If you need more urgently, but banks won’t approve your loan application due to your low credit score, here you have the solution to your problems: our ranking with the top 8 providers of loans for bad credit with instant approval in the US.

Carefully vetted and analyzed by our team of loans and finance specialists, you can borrow from $100 to $50,000 and repay it on your terms from just 1 month up to 84 months.

Check out our ranking below to apply for your bad credit loan with instant approval now.

Ranking of the Top 8 Loans for Bad Credit with Instant Approval in the US

Borrowing the money you need is just one click away from you – choose your preferred company from our ranking to start your bad credit loan application now:

- Big Buck Loans: Best Overall Bad Credit Loan Provider in the US

- Honest Loans: Fast application with flexible repayment options

- Low Credit Finance: Large number of bad credit loan offers

- Credit Clock: Best for emergency bad credit loans

- Fast Loans Group: No credit checks for bad credit loans

- Money Mutual: Fastest disbursement

- Heart Paydays: Alternative with instant approval

- Fast Money Source: Highest approval rate for bad credit

If you want more information about our recommended bad credit loan providers, you can find more details about them below.

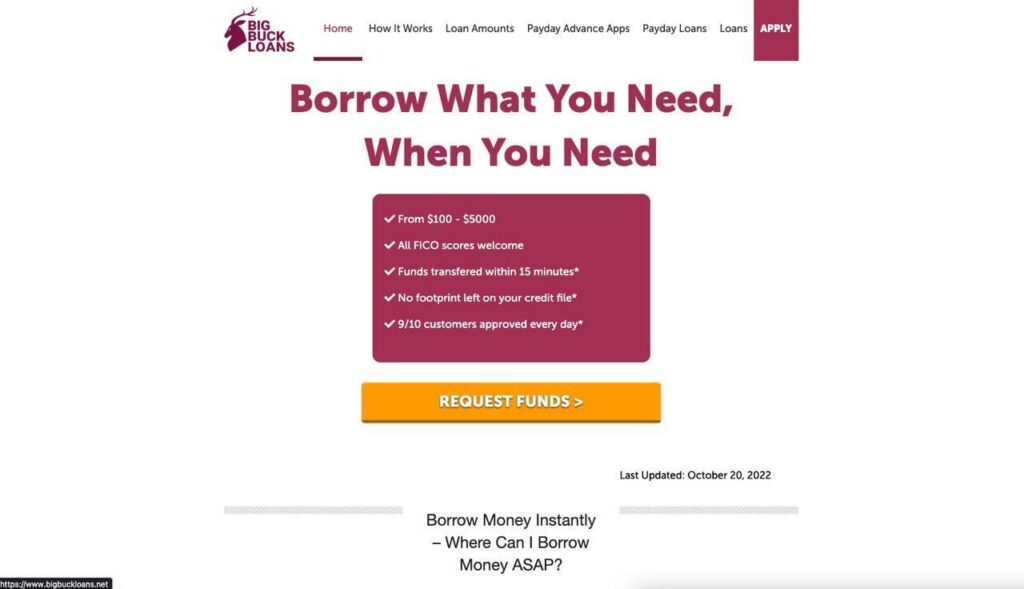

1. Big Buck Loans: Best Overall Bad Credit Loan Provider in the US

Offering you the opportunity to borrow from $100 to $5,000 and repay it over 2 to 84 months with a low APR and no credit checks, Big Buck Loans is our highest rated pick in this category. It unites all the benefits that make it an outstanding provider of loans for bad credit with instant approval, along with express disbursement that makes it also suitable for bad credit emergency loans.

