If you have a low or no credit score, chances are banks will reject your loan application instantly. This is the reality that over 110M Americans face nowadays, but thanks to our ranking of the 8 best loans for people with bad credit, now you can borrow money fast with instant approval and no credit checks.

Our recommended providers of loans for people with bad credit don’t have a minimum credit score requirement; they offer you the possibility to borrow from $100 up to $50,000 with the most flexible repayment periods and the most competitive interest rates in the industry.

We invite you to check out our ranking below to find your ideal provider and start your online loan application now.

Best Loans For People with Bad Credit You Can Borrow Now – Top 8 Providers in the US

Borrowing money with bad credit has never been easier, thanks to our recommended providers – choose your preferred platform to send your loan application now:

- Big Buck Loans: Best Overall Loans for People with Bad Credit

- Honest Loans: Easiest Online Application

- Low Credit Finance: Plenty of Offers of Bad Credit Loans

- Credit Clock: Best for Emergency Bad Credit Loans

- Fast Loans Group: Best for Large Loans for Bad Credit

- Money Mutual: Fastest Disbursement for Bad Credit Loans

- Heart Paydays: Instant Approval and High Approval Rate

- Fast Money Source: Highest Approval Rate for People with Bad Credit

Our recommended providers offer instant approval if you meet the eligibility criteria and same-day disbursement – making getting the money you need on time even easier.

A Closer Look At Our Recommended Providers of Loans for People with Bad Credit

If you want more details about our selected providers of loans for people with bad credit, here you have our full reviews. We will bring you a full description of each company, along with their pros and cons.

1. Big Buck Loans: Best Overall Loans for People with Bad Credit

Considered the ideal provider of loans for people with bad credit in the US since 2019, Big Buck Loans stands out from the rest thanks to its high approval rate with no minimum credit score requirement, most flexible repayment periods in the industry, highly competitive interest rate and lending amounts from $100 to $5,000 with instant approval and same day disbursement.

Pros

- Highest rated provider of loans for people with bad credit

- Borrow from $100 to $5,000 with no minimum credit score requirement

- Competitive APR with a fixed limit of 35.99%

- Flexible repayment periods of up to 84 months

- Instant approval and same-day disbursement

- No hidden fees

- No paperwork

Cons

- Not available in all states

Who Is It For?

Big Buck Loans is ideal for all customers with bad credit, including those with low income, highly indebted, and zero credit history.

In addition, thanks to its instant approval and same-day disbursement process, it’s an excellent choice if you need an emergency loan, mainly since you can borrow from $100 up to $5,000 without restrictions on how to use the money.

2. Honest Loans: Easiest Online Application

Honest Loans has been consistently ranked as one of the fastest and most reliable brokers of loans for people with bad credit for the last 7 years, thanks to its super-fast online application process, competitive APR, flexible repayment periods, and the possibility to borrow from $100 up to $50,000.

Pros

- Easy and fast online application

- Instant approval and same-day disbursement

- High approval rate for people with bad credit

- Competitive APR

- Flexible repayment periods

- Borrow from $100 to $50,000 with bad credit

- No paperwork

Cons

- Not available in all states

Who Is It For?

Honest Loans is a highly versatile broker, making it ideal for people with extremely bad credit, low income, or zero credit history. Since you can borrow up to $50,000 – it’s a proper choice if you need to borrow a large bad credit loan.

Thousands of Americans with an alternative source of income have relied on it to borrow money since 2016 because it accepts several types of income, such as unemployment benefits, self-employment, dividends, pension, and disability, amongst others.

3. Low Credit Finance: Plenty of Offers of Bad Credit Loans

Low Credit Finance stands out from other providers of loans for people with bad credit, thanks to its massive network of direct lenders. This will allow you to get dozens of offers after sending your application, allowing you to review and compare different proposals to find your ideal bad credit loan.

Pros

- Largest number of offers of loans for people with bad credit

- High approval rate for bad credit and no credit history

- Easily borrow from $100 to $5,000

- Automatic approval with same-day disbursement

- Flexible repayment periods of up to 48 months

- No paperwork

Cons

- Not available in all states

Who Is It For?

