Are you looking for $200 payday loans with no credit check, fast approval, low APR and flexible repayment periods? This is exactly what our top 8 recommended companies can offer you: payday loans for $200 under the best terms and conditions in the US.

After reviewing hundreds of payday loans companies in the 37 states that consider payday loans as legal, we’ve identified the 8 best lenders that offer an approval rate of 90% or higher with no credit checks, the lowest APRs and the most flexible repayment periods.

Here you have our ranking so you can borrow the $200 you need right now without paperwork and no questions asked.

Top 8 Companies for Fast Approval Payday Loans $200 in the US

Here you have our ranking of the 8 best companies for getting a $200 payday loan with fast approval and no credit checks in the US.

For more information about each lender, we recommend you to read our detailed reviews below.

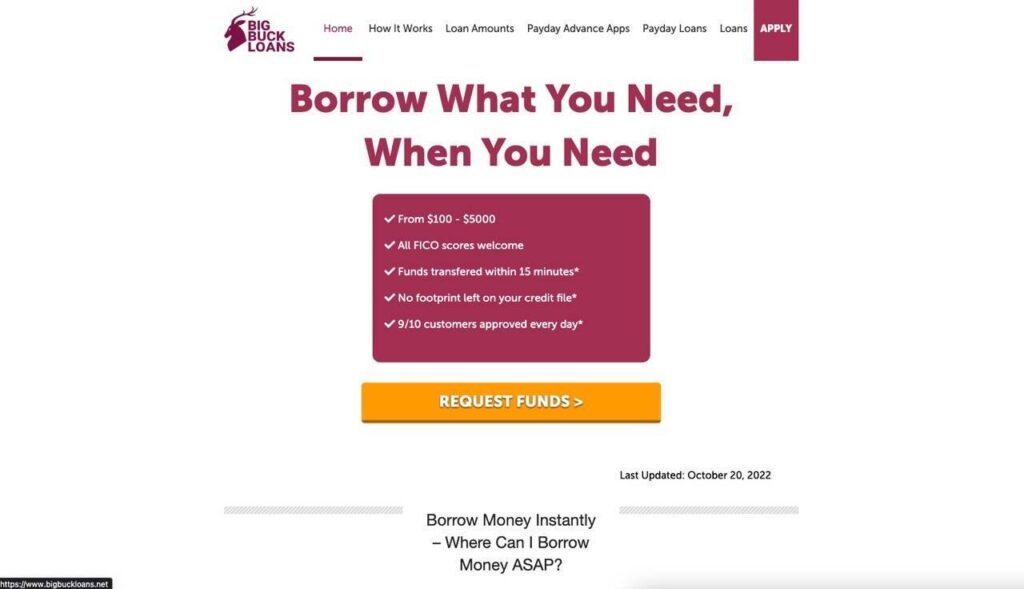

Big Buck Loans: Quick Approval and Disbursement

Big Buck Loans is our top recommended company for borrowing $200 payday loans in the US thanks to its immediate approval, quick disbursement, low interest rate, flexible repayment periods and 90% approval rate for all types of customers.

It’s a highly rated company thanks to its solid offers for $200 payday loans that are usually more affordable than the average of the industry. They offer their services in 37 states with thousands of satisfied customers, and since you can request up to $5,000 once you become a customer, you can rely on Big Buck Loans to get quick payday loans now and in the future.

Honest Loans: Fast Online Application

Honest Loans stand out thanks to its easy and fast online application process with instant approval, same day disbursement and a competitive APR for $200 payday loans. And thanks to their flexible repayment periods, you can customize your payday loan offer to your own needs.

Because Honest Loans understands the situation of thousands of Americans, they happily accept customers with bad credit, extremely bad credit, no credit history or who’re currently unemployed. Thanks to their easy-to-meet eligibility criteria, Honest Loan is an excellent choice for borrowing $200 in an emergency.