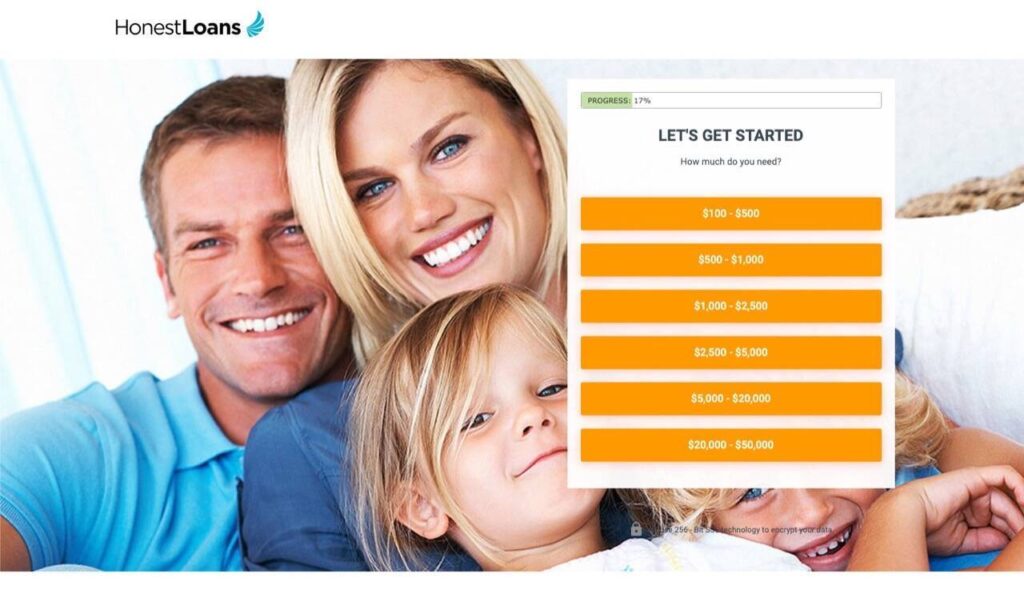

2. Honest Loans: Fast application with flexible repayment options

Honest Loans doesn’t make hard credit inquiries, and hence, you don’t need a minimum credit score to qualify for a bad credit loan from $100 up to $50,000. You can repay your loan over 1 to 60 months with a competitive APR, and thanks to its instant approval and fast disbursement, it’s a highly versatile provider you can use for any purpose.

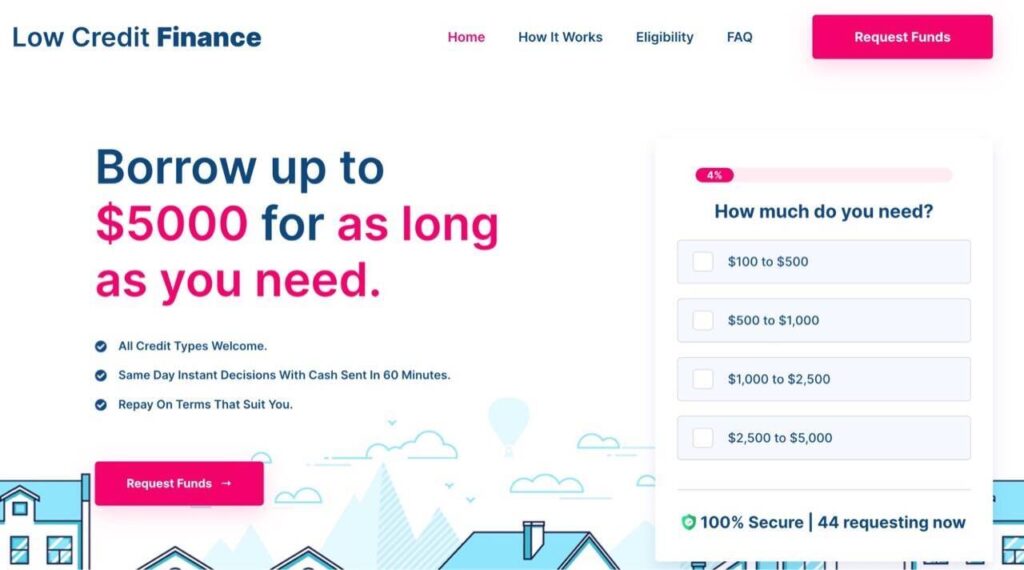

3. Low Credit Finance: Large number of bad credit loan offers

Low Credit Finance is an outstanding lending network that will help you to get a bad credit loan from $100 to $5,000 that you can repay in up to 48 months. Being the largest network of lenders that offer a high approval rate for customers with bad credit or no credit score at all, you can rely on Low Credit Finance to borrow the money you need at a competitive rate.