Low Credit Finance is an ideal choice for customers interested in reviewing and comparing different offers in one place and obtaining the lowest possible APR with flexible repayment periods of up to 48 months.

Since it offers instant approval and a disbursement speed of 60 minutes after getting approved, you can rely on it to borrow an emergency loan as well.

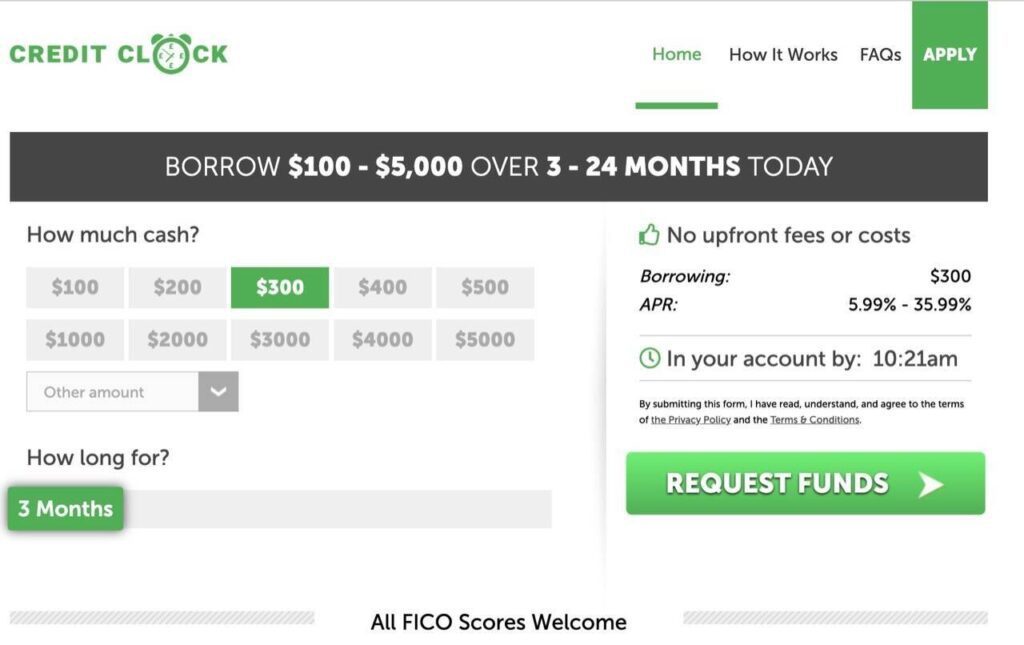

4. Credit Clock: Best for Emergency Bad Credit Loans

Credit Clock has helped thousands of Americans to borrow money from $100 up to $5,000 with no minimum credit score required and with flexible repayment periods of up to 24 months. Recognized as the fastest provider of emergency loans for people with bad credit, it’s easy to see why people with bad credit consistently rely on Credit Clock to borrow money fast since 2019.

Pros

- Available 24/7 to approve and disburse loans for people with bad credit

- Easily borrow from $100 to $5,000 for any purpose

- Highly competitive APR for bad credit

- Instant approval and express disbursement

- Flexible repayment periods of up to 24 months

Cons

- Not suitable for large loans over $5,000

- Higher APR for extremely bad credit

Who Is It For?

Credit Clock is the best choice for customers with bad credit who need money urgently, especially outside the usual business hours, over the weekend, or on holidays. Thanks to its 24/7 availability with instant approval and fast disbursement, it’s the ideal provider of emergency bad credit loans.

