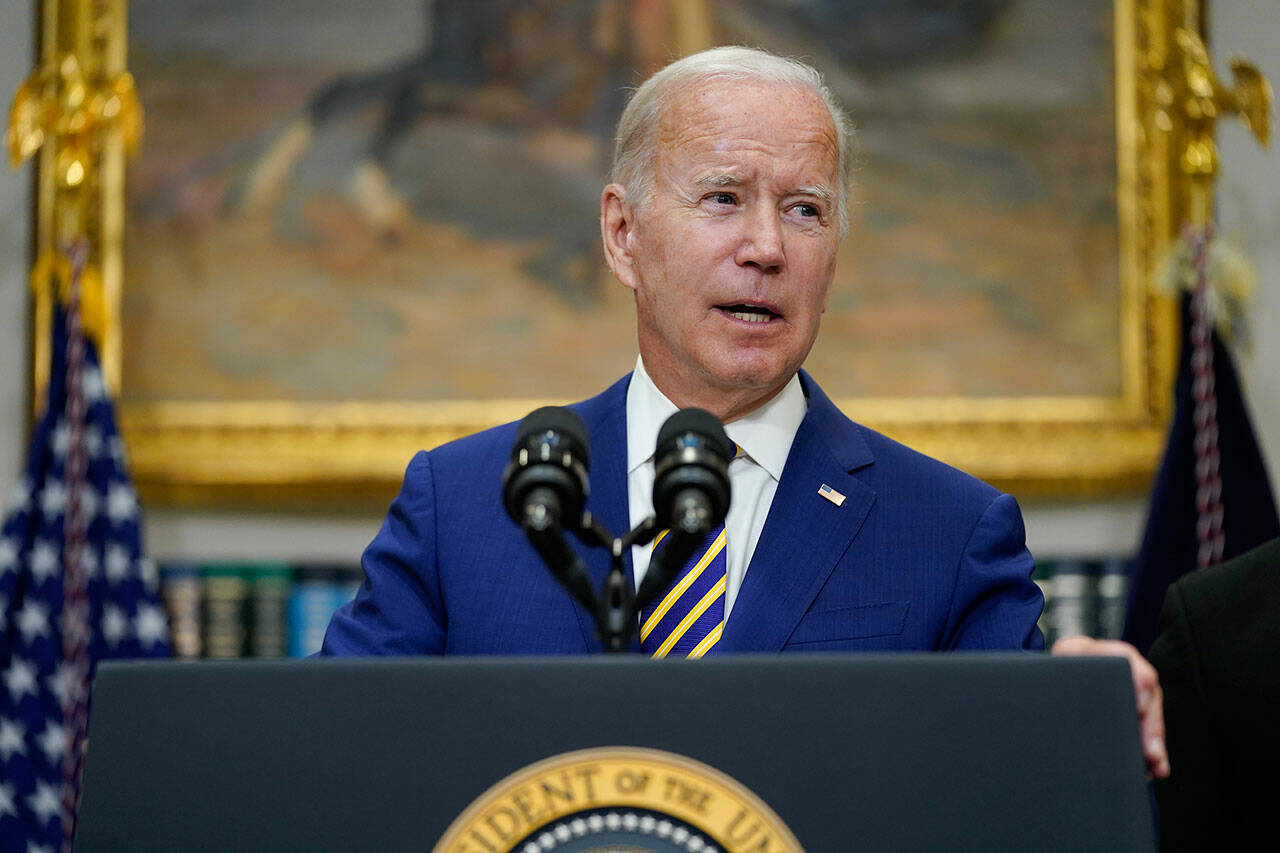

Flores’ hope for home ownership was reignited on Wednesday when President Joe Biden announced a plan to cancel a portion of student debt for millions of Americans. Under the plan, Flores is eligible for $20,000 worth of forgiveness.

“Seeing 25% of my student loans get forgiven is going to help me financially be able to do more,” Flores said. “I will finally be able to hopefully buy a house.”

Biden’s executive order will cancel up to $10,000 of student loan debt for people making less than $125,000 a year. It provides an additional $10,000 of debt relief for people who received a federal Pell Grant.

The decision could apply to as many as 43 million borrowers, according to the Biden Administration. Almost half of those people will see their student loan debt canceled in full.

On social media this week, Snohomish County residents were split on how they feel about the debt forgiveness plan. Those who benefit directly said the action will make a huge difference in their lives, though some said that more work needs to be done to resolve the student debt crisis. Others said the decision would be a detriment to taxpayers — or that it’s simply not fair.