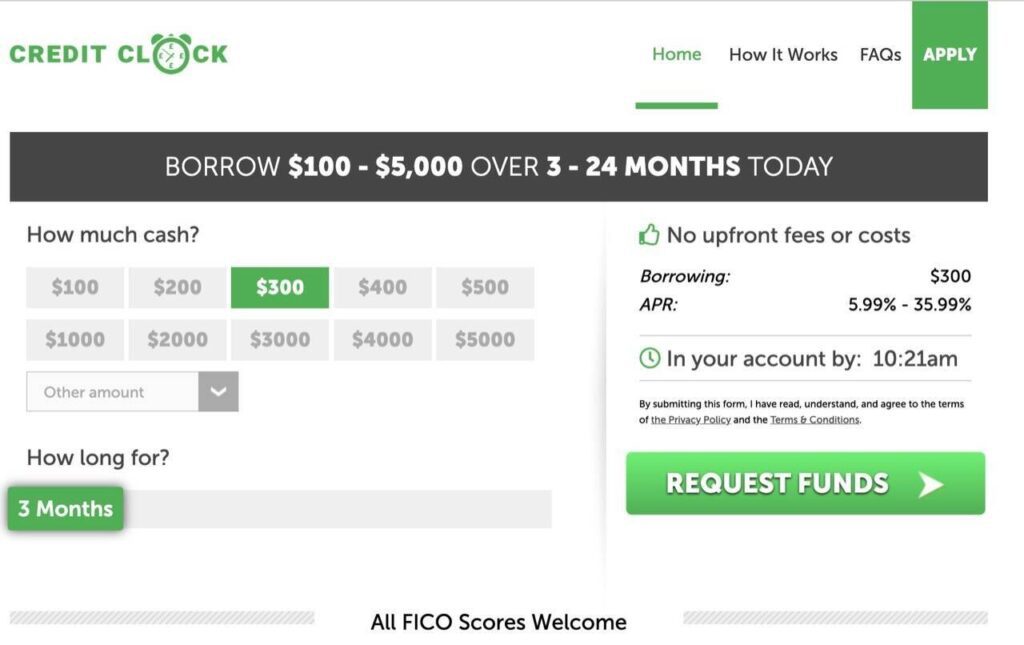

4. Credit Clock: Best for emergency bad credit loans

Credit Clock is the go-to company when you need money urgently and you have bad credit or no credit history because it’s available 24/7, it offers instant approval and express disbursement, and you can borrow from $100 up to $5,000 even with a 300-point credit score.

5. Fast Loans Group: No credit checks for bad credit loans

Fast Loans Group is an excellent choice for borrowers with bad credit because it doesn’t make hard credit checks, and you can borrow up to $50,000 and repay it over 60 months with a competitive interest rate. This company also accepts customers with no credit history, low income, or if you’re highly-indebted.

6. Money Mutual: Fastest disbursement

Money Mutual combines instant approval and fastest disbursement with a no minimum credit score requirement. You can borrow from $200 to $5,000 and repay it over 24 months with a low-interest rate, and since it disburses loans in 1-2 hours, you can rely on it for emergencies.

7. Heart Paydays: Alternative with instant approval

Heart Paydays is a solid alternative if our other recommended companies don’t accept your application. You can borrow up to $5,000 and repay it over 24 months with instant approval and same-day disbursement. However, remember that they tend to charge higher rates for borrowers with bad credit.

8. Fast Money Source: Highest approval rate for bad credit

If you’ve been rejected by other lenders and you want to borrow money urgently, Fast Money Source can be the solution to your problems. With an approval rate as high as 90% for bad credit, extremely bad credit, no credit history, low income and high-indebted customers, you can borrow from $100 to $50,000 and repay it over 60 months. However, keep in mind that they tend to charge higher interest rates.