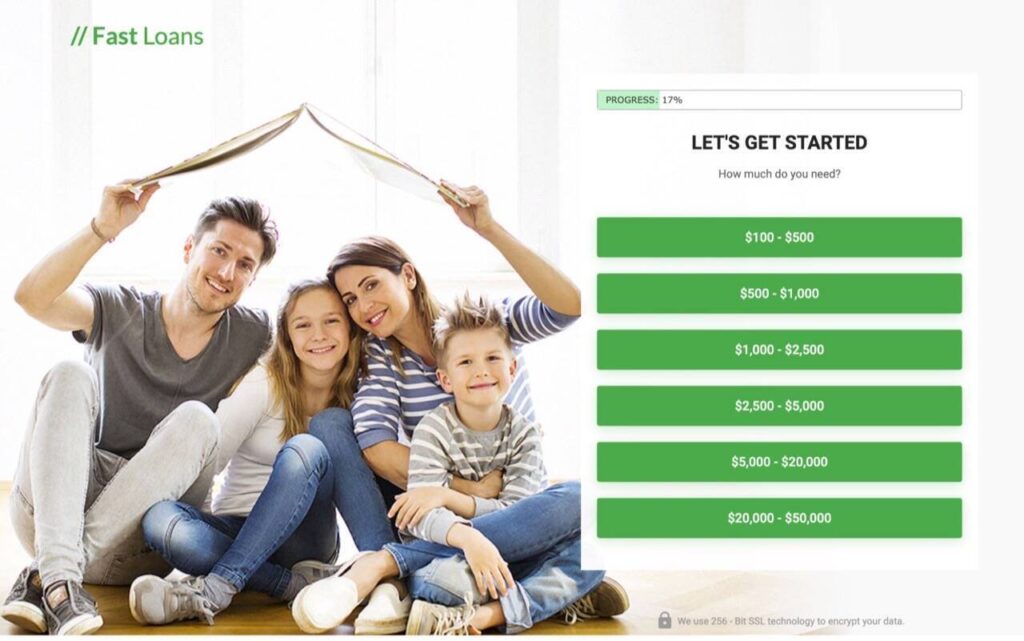

5. Fast Loans Group: Best for Large Loans for Bad Credit

If you need to borrow a considerable amount of money at a competitive APR and have bad credit, Fast Loans Group is the right choice. With lending amounts from $100 up to $50,000 with a low APR and flexible repayment periods, it’s a solid contender in the industry for customers who need to borrow a big loan.

Pros

- Easiest way to borrow up to $50,000, even with bad credit

- Instant approval and same-day disbursement

- High approval rate

- No paperwork

- Competitive interest rate

Cons

- Disbursement can be slow

- Not available in all states

Who Is It For?

If you need to borrow over $5,000 at an acceptable rate regardless of your credit score, then Fast Loans Group is the provider you need. Also, thanks to its instant approval and same-day disbursement, you can rely on it to get money fast.

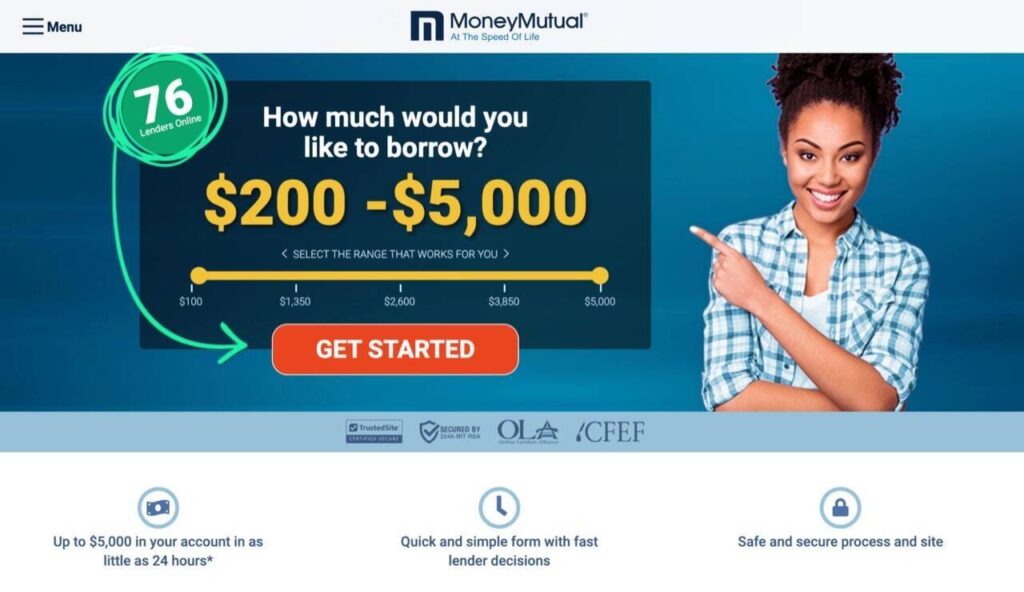

6. Money Mutual: Fastest Disbursement for Bad Credit Loans

Money Mutual is synonymous with speed because it offers instant approval, express disbursement, and a high approval rate. With loans available from $200 up to $5,000 with a competitive interest rate, it’s easy to see why thousands of Americans have preferred it since 2005.