Low Credit Finance: Largest Number of Offers

If you’re looking for a broker that can serve you plenty of offers when applying for a $200 payday loan, then you need to visit Low Credit Finance now. Because it has the largest network of lenders from our ranking, you can receive dozens of different offers and compare them to choose the best one.

Because it’s a broker the disbursement can take from 6 to 24 hours, however you’ll get the chance to get the best possible deal, allowing you to borrow a $200 payday loan at an extremely low cost and with flexible repayment periods.

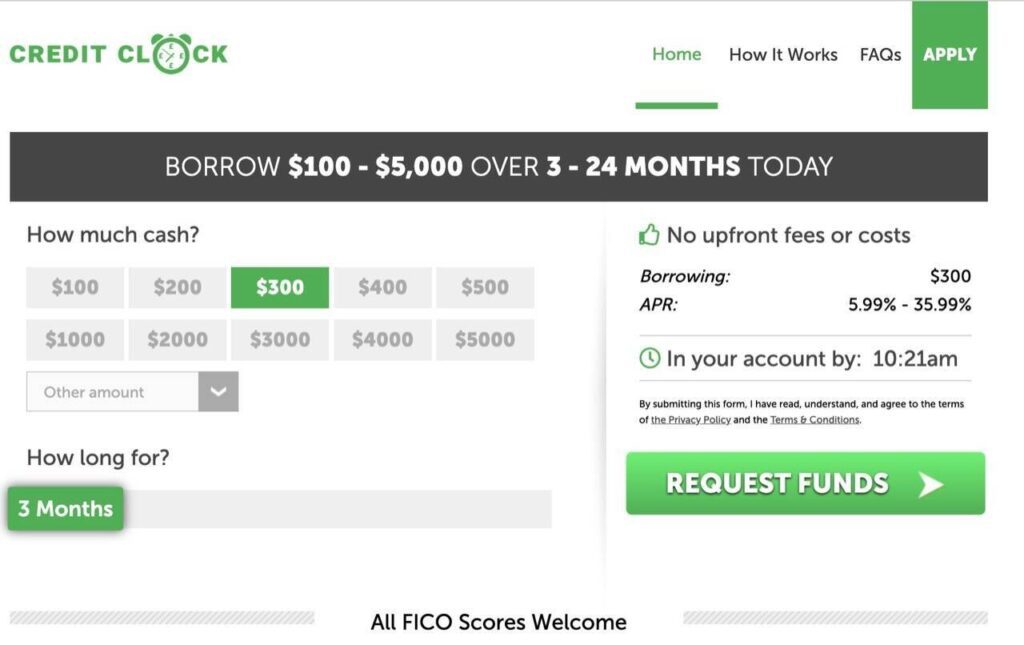

Credit Clock: Best Repayment Periods

If the short term doesn’t work for you and you need more options, then you should apply for a $200 payday loan at Credit Clock because it offers an outstanding variety of repayment periods. Be it just 2 weeks or longer than a month, you can repay your loan as you wish with a competitive APR, fast approval and same day disbursement.

Credit Clock is also the best choice when you need an emergency payday loan of $200 because they work 24/7/365 and they can approve your application instantly and disburse the loan at any time of the day, making it ideal for even the most unexpected emergencies.