Overview on the Best Providers for Instant Approval Bad Credit Loans

To make it even easier for you to pick the right provider, here you have a complete overview on our recommended companies.

| Payday Loan Provider | Best For… | Score |

|---|---|---|

| Big Buck Loans | Instant approval with low APR | 10/10 |

| Honest Loans | Fast application with flexible repayment options | 10/10 |

| Low Credit Finance | Large number of bad credit loan offers | 9/10 |

| Credit Clock | Best for emergency bad credit loans | 9/10 |

| Fast Loans Group | No credit checks | 9/10 |

| Money Mutual | Fastest disbursement of bad credit loans | 8/10 |

| Heart Paydays | Instant approval | 8/10 |

| Fast Money Source | Highest approval rate | 8/10 |

Comparing the Best Loans for Bad Credit with Immediate Approval in the US

Finally, to assist in your decision making, here you have a comparison table that will make it even easier for you to pick your ideal bad credit loan provider.

| Lender | Approval Speed | Disbursement Speed | Hard Credit Checks | Repayment Periods | Loan Amounts |

|---|---|---|---|---|---|

| Big Buck Loans | 1-5 seconds | 1-2 hours | No | 2 months to 84 months | $100 to $5,000 |

| Honest Loans | 1-5 seconds | 2-4 hours | No | 1 month to 60 months | $100 to $50,000 |

| Low Credit Finance | 10-20 seconds | 4-12 hours | No | 2 months to 48 months | $100 to $5,000 |

| Credit Clock | 1-5 seconds | 1-2 hours | No | 3 months to 24 months | $100 to $5,000 |

| Fast Loans Group | 10-20 seconds | 2-4 hours | No | 1 month to 60 months | $100 to $50,000 |

| Money Mutual | 10-20 seconds | 1-2 hours | No | 1 month to 24 months | $200 to $5,000 |

| Heart Paydays | 10-20 seconds | 4-8 hours | No | 3 months to 24 months | $100 to $5,000 |

| Fast Money Source | 30-60 seconds | 4-24 hours | No | 1 month to 60 months | $100 to $50,000 |

How to Get a Loan for Bad Credit with Instant Approval Now

Apply for your low credit score loan now to borrow the money you need today – here’s how:

- Choose a bad credit loan provider from our ranking

- Visit their website to start the online application process

- Fill out the application form and send it

- Get instantly approved if you meet the eligibility criteria

- Review the available bad credit loan offers

- Accept your preferred offer

- Receive the money into your bank account

Thanks to the easy online application process that our recommended providers bring you, you can apply for your bad credit loan in just 5 minutes and receive instant approval.

Benefits of Loans for Bad Credit with Instant Approval

Because we have selected the best online lenders in the US, you will enjoy the following exclusive benefits.

Instant Approval Guaranteed

Upon sending your application, our recommended providers will immediately review your application, and if you meet their eligibility criteria, they will grant you approval within seconds. You’ll quickly receive available offers for your selected loan amount and repayment periods to get the money you need right now.

Highest Approval Rate in the Industry

Did you know that some of our recommended companies, such as Big Buck Loans offer an approval rate as high as 90%? Because your credit score no longer matters, you can qualify even with a 300-point credit score. Forget about your bad credit and borrow the money you need from our recommended lenders.

Borrow As Much Money As You Need

You can borrow $100, $200, $300, $500, $1,000, $5,000, and even $50,000 depending on your own needs and goals. Our recommended lenders put at your disposal the funding you need at your disposal, regardless of your credit score, by offering you the most generous bad credit loans in the US.

Repay Your Loan On Your Own Terms

You can opt for repaying your bad credit loan in the short term or the long term – it’s up to you. You can choose repayment periods as short as 7 days or as long as 48 months. Our recommended companies bring you the most flexible repayment periods in the US to help you handle your debt as you wish.

Save Money with the Most Competitive APR

A bad credit score usually means a much higher APR, but it’s not the case at our recommended companies. We’ve selected the providers that offer the most affordable bad credit loans thanks to their low average and maximum APR. Even with a 300 points credit score, you won’t pay more than a 35.99% APR.

