By The Herald Editorial Board

We should all hope we’d be in the financial position where we’d have to pay Gov. Bob Ferguson’s proposed “millionaires’ tax,” because — as the name implies — it would levy a tax on annual income above $1 million, meaning we’d be doing pretty well.

And even with that income tax, it would still not touch the first million dollars in earnings, meaning that under the suggested rate of 9.9 percent, you’d pay a dime for hitting a dollar over $1 million; and, to be fair, each dollar after that.

Oh, the hardships of wealth, at least for fewer than half of the top 1 percent of the state’s earners.

Still, there are enough of those earners to bring in a projected $3 billion each year in additional revenue, for which the governor already has plans.

The details: Ferguson — while proposing a budget to state lawmakers that offers no support for additional taxes as the Legislature considers a supplemental budget during its coming 60-day session — calls for an amendment to the state constitution that would levy a high-earners’ income tax. Making that change would require two-thirds support in both House and Senate, as well as approval by the state’s voters; a process that — allowing time for nearly certain court challenges — likely delays any revenue collection until at least 2029.

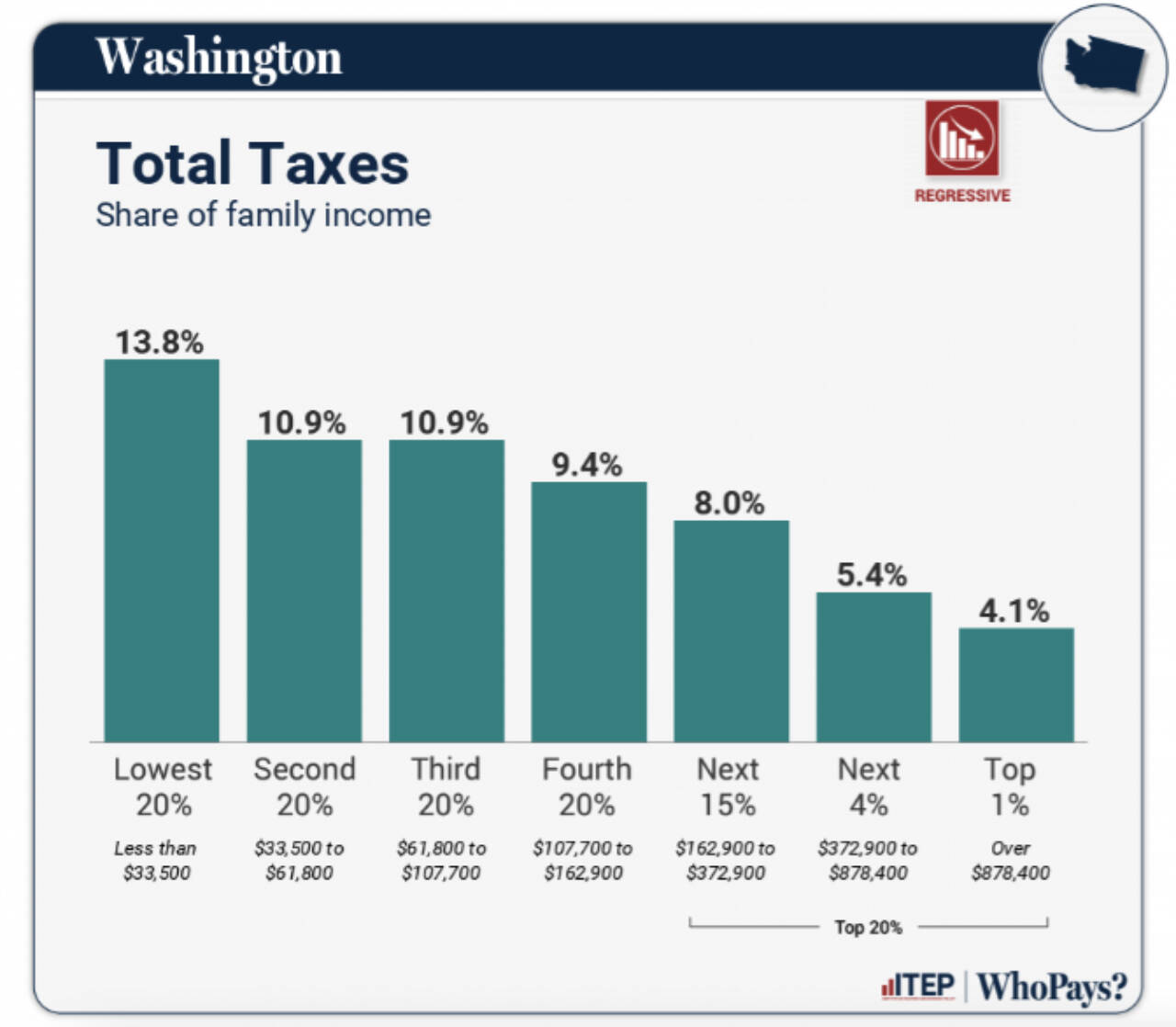

Ferguson, in a news release just before Christmas and in news coverage, outlined his recommendations for how that additional revenue could be used, in particular making additional headway in improving the fairness of the state’s package of taxes, which for years has landed the state at the bottom of rankings among all 50 states for its regressive burden, meaning those with lower incomes pay a significantly higher share of what they earn as taxes.