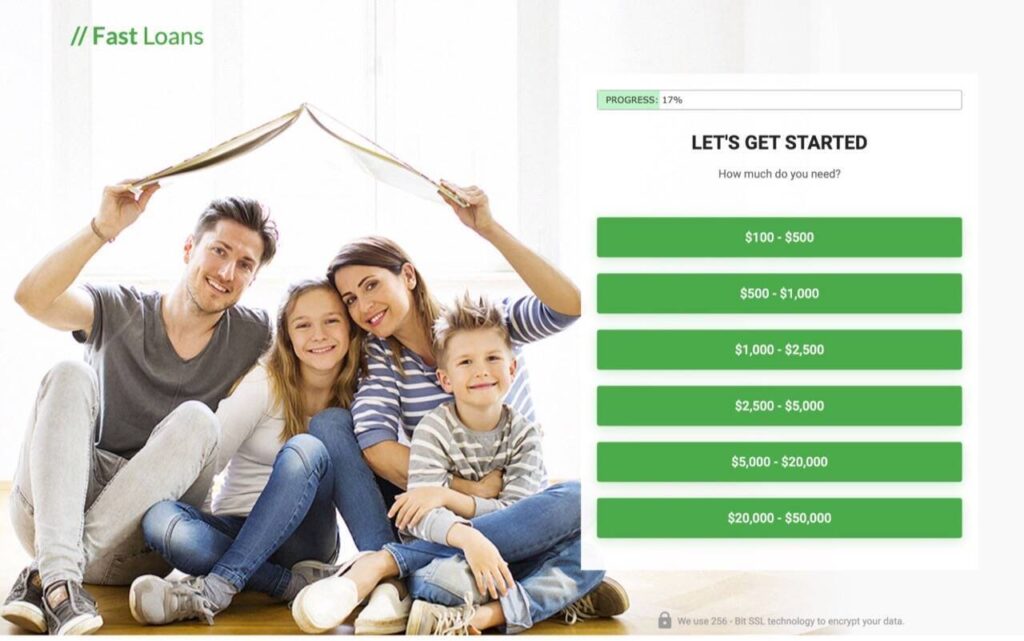

Fast Loans Group: No Hard Credit Checks

Having bad credit means restricted access to loans, but it won’t matter at Fast Loans Group because they perform zero hard credit checks. You can get approved for a $200 cash advance at this company even with a credit score of 300 points, all while offering you a competitive APR and same day disbursement.

Fast Loans Group is also especially good for low income or unemployed customers thanks to its minimum income requirement that is lower than the average of the industry. If this is your case and you don’t want to undergo credit checks, then Fast Loans Group is the right choice for you.

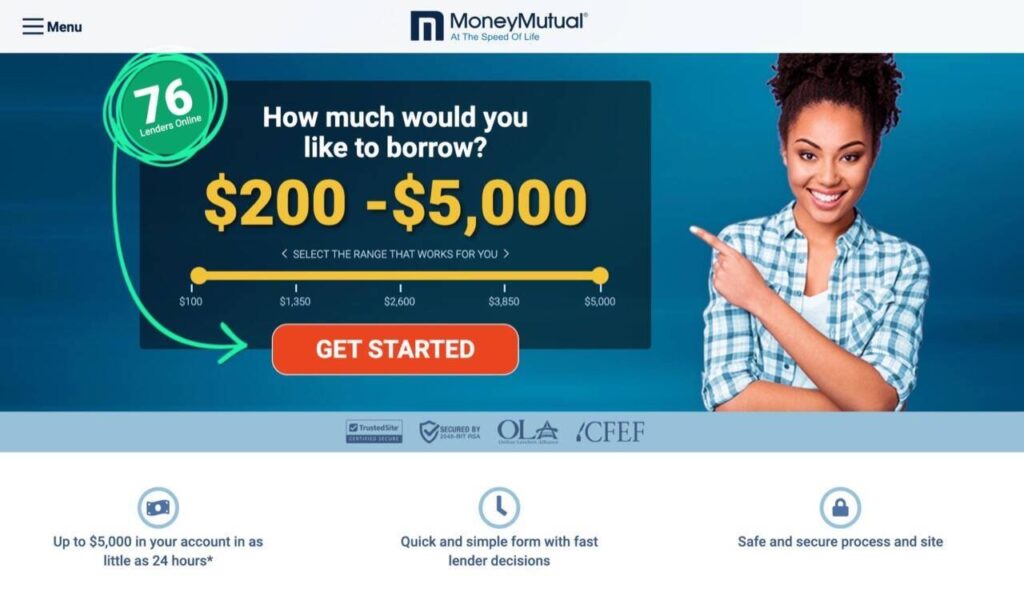

Money Mutual: Fastest $200 Payday Loan Disbursement

Do you need $200 as soon as possible? If your situation cannot wait, then you should apply for a $200 payday loan at Money Mutual because it offers the fastest disbursement in the industry at an average of 1-2 hours. Along with instant approval, Money Mutual will also offer you a privileged APR to help you save money with your emergency bad credit loan.