Rebuild Your Credit History and Boost Your Credit Score

Borrowing from our recommended companies will mark a new beginning for your financial life, because they will help you to rebuild your credit history and boost your credit score. They report to credit bureaus, hence by repaying your bad credit loan on time, you’ll start adding positive items on your credit report and your credit score will improve as a result.

How We Chose the Best Bad Credit Loans with Instant Approval in the US

We considered the following 6 factors when building this ranking, because they allowed us to identify the providers with the best bad credit loans in the US.

Legitimacy and Reputation

The first factor to observe is the legitimacy and reputation of the online lender. We start by verifying if the lender is properly licensed to do business in all the states they operate in, by checking the different state regulators and government state agencies.

After making sure the online lender is licensed and hence legal, we proceed to check the following sources to make sure it’s legit and reputable:

- Better Business Bureau (BBB)

- Consumer Financial Protection Bureau (CFPB)

- Online Communities

This way we make sure to exclude all the bad credit loans scams and shark loans, to protect you as a borrower.

Approval Rate for Bad Credit

The second factor to observe is the approval rate for bad credit, because you have a low credit score and hence you need a lender willing to approve you regardless of it. This is why we only recommend lenders that offer a 80-90% approval rate, even if you have extremely bad credit or no credit score or history at all. Check out this article for the best no credit check loans.

Approval and Disbursement Speed

We are talking about bad credit loans with instant approval, and hence the application review and approval process should be instantaneous. This is exactly what our recommended lenders offer you, thanks to their review systems powered by AI and cutting edge tech, capable of analyzing your information within seconds to verify if you meet their eligibility standards.

For example, lenders like Big Buck Loans and Honest Loans are capable of bringing you an answer within 5-10 seconds, instantly bringing you their available bad credit loan offers as well.

We also make sure that our recommended lenders can disburse your loan the same day, allowing you to get the money as soon as possible.

Available Loan Amounts

We only selected lenders that can put multiple loan amounts at your disposal. This is why our recommended companies can lend you as little as $100 or as much as $50,000. You can use our ranked bad credit loans to cover any expense or fund any project with ease thanks to their high approval rate and instant approval with same day disbursement.

Available Repayment Periods

Because we all have different needs and goals, we have selected online lenders that can bring you several repayment periods such as 7 days, 14 days, 3 months, 6 months or even 48 months. You can opt for both short term or long term bad credit loans through our recommended providers.

APR and Fees

A fair APR for Poor and Fair credit scores and no hidden fees – these are the promises that our recommended providers of bad credit loans stick to. This is why you’ll have the opportunity to borrow bad credit loans at the most competitive rates in the US.

What Are the Requirements to Qualify for a Bad Credit Loan?

Now that bad credit is no longer a problem at the hour of qualifying for a loan through our recommended providers, here you have a breakdown on the requirements you need to meet to qualify for your special credit.

Essential Requirements

To qualify for a bad credit loan you need to meet the following essential requirements:

- 18 years old

- US citizen or permanent resident

- Phone number

- Email address

- Verifiable address

- Active bank account

Income Requirements

Your income source must be verifiable and you must earn at least $800 to $1,000 per month to qualify for a bad credit loan. You can qualify if you’re employed, self-employed, unemployed on benefits, if you have a pension or if you have dividends. As long as your income source is verifiable and enough to cover the expenses of the loan, you can get approved.

Debt Requirements

Your debt-to-income ratio (DTI) shouldn’t be higher than 40-50% to qualify for a bad credit loan. It’s calculated by dividing your monthly expenses plus consumer debts between your monthly gross income.

What Does Instant Approval Mean?

It means that your loan application will be reviewed instantly by the automatic systems of the loan provider. It will analyze it to determine if you meet the eligibility requirements, and if it’s the case, it will grant you instant approval and then bring you the available offers for your selected loan amount and repayment period.

Take into account that instant approval doesn’t mean guaranteed approval, because every application undergoes a review and analysis process to determine your creditworthiness. Because even though the approval rate is approximately 90%, not everyone will qualify for the loan, and hence promising “guaranteed approval” would be misleading.

Also, instant approval doesn’t mean instant disbursement, which is a different process. After being automatically approved and accepting the bad credit loan offer, you need to wait from 1 to 24 hours for the provider to disburse the loan money.

