By The Herald Editorial Board

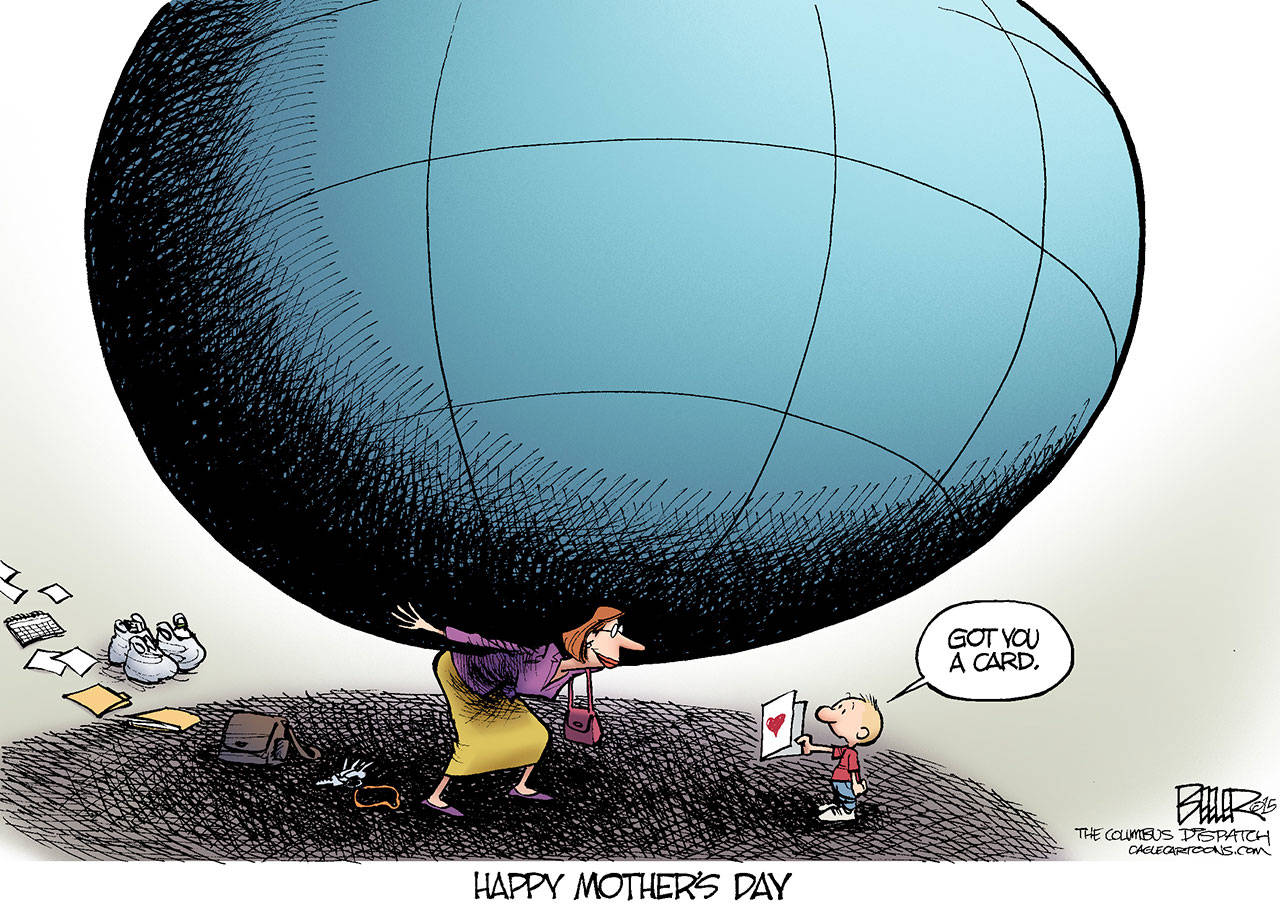

No doubt, Mom will love what you got her for Mother’s Day, whether it’s a fuchsia basket, a gift certificate, chocolates, the day off from cooking and clean-up or just a card. (But tell us you did get her more than a card.)

Certainly, she’ll appreciate the sentiment behind the gift and the gratitude you’ve shown for all she’s done.