Money Mutual will also open you the doors to bigger payday loans after repaying your $200 cash advance, because they can lend up to $5,000 with immediate approval and disbursement.

Heart Paydays: Ideal for No Credit History

If you have zero credit history and you want to maximize your chances of getting approved for a $200 payday loan ,then Heart Paydays is your best option. Because it offers the highest approval rate for customers with no credit history, along with a competitive APR and immediate approval.

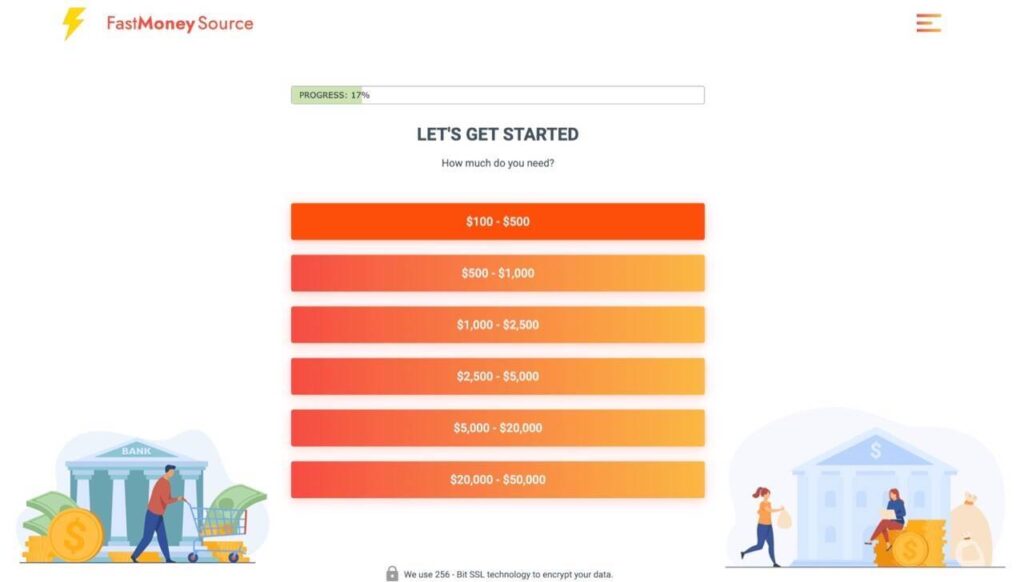

Fast Money Source: Highest Approval Rate for $200 Payday Loans

If you have extremely bad credit, low income or if you’re unemployed, then you need a payday loan lender with the highest approval rate in the industry, and it’s Fast Money Source. With an approval rate higher than 90%, you can rely on it to borrow the $200 you need right now at a competitive APR and with flexible repayment periods.

How to Apply for Payday Loans $200 in 5 Easy Steps

If you’re ready to borrow $200 from our recommended lenders but you don’t know how to do it, just follow our quick 5-step tutorial to apply for your payday loan today.

1. Choose a $200 payday loan company from our ranking

Check our ranking of the 8 best companies for borrowing a $200 payday loan in the US, read our reviews and choose the best lender for your own needs and goals. Then, simply click on its name to visit their official website.

2. Visit their website and fill out the $200 payday loan application form

Once you’re on their official website, look for the application form and fill it out. You’ll have to enter information such as:

- Full name

- Birth date

- Address

- Income

- Phone

- Bank account (to receive the $200 loan)

- Employer information (if any)

- Preferred repayment date or period

The application process will take you a maximum of 5 minutes and then you’ll receive the instant approval decision.