How Long Does It Take to Receive the Money from a Bad Credit Loan?

On average, a bad credit payday loan provider will take from 1 to 24 hours to disburse it. The factors that will influence how long it will take are:

- Loan amount

- Time of the application

- The provider you chose

We’ve clearly detailed the fastest providers from our rankings, so you can get the money in 1-4 hours at max if you need it urgently. Hence, if you want to receive your bad credit loan money as soon as possible, you should rely on Big Buck Loans, Honest Loans, Credit Clock or Money Mutual.

Types of Bad Credit Loans with Instant Approval

Here you have the main types of bad credit loans you will find on the market. We’ve brought a precise description for each to help you pick the best option for your own needs and goals.

Bad Credit Short Term Loan

If you want to repay your loan as soon as possible and you only need to borrow from $100 to $300, then this is the bad credit loan you need. You can repay it in 7 days, 14 days, 21 days, 30 days, 2 months or even 3 months. They’re usually disbursed in 1-2 hours and you’ll save money in comparison to bigger payday loans with a long term repayment period.

In this category, you will normally find payday loan and cash advances, because they’re short-term and they usually bring you a small loan amount from $100 to $500.

Long Term Bad Credit Loan

If you need to withdraw more than $300-500 and you’d like to have more time to repay the loan, this is the type of bad credit loan you need to choose. You can easily withdraw from $500 to $5,000 (or even $50,000 through selected providers), and you can repay it from 3 to 48 months.

They are also offered as bad credit installment loans, because you repay them in installments over several months.

Bad Credit Emergency Loans

This is a special type of bad credit loan that offers instant approval, express disbursement and availability 24/7. They range from $100 to $5,000 and you can use them for any emergency such as an urgent car repair or unexpected medical expenses. The best example in this category is Credit Clock, as it’s famous for offering the bad credit emergency loans with the fastest disbursement in the industry.

Short Term vs. Long Term Bad Credit Loans

The most popular types of bad credit loans are short term and long term. In this section, we will bring you a compelling comparison between them to help you understand better the loan you’re going to borrow.

Available Bad Credit Loan Types

If you opt for the short term, then you’ll have at your disposal payday loans, cash advances and small emergency loans for bad credit. If you opt for the long term, you will have bad credit installment loans and large emergency loans amongst your options.

Repayment Periods

A short-term loan will only bring you the following repayment periods:

- 7 days or 1 week

- 14 days or 2 weeks

- 21 days or 3 weeks

- 30 days or 1 month

- 2 months

- 3 months

Whereas a long term bad credit loan will allow you to repay the loan in…

- 3 months

- 6 months

- 9 months

- 12 months

- 24 months

- 36 months

- 48 months

You can repay it over 3 to 48 months, bringing you more flexibility and freedom to administer your debt as you please.

Repayment Type

A short-term bad credit loan, especially those issued for 7 to 30 days, have to be repaid in one lump sum payment, whereas you need to repay long term bad credit loans in several monthly installments.

Available Loan Amounts

When you opt for a short-term bad credit loan, the available loan amounts range from $100 to $1,000 – unless your debt-to-income ratio and income allow you to repay a bigger loan within a short time frame (for example, 30 days). Whereas long-term bad credit loans allow you to borrow from $100 to $5,000 or even up to $50,000 via selected providers such as Honest Loans.

APR and Fees

Short-term loans tend to be more affordable because the APR won’t run for long, whereas a long-term bad credit loan will be subject to the full action of the APR. For example, taking out a $500 bad credit loan and repaying it in 30 days will be cheaper than taking out the same loan amount and repaying it over 12 months.

How Much Will a Bad Credit Loan Cost?

There are 3 factors you need to consider to calculate the cost of your bad credit loan: your credit score, the repayment period and

Factors to Consider Before Taking out a Bad Credit Loan

If you’re still in doubt about applying and borrowing a bad credit loan, here you have the most important factors to consider before making this important decision.

How are you going to use the money?