Pros

- Fastest disbursement for people with bad credit

- Easily borrow up to $5,000 with no minimum credit score requirement

- Instant approval

- High approval rate

- No paperwork

Cons

- Higher interest rate for extremely bad credit

- Lower approval rate for highly indebted customers

Who Is It For?

Money Mutual is for customers with bad credit who want to borrow from $200 to $5,000 and receive the money as soon as possible while paying an acceptable APR on the loan.

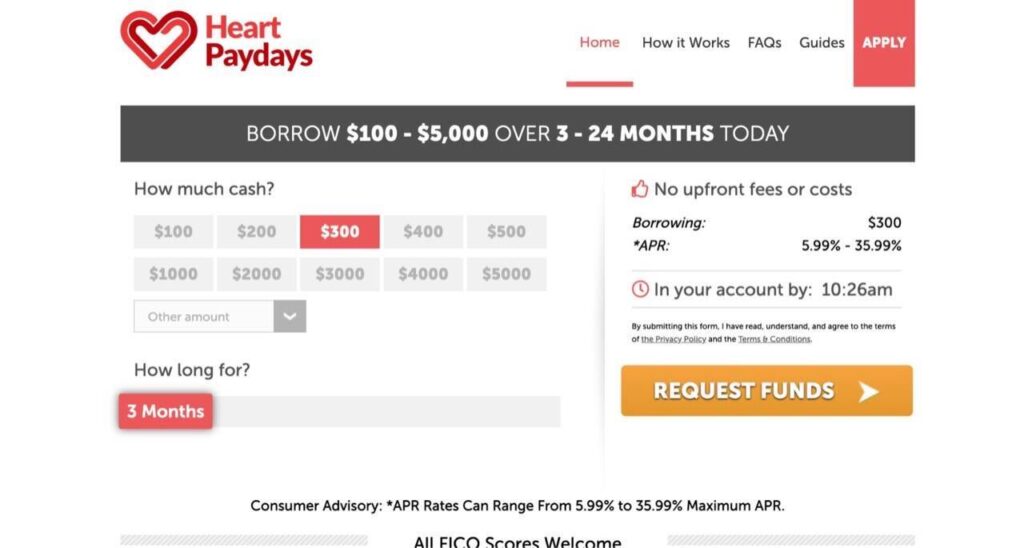

7. Heart Paydays: Instant Approval and High Approval Rate

Heart Paydays is a solid choice in the industry of loans for people with bad credit because it offers key benefits: a high approval rate, competitive APR, flexible repayment periods, and fast disbursement. This is why thousands of people with bad credit have easily relied on Heart Paydays to borrow from $100 up to $5,000.

Pros

- Instant approval

- High approval rate for bad credit

- Fast disbursement

- Easily borrow up to $5,000

Cons

- Online application is slower

- Higher interest rate for extremely bad credit

Who Is It For?

Heart Paydays is for customers looking for a payday loan with a high approval rate for people with bad credit whom other providers of bad credit loans have already rejected. It offers instant approval, a high approval rate, same-day disbursement, and loans up to $5,000, so it’s a solid alternative.

8. Fast Money Source: Highest Approval Rate for People with Bad Credit

If all providers and lenders fail to approve your application, you still have another option: Fast Money Source. Thanks to offering the highest approval rate for people with bad credit, in addition to its lending amounts from $100 up to $50,000 and flexible repayment periods, it’s an excellent option.

Pros

- Highest approval rate for people with bad credit

- Loans from $100 up to $50,000

- Instant approval

- Same day disbursement

- Competitive APR

Cons

- Higher interest rates on short-term loans

- Not available in all states

Who Is It For?

Fast Money Source is for people with extremely bad credit or zero credit history whom banks and other providers of low credit score loans have already rejected. Since its approval rate can be as high as 90%, it’s an excellent source of quick funding from $100 up to $50,000.