3. Wait for the instant approval decision

After filling out the form and sending your application, you only need to wait 1-2 minutes for the instant approval decision. Their system will review your application and determine if your creditworthiness is satisfactory to borrow $200 USD, and if it’s the case, they will let you know that you’ve been approved and then they will send you their payday loan offer.

4. Agree to the payday loan offer

The payday loan offer will show you the final price of the $200 payday loan, APR, finance charges, exact repayment date and period, and additional terms and conditions. If you agree to the offer and contract after reviewing them, then the lender will proceed to disburse the loan.

5. Receive the $200 same day

Congratulations! The lender will now proceed to disburse the $200 into your bank account the same day. This process can take anywhere from 1 to 24 hours. Hence, if you need the money urgently, we recommend you to apply for a loan at Big Buck Loans, Money Mutual, Honest Loans or Credit Clock, as they’re the companies with the fastest disbursement.

Overview of Paydays Loans for $200

| Payday Loan Lender | Best Benefit | Score |

|---|---|---|

| Big Buck Loans | Quick approval and disbursement | 10/10 |

| Honest Loans | Fast online application | 10/10 |

| Low Credit Finance | Largest number of offers | 9/10 |

| Credit Clock | Best repayment periods | 9/10 |

| Fast Loans Group | No hard credit checks | 9/10 |

| Money Mutual | Fastest disbursement | 8/10 |

| Heart Paydays | Ideal for no credit history | 8/10 |

| Fast Money Source | Highest approval rate | 8/10 |

What Are Payday Loans $200 and How Do They Work?

$200 payday loans are special short-term loans that can lend you $200 even if you have bad credit, no credit history, low income or if you’re unemployed. Because they rely on your income and debt-to-income ratio to determine your creditworthiness.

They were initially designed to be repaid the next day after your payday, hence they received the name of payday loans. Fortunately, thanks to the new regulations and customers’ requests, payday loans have evolved and now you can repay them in the short or long term as you prefer.

Payday loans $200 work like regular personal loans, because you’ll have to repay it on the agreed date, and the price will be determined by the finance charges and APR. They also offer solutions in case you have problems repaying the loan such as requesting an extension.

7 Benefits of $200 Payday Loans in the US

Payday loans $200 are a godsend in a wide myriad of situations, and here you have a list with the top 7 benefits you can enjoy thanks to these special loans.

#1 – Borrow money with no questions asked

When applying for an online payday loan, you need to fill out a simple form and that’s it. The system will automatically review your application and let you know if you’ve been approved. You can forget about answering dozens of unnecessary questions and annoying paperwork.

#2 – Get $200 immediately

If you’re approved after the automatic review, our recommended companies will let you know the terms and conditions of your $200 payday loan, and once you agree to them, they will proceed to disburse the loan immediately.

#3 – Use the $200 as you please

Because they don’t ask questions about how you’re going to use the loan money, you can use the $200 as you please. Be it for emergency expenses, repairing your phone or covering unexpected travel expenses, you’re free to use the $200 you’ve just borrowed without restrictions.

#4 – Qualify for a $200 loan regardless your credit situation

When applying for a $200 payday loan, you can forget about having bad credit, extremely bad credit, lots of credit accounts or no credit history at all, because our recommended companies don’t care about it. You can still qualify for your $200 cash advance regardless of your credit situation.

#5 – Start building your credit history

Borrowing a $200 payday loan from our recommended companies and repaying it on time will help you to build a solid and positive credit history. If you’ve never taken out a loan before, then it’s your opportunity to do it under the best terms and conditions to start building your financial records.

#6 – Get access to bigger and better loans soon

Repaying your $200 payday loan on time will bring you even more benefits such as the opportunity to borrow bigger and better loans in record time. Our recommended companies can lend as much as $5,000 to $50,000, bringing you more options to finance purchases, liquidate debt, cover unexpected expenses or even fund your projects and businesses.