If you need the loan money to pay for an urgent home repair, unexpected medical bills or any other matter that demands the money, you should apply for a loan now. However, if you’re going to use it on purchases you don’t really need, we recommend you reconsider your decision because you will only add an extra debt to your life.

Is a bad credit loan your unique solution?

You should also explore other options before taking out a bad credit loan such as borrowing from friends or family, requesting an advance payment or working extra hours. If none of these options are available to you, then applying for a bad credit loan will be your next best decision, especially since we’ve only selected the most reputable and favorable lenders in the US.

Do you need the money urgently?

If your problem or need can wait for you to get the money via other means, you should wait some time before applying for your loan. However, if it’s an emergency and you need the money now, then by all means go ahead and apply for a bad credit loan with instant approval through our selected companies. They will be your best ally to get the money you need in record time.

Are you sure you can afford to repay the loan on time?

Before taking out the loan, take a deep look into your finances and find out if you will be able to repay the loan on time. Failing to do so will only add more problems to your life instead of solving them.

Alternatives to Bad Credit Loans with Instant Approval

If our recommended bad credit loans are not exactly what you were looking for, here you have some alternatives to obtain the money you need now.

Collateral Loan

If your credit score is going to make your loan considerably expensive, a solid alternative is a collateral loan. It will reduce the APR of your loan, increase your chances of approval and you’ll have more repayment periods to choose from. The disadvantage is that failing to repay the loan will result in losing your collateral.

Title Loan

Similar to a collateral loan, but here you’ll have to use a house or car title as a guarantee for the loan. It will allow you to reduce the APR of the loan and exponentially increase your chances of approval. However, just like a collateral loan, you might lose your house or car if you fail to repay the loan.

Pawnshop Loan

You can also visit a pawnshop and offer a valuable item as collateral for your loan. The advantages are higher chances of approval and you can negotiate the loan APR, period and terms, but just like title and collateral loans, you’ll lose your item if you don’t repay it on time.

Direct Lenders vs. Lending Networks for Bad Credit Loans

When applying for a bad credit loan in the US, you have two options: direct lenders and lending networks. Here we will cover their differences.

Bad Credit Loans by Direct Lenders

A direct lender is an individual, company or institution that can directly approve your application and disburse the loan from their funds. Hence, they’re authentic lenders, and it resembles the same process as applying for a loan at a bank.

While the disbursement tends to be fast, the disadvantage is you need to send your application with each direct lender to compare APRs, loan terms and other conditions.

Bad Credit Loans by Lending Networks

Lending networks work with hundreds of different direct lenders. After sending your application through them, they will instantly approve it if you meet the eligibility criteria and then share it with their network of direct lenders.

The direct lenders that want to collaborate with you will send their offers so you can review them. Once you agree to an offer and accept the contract, they will proceed to disburse the bad credit loan into your bank account.

F.A.Q

If you still have questions regarding instant approval bad credit loans, here you have a list of the most frequently asked questions with their respective answers.

What’s the easiest loan to get with bad credit?

Big Buck Loans and Money Mutual offer the easiest loans to get with bad credit thanks to their 90% approval rate for customers with bad credit, no credit score, no credit history or extremely bad credit.

How can I borrow money urgently?

If you need to borrow money urgently, you only need to send your application through any of our recommended bad credit loan providers. They will review your application and approve it instantly, and proceed to disburse the money in 2-4 hours.

Can I borrow money with a 500 credit score?

Yes, even though a 500 credit score falls in the “Fair” category and most banks would reject your application, you can qualify for a bad credit loan through our recommended providers. You will even get a preferential APR for your loan, which will help you to save money, especially if you apply for a long term bad credit loan.

Can I get a loan with a 400 credit score?

Yes, a 400 credit score will make you qualify for a bad credit loan through our recommended providers, and in addition you’ll get access to instant approval with same day disbursement so you can receive your money in record time.

Can I get a loan with 300 credit score?

A 300 credit score is considered as extremely bad credit and it will be nearly impossible to qualify for a regular personal loan at banks, but our recommended providers can approve you for a bad credit loan with a 300 points credit score. As long as your income can cover the expenses of the loan, you stand a high chance at getting approved.