How regressive? Currently the state’s lowest-paid 20 percent of families — those making less than $33,500 a year — pay about 13.8 percent of their income as taxes; the top 1 percent of earners — those making more than $878,400 a year — pay 4.1 percent of their income as taxes, according to the Institute on Taxation and Economic Policy. Even those with incomes between $33,500 and $107,700 — the next 40 percent — are paying about 10.9 percent of their income as taxes. Those making between $107,700 and $162,900 a year pay about 9.4 percent as taxes.

Until the state’s adoption of its Working Families Tax Credit program and its capital gains tax, ITEP had ranked the state as having the most regressive tax system in the nation. Those changes boosted the state in the organization’s most recent report to No. 49.

With greater tax fairness in mind, the governor suggested the additional revenue could be used to bolster the state’s Working Families Tax Credit, which currently provides $1,290 annually — a little more than $100 a month —to those who qualify based on income and number of children. As well, Ferguson suggests reducing the state’s business and occupation (B&O) tax to aid small businesses, exempting the tax for businesses making less than $1 million. As well as helping those businesses, the tax could also improve affordability, as businesses routinely pass on the costs of the B&O tax to consumers.

Ferguson also suggests more spending for K-12 education and the elimination of sales tax on personal hygiene products, putting soap, shampoo, toothpaste, deodorant, diapers and other such essentials on the same untaxed shelf as most food items in grocery stores.

While final allocation of that revenue would require input from lawmakers, the governor’s suggested allocation takes another few steps toward tax fairness, requiring more be paid by the state’s very top earners and using that to ease the tax burden on at least three-fifths of the state’s 8 million residents, while also paying further dues toward the state’s “paramount duty” to provide for K-12 education.

Getting there will be another matter.

The headwinds: The first steps toward passage require two-thirds approval of both chambers to place the question before voters. With Democratic majorities in both chambers, even a blue wave of support among lawmakers would still fall short; currently Democrats make up 61 percent of the Senate and 60 percent of the House. The amendment will need the votes of several Republicans to get to two-thirds.

And voters — with the exception of an initiative in 1932 that sought to adopt a graduated income tax that won with 70 percent support — have rejected adoption of an income tax over the following decades. The most recent ballot measure was in 2010, which would have taxed income above $200,000 for individuals — about $300,000 today, adjusted for inflation — while reducing state property tax levies, certain B&O taxes, and allocating funding to education and health. That initiative failed with 64 percent opposed. Washington remains one of only seven states without an income tax.

Critics of past proposals for a state income tax — including one by the late State Treasurer Jim McIntire in 2015 that would have imposed a flat 5 percent income tax, while reducing property taxes, the state sales tax and the B&O tax — have also pointed to the state Supreme Court’s reversal of the 1932 initiative.

But that court’s decision, first deadlocked in a 4-4 tie among justices, changed to 5-4 defeat when one of the justices who had earlier supported the income tax flipped his vote when a new jurist filled a court vacancy.

And, observers will note, the current court is not the same court of 90 years ago; having found the state’s capital gains tax constitutional in 2023.

Critics warn that many of those who would have to pay the tax would pick up stakes and move to a tax-friendlier state, just as Amazon’s Jeff Bezos did in 2024, when he moved his residence from Washington state to Florida. While Bezos cited family and business reasons for his move, he still was said to have saved himself an estimated $954 million after selling $13.6 billion in Amazon stock while living in Florida rather than in Washington, avoiding the new capital gains tax.

Yet, Bezos, along with being the fourth-richest man in the world, may prove to be an outlier.

Reason to try: A report by the Institute for Policy Studies found that what it called the “millionaire class” actually grew in two states where it studied wealth taxes, including Washington with its capital gains tax.

Washington, the progressive research organization said, saw an increase in its millionaire class from 463,000 in 2022 to more than 681,000 by 2024 after the capital gains tax, which raised $1.2 billion as of 2024, cleared the state Supreme Court.

In the same vein, when Massachusetts adopted its own millionaires’ tax — adding a surcharge for high earners above the state’s 5 percent income tax — the number of its top earners grew by nearly 39 percent. And rather than chasing away tax revenue, Massachusetts reported revenue from its millionaires’ tax at nearly $3 billion last year, far more than the $1.3 billion it had expected.

Considering the still-regressive nature of Washington state’s bundle of taxes — with a sales tax rate that places it as fourth highest among the 50 states, behind only Louisiana, Tennessee and Arkansas — and its current ITEP ranking, the Evergreen State still has work ahead to rebalance its measure of tax fairness, especially in a state that has contributed much in providing the infrastructure, workforce and business climate that has fostered the success of technology, aerospace, health and other industries.

State lawmakers should allow voters another opportunity to consider an income tax, limited to the state’s very top earners.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.