#7 – Pay the lowest cost for an emergency loan

Because we’ve carefully chosen the best companies from the industry, you’ll pay the lowest cost when borrowing your $200 payday loan. Even though emergency loans are known for being expensive, we’ve done our best to keep the final cost as affordable as possible.

How We Selected the 8 Best Companies for Fast Approval Payday Loans $200

Because our goal is to help you get a $200 payday loan under the best terms and conditions, we’ve analyzed the entire industry to select the top 8 companies in the US that lend payday loans fast, easily and with the lowest APR and finance charges. Here’s how we’ve done it.

License and Online Reputation

In the United States, every payday loan lender needs to be registered and licensed by the states they do business in, and hence we only select registered and licensed companies. This brings you legal protection as a borrower and ensures that you’re dealing with a legal and regulated lender.

We also take online reputation into account when reviewing a new $200 payday loan company, because the feedback from previous and actual customers is always important. Hence, we only select lenders with a clean record of positive reviews and ratings. Be it on TrustPilot, forums or social media communities, we only rank highly-rated payday loan lenders.

Application Approval Rate

If you’re looking for a $200 payday loan, chances are you’ve already tried to get the $200 you need by other means without success. And because we want to make sure that you can get the money you need right now, we have only selected payday loan lenders with the highest approval rate in the industry.

For example, companies like Big Buck Loans approve 9 out of 10 applications, offering an outstanding 90% approval rate, even if you have bad credit, no credit history, high debt-to-income ratio or low income.

APR and Finance Charges

We only select payday loan companies that charge the lowest APR and finance charges in the industry for $200 payday loans, to help you save money even if you have extremely bad credit. In addition, you won’t have to pay upfront fees or “hidden fees” after agreeing to the contract – everything will be transparent and straightforward.

Approval and Disbursement Speed

Payday loans mean speed and hence we only select companies that can approve your application instantly and disburse the $200 the same day. Recommended lenders like Big Buck Loans, Honest Loans and Money Mutual can disburse your loan in 1-4 hours on average, thanks to their efficient AI-powered systems.

Repayment Periods

Even though payday loans are usually short-term loans, we have selected companies that can bring you flexible repayment periods. Be it just 7 days or over 30 days, you can opt for repaying your loan as you please.

Furthermore, we have also made it sure that longer repayment periods won’t mean an excessively higher APR or finance charges. Because you can opt for repaying your $200 long over multiple weeks or months at the lowest price.

Customer Support

We have only selected lenders that can provide you with an efficient and fast customer support service 24/7. Be it that you need to solve certain questions before applying for your $200 payday loan, ask for an extension or get instructions on how to repay your loan, our recommended companies will bring you all the answers you need in record time.

Who Can Qualify for a $200 Payday Loan?

If you meet the following eligibility criteria, then it’s highly probable you’ll qualify for a $200 payday loan at our recommended companies:

- You’re a US citizen or permanent resident

- You’re 18 years old or older

- You have a phone number

- You have an email address

- You have a verifiable source of income

- You have a bank account

Since our recommended lenders don’t use your credit score to determine your creditworthiness, it’s much easier to qualify for a $200 payday loan regardless of your credit score or credit history.

Can You Qualify for a $200 Payday Loan with Bad Credit?

Yes, you can qualify for a $200 payday loan with bad credit or even extremely bad credit. Because they don’t factor in your credit score when approving your application, as they analyze other factors such as income and debt-to-income ratio.

In the US, the credit score ranges from 300 to 850 points and you can be labeled as Very Good, Good, Fair or Poor based on your credit score. Credit scores in the Fair and Poor category, below 560 points, are considered as bad credit.

Our recommended lenders will only use your credit score to calculate the final APR and finance charges of your loan. Therefore, they don’t perform hard credit checks that would decrease your credit score even more, as they only use harmless soft credit checks.

$200 Payday Loans vs. $200 Cash Advance: Is It The Same Type of Loan?