Overview and Comparison of the 8 Best Loans for People with Bad Credit

The following table will give you a complete overview and quick comparison between our recommended providers so you can choose the best bad credit loan.

| Providers of Loans for People with Bad Credit | Best Benefits | Score |

|---|---|---|

| Big Buck Loans | High approval rate for people with bad credit, low APR, highly flexible repayment periods, loans from $100 to $5,000, and fast disbursement with instant approval | 10/10 |

| Honest Loans | Easy online application, instant approval, same-day disbursement, large loans available up to $50,000, and high approval rate | 10/10 |

| Low Credit Finance | Largest network of direct lenders, high approval rate, flexible repayment periods, loans up to $5,000, and express disbursement | 9/10 |

| Credit Clock | Approves and disburses loans 24/7, high approval rate, loans from $100 to $5,000, flexible repayment periods, and low APR | 9/10 |

| Fast Loans Group | Large loans up to $50,000, instant approval, same-day disbursement, competitive APR | 9/10 |

| Money Mutual | Fast disbursement with instant approval, loans from $200 to $5,000, competitive APR, high approval rate | 8/10 |

| Heart Paydays | Instant approval, high approval rate, same-day disbursement | 8/10 |

| Fast Money Source | Highest approval rate for people with bad credit, large loans available | 8/10 |

How to Apply for a Loan for People with Bad Credit in 5 Steps

Here’s how you can apply for your loan through your preferred provider in only 5 steps:

- Select a provider of loans for people with bad credit from our ranking

- Visit the website and fill out the application

- Submit the application form and wait for an instant decision

- If you’re approved, review the available offers

- Accept your loan offer and contract to receive the money in your bank account

After instant approval, you can expect to receive your loan money on the same day, allowing you to use your funds immediately.

How to Qualify for a Bad Credit Loan through Our Recommended Providers

To qualify for a bad credit loan through our recommended providers, you need to meet the following eligibility criteria:

- You must be a US citizen or permanent resident

- You must be at least 18 years old

- You must have a steady and verifiable source of income

- You must have an acceptable debt to income ratio

- You must have an active phone number

- You must have an email address

- You must have a bank account (checking)

Why Choose Our Recommended Loans for People with Bad Credit

Let’s explore why applying for a low-credit online loan through our recommended providers is an excellent idea.

Carefully Analyzed and Selected

Using over 100 data points, our dedicated team of finance specialists has invested 300+ hours analyzing, reviewing, and comparing providers of loans for people with bad credit only to pick companies licensed and registered in all the states they do business in.

When applying for a loan through our recommended providers, you can rest assured that your rights as a borrower will be respected and protected because you’re dealing with legit and regulated companies.

No Hard Credit Checks Guaranteed

A hard credit check is the last thing you need when applying for an online loan with bad credit. This is why we have only selected providers that perform no hard credit checks. You can forget about them because your credit score won’t be used to determine your creditworthiness. See here for the best no credit check loans.

All Types of People with Bad Credit Are Accepted

We have only selected providers with the highest approval rate for people with bad credit. It doesn’t matter if you have a credit score of 600, 500, 400, or 300 points or no credit score or history – you can qualify for an online loan through our recommended companies.

Bespoke Bad Credit Loans with the Ideal Lending Amount For You

Thanks to the wide variety of available lending amounts, you can apply for a bespoke bad credit loan to cover any expense. You can borrow from $100 up to $50,000 regardless of your credit score.

Repay Your Loan on Flexible Repayment Periods

Be it short-term or long-term, you can repay your loan on your terms, thanks to the flexible repayment periods of our recommended providers. You can repay your loan in only 1 month or over 84 months – bringing you total freedom to manage your debt according to your needs and finances.

Obtain Fast Money When You Need It

You need the money as soon as possible, and our recommended providers are here to help, thanks to their instant approval and same-day disbursement process. After sending your application, you will receive an instant decision, and if you’re approved, the provider will disburse your loan on the same day.

Only Pay the Fair Price for Your Loan

We have compared all the providers of loans for people with bad credit to identify the companies with the lowest APR and fees. This is why our recommended providers can bring you the lowest APR in this category, making it possible to borrow money at the most convenient rate.

