By The Herald Editorial Board

Nothing is certain, Benjamin Franklin famously said, except death and taxes.

What is becoming increasingly less certain about taxes, however — when it comes to how Washington state will pay for transportation infrastructure — is which tax will be used to raise needed revenue.

While a legal challenge has begun following the passage of Initiative 976, it’s difficult to imagine state lawmakers will entirely ignore the message from voters — especially with legislative elections coming shortly after the next session — that a majority don’t want the annual renewal of their car licenses to cost much more than the $30 that Tim Eyman promised them. (Quick aside; car tabs were never going to be only $30, because I-976 said nothing about up to $20 in service and third-party agency fees above the $30 the state would collect.)

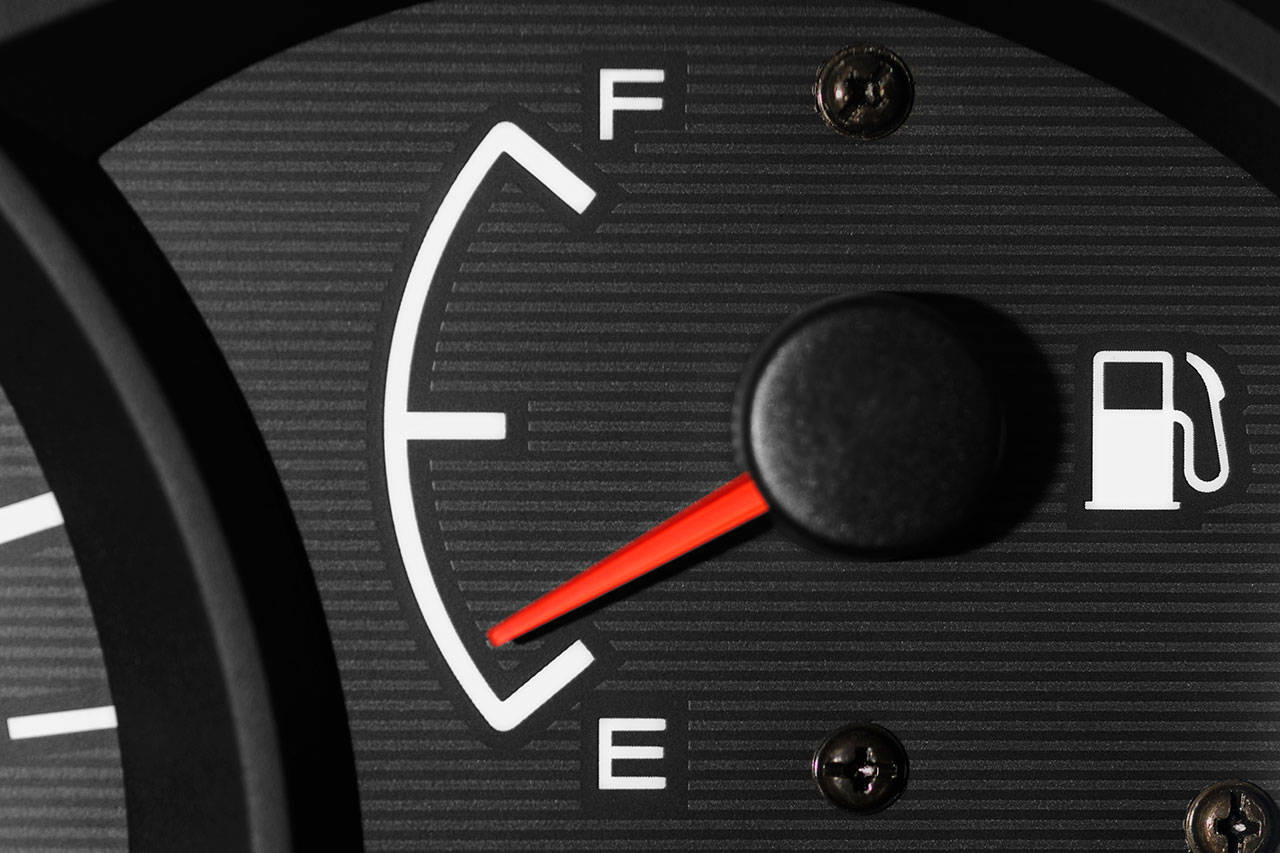

That uncertainly — and the potential of lost revenue from weight fees, excise tax and other charges — has placed more attention on how the state will ultimately replace its gas tax, the revenue from which isn’t keeping pace with the increasing costs of replacing and maintaining highways, bridges, ferries and more.

Even at nearly 50 cents a gallon — the fourth-highest state gas tax in the nation — the revenue from the gas tax is expected to decline by as much as 45 percent by 2035, according to figures from the state Transportation Commission. As vehicles have become more fuel efficient and a growing number of drivers switch to hybrids and plug-in electric vehicles, more miles are being driven that take a detour around the gas tax.

Which is why the Transportation Commission — after years of discussion, studies and a year-long pilot program among some 2,000 drivers, including a former Herald Street Smarts reporter — has now forwarded its recommendations to the Legislature to begin a gradual switch from the gas tax to a per-mile fee or “road-usage charge.”

Any switch would be gradual. The state has construction bonds already obligated to gas-tax revenue that won’t be paid off for 10 years or longer. And there are plenty of questions that will have to be answered about how to implement a per-mile fee. Participants in the pilot were given different options, including a GPS device or simply submitting a photo of their odometer.

While some have expressed concerns about devices that essentially track a vehicle’s location from point to point, we’ve previously noted there are options and technologies that can protect the privacy of drivers and report only miles driven.

The Transportation Commission’s recommendations include a gradual lane change to a road-usage charge, starting with the state’s fleet of vehicles, then electric vehicles and hybrids. Currently, electric vehicles pay a flat $225 in lieu of the gas tax, while owners of hybrids pay an additional $75 fee on their car tabs (another fee not included in I-976). That’s a fair group to begin with, as long as the state continues to make investments in adding vehicle-charging stations throughout the region.

Starting with state vehicles, EVs and hybrids should allow a large enough group to test various fee-collection methods and help determine a fair per-mile rate. The commission has recommend a fee of 2.4 cents per mile, although it will be up to state lawmakers to set that fee and determine possible exceptions to who pays.

Another issue legislators will have to resolve: whether the road-usage charge will be strictly used for road, bridge and similar infrastructure or if some portion can go toward transit and other transportation modes. While the gas tax is constitutionally obligated for highway needs, there’s a case to be made that more funding for transit projects can be just as effective and cheaper than adding highway lanes in reducing congestion, as it can encourage more drivers — especially solo drivers — to leave their vehicles at home.

There’s a long road ahead for this switch, but one that needs to begin as soon as possible. Starting with the state’s own fleets of department and agency vehicles — and potentially inviting local government fleets the option of joining in — the state can put the road-usage charge to a street-level test before it is expanded to more of the state’s motorists.

Work to begin this switch in revenue sources can’t be delayed much longer; soon enough the gas tax will be running on fumes.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.