When looking for a $200 payday loan online, you’ll often find some companies offering cash advances as if they were the same type of loan… but is it really true? Here we will answer this question.

Payday loans and cash advances are the same type of loan

Payday loans and cash advances are the same type of loans, since both of them were created to offer customers the opportunity to borrow cash quickly and repay it after their payday. Therefore, when looking for this type of loan, you can also opt for a $200 cash advance because it’s essentially the same product.

Other names for $200 payday loans in the US

$200 payday loans can also receive the following alternative names:

- $200 loans for bad credit

- $200 loan cash advance app

- $200 bad credit emergency loan

- $200 payday loan no credit check

Remember that if you see these name variations, you’re still applying for the same type of loan. Even our recommended companies use different names for $200 payday loans on their websites and apps.

Can You Apply for Payday Loans $200 on Mobile?

Yes, you can apply for a $200 payday loan on mobile thanks to the mobile websites and apps of our recommended companies. You can apply for your loan on iOS, Android and Windows and any device be it a smartphone or tablet in just a couple of clicks.

This is especially important if you’re looking for a $200 cash advance app, because you can find it with our recommended companies. All you need to do is to fill out the application form, let the system analyze it and if you’re approved, the company will disburse the $200 immediately.

Are $200 Payday Loans Instant Approval?

Yes, because our recommended companies use AI-powered systems to review applications, they’re capable of approving them instantly if you meet the eligibility criteria. They will instantly analyze your data to make sure it’s real and accurate and make sure that your income and debt-to-income ratio will allow you to repay the $200 loan, and then they will proceed to approve your application.

Even though our recommended $200 payday loans offer instant approval, the disbursement can take anywhere from 1 t o 24 hours depending on your individual case. For example, lenders like Money Mutual, Big Buck Loans and Credit Clock disburse loans within 1-4 hours, whereas other companies take an average of 12 hours to deposit the $200 in your bank account.

What is the Real Cost of a $200 Payday Loan?

Even though the real cost of your $200 payday loan will vary depending on your credit score, chosen repayment period and state you live in. These factors will determine the final cost of your payday loan.

Certain states limit the APR for $200 payday loans at 300-400% for a period of 2 weeks, whereas other states only allow companies to charge a fixed finance charge such as $10 to $45 USD.

Our recommended companies will let you know the exact price for your payday loan when delivering the final offer and contract, and it will go according to the regulations and laws of your state.

About Income and $200 Payday Loans

Since payday loan companies use the income as an important factor to determine your creditworthiness, it’s normal to have the following questions:

- How much should I make per month to qualify for a $200 payday loan?

- Can I qualify for a $200 payday loan if I’m unemployed?

- Is it possible to qualify if I have low income?

- Can I get a $200 payday if I work part time?

To answer them all, here’s what you need to know:

- Our recommended payday loan companies can approve your application with a minimum income of $800 to $1,000 per month

- You can get approved for a loan even if you’re unemployed as long as you have an alternative income source such as a pension, dividends, freelance work, etc.

- You can qualify for a $200 payday loan if you have low income, as long as your debt to income ratio (DTI) allows you to take on new debt

- You can get a $200 payday loan if you work part time, as long as it covers the expenses of the loan. Hence, you need to make a minimum of $800 to $1,000 per month.

To summarize, if your monthly income is at least $800 to $1,000 per month, you can qualify for a $200 payday loan at our recommended companies.

About Debt to Income Ratio and $200 Payday Loans

Your debt-to-income ratio (DTI) will play a decisive role when applying for a $200 payday loan, as it will determine your creditworthiness along with your income. The DTI is simply your monthly debt divided by your monthly gross income.

If you make $4,000 per month and your monthly debt is $1,500 (housing cost + consumer debt), then your DTI would be 37.50%, which is slightly over the recommended maximum DTI of 35%.

Now that you know how to calculate it, and the recommended maximum DIT, you can know beforehand your probable chances of qualifying for the payday loan.