What are Loans for People with Bad Credit?

As you can easily guess, they are personal loans specially designed for people with a low credit score, typically below 669 points, hence falling in the Very Poor, Poor, or Fair categories. Being a suboptimal score according to banks and traditional lenders, it receives the name of bad credit.

Because these personal loans are designed for people with bad credit, they don’t perform hard credit inquiries nor factor in the credit score when determining a customer’s creditworthiness. They rely on other factors such as monthly gross income, reliability of income source, and total amount of consumer debts.

Pros and Cons of Bad Credit Loans

Let’s compare the advantages and disadvantages of online loans for people with bad credit to help you decide if it’s the right kind of loan you should apply for.

| Pros | Cons |

|---|---|

| High approval rate with no minimum credit score requirement | APR can be higher than that of conventional personal loans |

| Get money fast thanks to instant approval and same-day disbursement | They are not available in all states |

| Available for people with low income, unemployed, or who are highly indebted | |

| Easy and fast online application with no paperwork | |

| Get the opportunity to rebuild your credit and boost your credit score. | |

| Obtain access to bigger loans at a lower APR. |

The answer here is clear: if you have bad credit and cannot qualify for a loan at banks, you need a bad credit loan, as it’s the easiest way to obtain the money you need.

What Is Considered as Bad Credit in the US?

This type of loan was explicitly designed for people whose credit score falls in any of the following ranges and categories:

- Fair: 580 to 699 points

- Poor: 500 to 579 points

- Very Poor: 300 to 499 points

If your score is below 669 points, you will be considered a person with bad credit. It’s labeled as such because banks and traditional lenders consider it a bad signal when reviewing your application, and hence, it’s detrimental to your creditworthiness.

The Reality of Bad Credit

They also label it as bad credit because it shows that customers with a score below 669 points are less likely to repay their debt on time, creating problems for lenders. This is why they usually dismiss such applications, but our recommended lenders are here to change it

because this prejudice doesn’t apply to all people with bad credit.

On the other hand, for our recommended lenders, there is no bad credit because they don’t factor in your credit score to determine your creditworthiness. They rely on alternative information such as your income source and debt to income ratio.

What is Extremely Bad Credit?

Even though it’s hard to qualify for a loan if you have a credit score of 500-669 points, some banks might still accept your application but will charge you excessively high-interest rates. However, if you have a credit score below 500 points, for example, 350 points, getting approved is virtually impossible, even by paying the highest possible APR on your loan.

This is known as extremely bad credit, and it’s a serious problem because it will make it impossible for you to borrow money from banks or traditional lenders.

If you have no credit score, then it might also be considered extremely bad credit because only a small percentage of banks will be likely to accept your loan application.

A Problem that Affects Millions of Americans

Did you know that approximately 110M Americans have bad credit? Over 30% of the US population have a Very Poor, Poor, or Fair credit score that stops them from borrowing money from traditional lenders and banks.

This is why loans for people with bad credit have become increasingly popular in the US because a large percentage of the population needs them. On top of that, since they bring immediate approval and same-day disbursement, they’re the ideal solution for emergencies.

Types of Loans for People with Bad Credit in the US

Here, you have a complete list of all the bad credit loans you can apply for through our recommended providers.

Unsecured Personal Loans for Bad Credit

This is the most popular type of loan for people with bad credit because you don’t have to use collateral to get approved. After sending your application and verifying that you meet the eligibility criteria, the provider will disburse the money into your bank account.

Installment Loans for People with Bad Credit

If you want to repay your loan over several months, you can apply for an installment loan through our recommended providers. You can opt for repaying your loan in up to 84 monthly statements through selected lenders while paying a fair APR even if you have extremely bad credit.

Payday Loans for Bad Credit

You can also apply for payday loans for bad credit and no credit check through our recommended providers, especially if you want to borrow money only for the short term and for a moderate amount. For example, a popular payday loan for bad credit is $300 for 30 days, which you can usually repay from your next paycheck.