But what she might really like — and not just for herself, but for her daughters and granddaughters, too — would be some progress on changes that could make life easier for herself and her family, things that have become especially clear during the pandemic.

It’s not too late to print up another gift certificate that promises that you’ll work to see the following adopted or strengthened:

Equal pay for equal work: The Equal Pay Act has been around since 1963, as long as some of our mothers have been mothers. Yet though the act made it illegal to pay women less than men performing comparable work, progress in closing the wage gap has been slow, especially so for women of color. When adopted, women were paid about 60 cents for every dollar a man earned; today, according to the National Women’s Law Center, women in general are making about 82 cents on the dollar for men. For Latinas it’s 55 cents for every dollar earned by white males; 60 cents for Native American women; and 63 cents for Black women. Asian women, at 87 cents, come closest to parity.

Women still are paid less than men for the same work, but much of that gap also is because women — especially women of color — are over-represented in lower-wage jobs because of cyclical poverty and systemic disadvantages.

Advancement of the following could help close those gaps:

Child and working family tax credits: Washington state’s Legislature presented an early — if long delayed — Mother’s Day gift for moms and families this session by finally funding the Working Families Tax Credit it adopted in 2008. Packaged with adoption of a state capital gains tax, it allocated funding for the tax credit for the first time. Based on household size and income level, the annual credit essentially delivers a rebate on sales tax of $300 for singles and married couples with no children; $600 for families with one child; $900 for families with two children and $1,200 for families with three or more kids. The rebate is expected to help about 420,000 households in the state.

The federal Child Tax Credit also was expanded as part of President Biden’s covid relief package, increasing the $2,000 annual credit for each child aged 16 and younger, adjusted for income, to $3,000 for children 17 and younger, with a $600 bonus for children 6 and younger. But that extension is temporary, expiring in 2022; Biden has called for permanent extension of the credit in his American Families Plan.

At the same time, a Republican proposal — for those who still consider him part of the GOP — has been forwarded by U.S. Sen. Mitt Romney, R-Utah. Romney’s plan would permanently provide an allowance of up to $4,200 for each child, birth to 5 years and $3,000 for children 6 through 17 years of age, again adjusted for family income. Romney’s proposal also would end some current programs, including Temporary Assistance to Needy Families, a separate block grant program for low-income families with children and would tighten restrictions on the Supplemental Nutrition Assistance Program (SNAP), commonly referred to as food stamps.

Child care: Federal assistance for child care has been another long battle. President Nixon vetoed a bipartisan bill in 1971 — the Comprehensive Child Development Act — that would have supported a national program of affordable child care. Biden, again as part of his American Families Act, seeks a similar program, with universal preschool and subsidized child care for low- and middle-income families.

There’s a definite need for an expansion of available, affordable child care. Under the current federal program of child care block grants, only 1 in 7 eligible children are served; and Head Start serves fewer than half of eligible children, according to recent testimony before the House Committee on Education and Labor.

Unfortunately, such proposals with potential to provide significant help to low- and middle-income families already are getting lost in the partisan weeds, with some Republican members of Congress bemoaning universal pre-K offerings — along with free community college — in Biden’s plan as allowing an opening for “indoctrination.” Unless such indoctrination covers coloring, counting and singing “The Wheels on the Bus,” we’re not seeing it.

There yet may be an avenue for compromise — and support from the American public — if Biden adapted his proposals to provide additional direct funding to families, as a few moderate Republicans have proposed Families could use that allowance to either pay for child care and preschool programs or to provide enough support for families to allow one parent to remain home, either full or part-time.

A 2018 Pew Research Center poll found that 47 percent of parents say they spend too little time with their kids, including 35 percent of mothers and 63 percent of dads, most often because of work obligations.

For single parents — who represent 35 percent of families — staying home is not an option, of course. And it’s not an option for families where both parents because of low pay are working out of necessity.

More families, however, might gladly choose a parent to stay home or rotate that responsibility if the family budget allowed for it, which is where programs such as tax credits, affordable health care coverage and a sufficient increase in the minimum wage could start to make that a possibility.

The best thing about promising all this as a gift for Mom: It’s something the whole family can enjoy.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.