“They took out the student loans, they need to pay them back,” Snohomish-area resident Steve Dalton wrote on Facebook in response to a Daily Herald posting.

Bothell resident Jennifer Bereskin said she understands why someone might be frustrated that other people are getting a debt break, when they did not. But those that do benefit will “pay it forward” for others, she said.

“I would hope that being able to pay off this part of my debt means that now I can pay my rent, I can put more money into groceries, I can put more money into the other aspects of the economy,” said Bereskin, who owes about $40,000 and qualifies as low-income under state and federal definitions. A full-time student at Northwest Indian College and mother of a son with a disability, she said she is on an income-driven repayment plan that does not require her to make payments.

But her interest continues to accrue. Bereskin said the original loan she used to get her first degree 10 years ago totaled $10,000. Now, after re-enrolling in school after a decade off, she owes four times that.

Bereskin, a Pell Grant recipient, said she’s grateful that almost half of her debt will be forgiven, but she wants legislators to tackle “predatory” interest rates next.

Marysville resident and local teacher Courtney Shipley agreed. She expects to receive $20,000 in forgiveness because she received a Pell Grant. With about $67,000 left on her student loans, that will wipe out just shy of one-third off her payback costs.

“That’s going to be a good amount of my loans being canceled, which means that I can continue to pay and I can get to a point where financially I’ll be able to continue my education,” said Shipley, who graduated from Western Governors University in 2021 with a degree in elementary education and special education.

She wants to get a master’s degree in teaching, but before amassing more debt, she wants to pay down her existing loans, she said. For her, the loan forgiveness shortens her wait.

“My initial plan was to start within the next six to seven years. But depending on financial situation it could be within the next four,” she said.

Despite her excitement, Shipley said some of her friends won’t qualify for forgiveness, and future students still face huge university bills with high interest rates. Shipley suggested the government should take further steps: regulating the cost for college, adding more financial aid for families in the middle class, or decreasing interest rates on student loans.

“I hope that this turns the conversation more to, ‘How do we prevent this from having to happen again?’” Shipley said.

Dean Toner, a technology architect living in unincorporated Snohomish County, also wants to see higher education reform — but he disagrees with the approach Biden took. Instead of a long-term solution, Biden’s decision is a “one-time forgiveness” that shifts hundreds of billions of dollars to the taxpayer, Toner said.

The nonpartisan Committee for a Responsible Federal Budget estimates loan forgiveness will cost between $440 billion and $600 billion. That money will roll over into the federal deficit.

The fiscally conservative National Taxpayers Union Foundation added that taxpayers will bear the consequences of that cost, whether in “spending cuts, tax increases, more borrowing or some combination thereof.” On average, the plan costs $2,085.59 per taxpayer, NTUF said.

Toner, 50, paid off almost $50,000 in student loans between 2013 and 2019 while raising his family. He struggled for a few years before refinancing his loans with a private provider, a move that dropped his interest rate and made it easier for him to “aggressively” chip away at the total. He gave up family vacations and “skimped” on purchases to afford the bill, he said.

He sympathizes with the people with outstanding loans who are excited to see some of their debt canceled, and he is happy to see them get some relief, he said. But the debt cancellation “doesn’t solve the problem.”

“Somebody’s got to pay it. It’s a transferring of responsibility, and you transferred the payback of that debt onto the taxpayer, which is what I’m frustrated about when I am already heavily burdened with taxes,” Toner said.

In Stanwood, Flores said he is not worried about the tax implications of the debt forgiveness. It gives him and millions of other people — including marginalized communities of low-income and minority students — a “little breathing room.”

“People did not care that PPP (Paycheck Protection Program) loans were forgiven, that people like Tom Brady, Kanye West and all those other celebrities people love took out millions in PPP loans and didn’t have to pay it back,” Flores said. “But as soon as something happens that can lift mostly people of color who are affected by this, now it’s a problem. … If my tax dollars can bail out businesses and banks and celebrities, why can’t it help the general public?”

Just because one person had to struggle to pay off their loans, he said, doesn’t mean everyone should have to.

Flores sided with those who said the fix is not enough. While it will help ease the pressure on low-income families who are burdened by debt, it doesn’t pay off all of their loans — or prevent future generations of students from the same problems he faced.

“This is just a little Band-Aid over a bigger wound,” Flores said.

Mallory Gruben is a Report for America corps member who writes about education for The Daily Herald.

Mallory Gruben: 425-339-3035; mallory.gruben@heraldnet.com; Twitter: @MalloryGruben.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.