Cash Advance Loan for People with Bad Credit

This is another name for short-term loans if you have bad credit. Because, just like payday loans, you can borrow a moderate amount of money, usually $100 to $500, and you can repay it from your next paycheck or within a short timeframe.

How Much Do Loans for People with Bad Credit Cost?

To understand how much it will cost to take out a bad credit loan, here you have a full breakdown of all the fees and interest rates.

The Interest Rates for People with Bad Credit

The APR for your loan will function to your credit score category, and here you have an overview of what you should expect to pay:

- Fair: 20-22% APR

- Poor. 22-25% APR

- Very Poor: 25-35.99% APR

Remember that our recommended providers have a maximum APR of 35.99% – because this is the safest way to protect you against predatory interest rates. However, this doesn’t mean you will pay 35.99% just for bad credit because we have selected the companies with the most competitive interest rates for people with bad credit.

Additional Fees

Depending on the lender you select, you might have to pay extra fees such as:

- Origination fees

- Late payment fees

- Fixed finance charges

- Early repayment fees

- Application fees

Fortunately, our recommended providers don’t charge application fees because it’s a 100% free process. You don’t have to make any upfront payment, a benefit that separates our recommended companies from the rest of the bad credit loan providers.

The same applies to early repayment fees – you don’t have to pay them if you decide to repay your bad credit loan sooner than expected. This way, you can rely on our recommended providers to bring you funding under favorable terms and conditions.

You will only have to pay the corresponding APR for your bad credit loan without additional or hidden fees that will only drive up the price of your cash advance.

Practical Example of How Much a Bad Credit Loan Will Cost You

Suppose you want to borrow $1,000 from one of our recommended providers, and you’ve chosen a repayment period of 12 months with an APR of 20% due to your credit score. Here you have a breakdown of the expenses of the bad credit loan:

- Loan Amount: $1,000

- Repayment Period: 12 Months

- APR: 20%

- Monthly Repayment: $92.63

- Finance Charge: $111.56

- Total Repayable Amount: $1,111.56

In the end, the loan will cost you a total of $111.56, and considering how fast and easy our recommended providers make it for you to borrow money, it’s an acceptable price.

Alternatives to Loans for People with Bad Credit

If our recommended loans aren’t what you need now, we invite you to explore the following alternatives to obtain the money you need.

Apply for a Collateral Secured Loan

If you’re comfortable using collateral to guarantee borrowing money, you should apply for a collateral secured loan. Even if you have bad credit, you stand a significant chance of getting approved, and at the same time, you will reduce the APR and fees of your loan.

Consider a Credit Card Cash Advance

If you have a credit line, you can use it to get an immediate cash advance. If your credit card company allows it, you can borrow money directly from your credit line, bringing you immediate funding for many purposes since they don’t ask questions about why you need the money.

Home Equity Loans

This type of loan will disburse you a large amount of money upfront in exchange for using your home as collateral. Just like a conventional loan, you’ll have to repay it in monthly statements. This is a solid alternative if you need a large loan, but remember that failing to repay it on time will lead to losing your home.

Bank Agreement

If you have a solid relationship with your bank, you can ask for a bank agreement to borrow money fast and repay it as soon as possible. We consider it as a last resort because bank agreements are hard to come by, and even then, you will only be able to borrow a severely limited amount of money with a short-term repayment period and likely a higher interest rate than that of a conventional loan for people with bad credit.

Sell Stuff You Don’t Need

If you have old stuff you no longer need, such as a video game console, a TV, a computer, or valuable possessions, you should consider selling it for quick cash. Thanks to marketplaces such as Facebook Marketplace, you can quickly find a buyer, allowing you to get money quickly without having to borrow a loan.

Borrow from Friends or Family

If you can borrow the money you need from close friends or relatives, it’s an option worth considering because you can expect to pay a minimal interest rate. However, keep in mind that lending between friends and family can usually be a bad idea because it can create conflicts if you fail to repay the loan on time.

Improve Your Credit Score

If you don’t need the money urgently and can wait until improving your credit score, then you should do so. This will only benefit you in the long run by giving you access to better loans at a lower rate.

This won’t be a viable solution if you need the money urgently. In such a case, considering that our recommended lenders bring an 80-90% approval rate, your best option is to apply for a loan through our selected providers.