Anybody who survived the wild ride of the real estate market a decade ago can’t be blamed for being a little wary nowadays.

The housing market collapse sparked what has become known as the Great Recession. In Snohomish County, one in three construction jobs disappeared and more than 11 percent of the workforce was unemployed.

The recession has been over for years. Now, the housing market has roared back in the Puget Sound area. Home prices have climbed to the highest ever seen.

Last year, median home prices in Snohomish County rose to more than $400,000 for the first time and that lumps in lower priced condominiums.

Single-family homes alone in the county went over $440,000 in 2017 up from $390,000 in 2016, or a 13 percent increase year over year, according to the Northwest Multiple Listing Service. The median price for a single-family house reached $382,500 in March 2007, just before the recession.

So is the real estate market solid or is it built on sand?

Four experts weighed in whether there’s another housing bubble brewing (spoiler alert: all four say no.) They also shared their opinions about what to expect with rising interest rates, what can be done about a lack of homes and risks on the horizon that could affect the market.

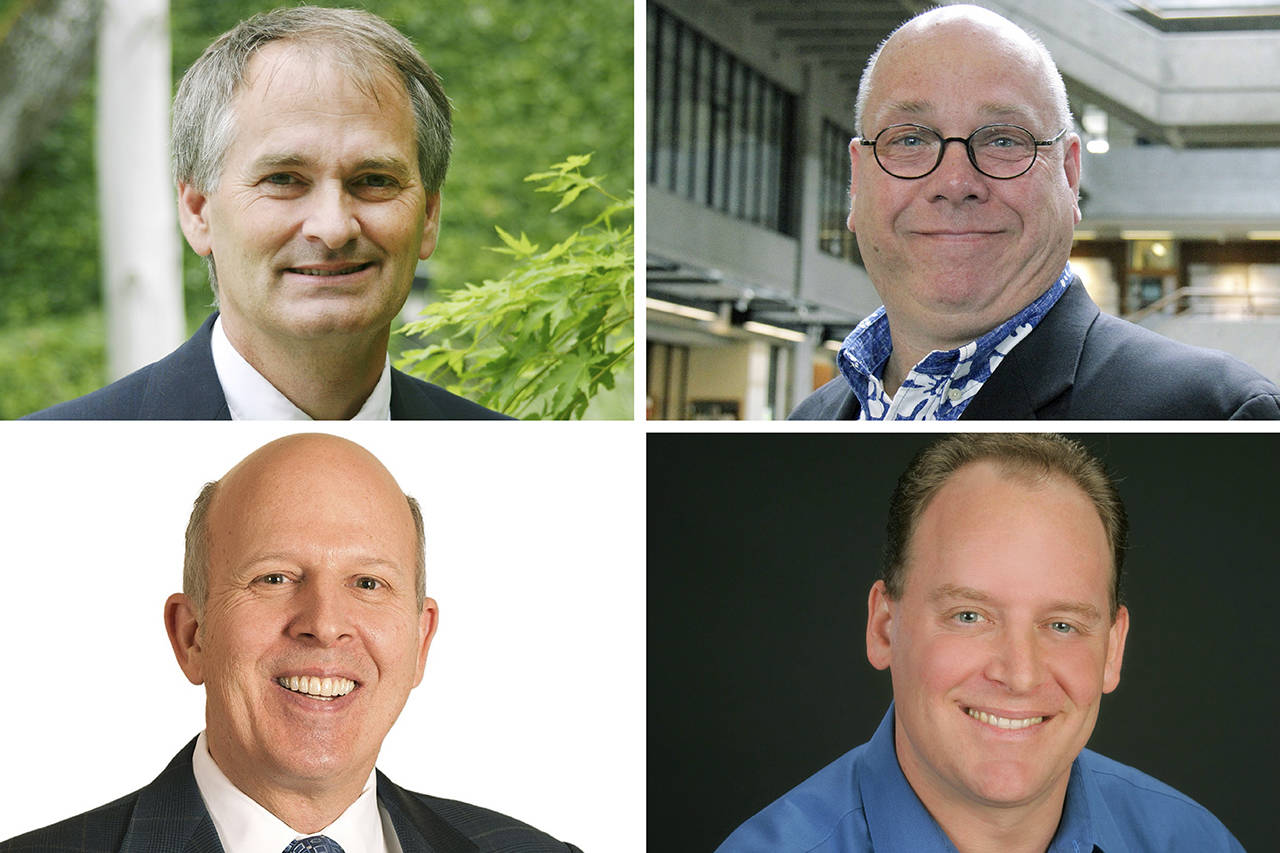

Those experts include a real estate analyst, a CEO of a real estate company, a builder representative and an academic. They sent their answers via email.

They are: Todd Britsch, regional director of Metrostudy, based in Bothell; J. Lennox Scott, chairman and CEO of John L. Scott; Mike Pattison of Master Builders Association of King and Snohomish Counties; and James Young of the University of Washington’s Runstad Center for Real Estate Studies.

Are we in a housing bubble?

Britsch: No housing bubble but real estate is cyclical and at some point we will have a buyer’s market. Just not any time soon.

Pattison: No, we are not in a housing bubble.

Scott: Seattle/Puget Sound is going through a growth spurt. It happens every decade. This is a historical moment. Both key indicators are very favorable — job growth and historically low interest rates.

Young: It depends upon what you would define as a bubble. A bubble is usually when prices get ahead of the fundamentals that influence the marketplace. For the Seattle area, we still have very high inward migration, extraordinary levels of job growth within high paying economic sectors, and record low interest rates.

Will there be a correction?

Britsch: How do you correct supply and demand? Too little supply for years for the demand. We would need to hit a major recession and that does not appear to be imminent.

Pattison: Information presented at Master Builders Association of King and Snohomish Counties’ recent economic forecast breakfast suggests home prices are starting to reach a peak in some areas of our region. However, we expect the housing market to remain strong.

Scott: When interest rates reach the 5 percent range, home appreciation rates will ease slightly. Job growth will keep housing sales activity strong.

Home price appreciation has been rising above the historical norm of 4 percent for several years. Job and population growth is keeping the market in a pressure cooker.

Unlike the major housing correction during the Great Recession, this time home buyers need to meet higher qualification standards. We recommend buyers get fully underwritten for a mortgage or leverage their buying power with cash.

Young: As long as high demand continues, it will be difficult for supply to catch up. Those are market fundamentals and there is no sign that we are in bubble territory just yet.

Do you see prices continuing to climb?

Britsch: Yes, but there will come a time when rates become too high and a buyer can no longer afford housing.

Pattison: Yes. Although we could see home prices start to taper in our region this year, core areas in south Snohomish County and King County can expect to see continued price appreciation due to the lack of inventory. This includes new construction and resale homes.

Scott: Yes, I anticipate 8 percent median home price appreciation in 2018 in Snohomish County. During the spring of 2019, median home price appreciation will be down a few degrees of hotness. There will always be a lack of supply of housing in the more affordable and mid-price ranges where 80 percent of sales activity takes place.

Young: Based upon the above analysis, as long as the economy does well and interest rates remain low house prices should continue to climb.

What affect will higher interest rates have on the market?

Britsch: If rates hit 5 percent, buyers will need to make roughly $130,000 to buy a $460,000 home vs. over the last couple years that was just over $100,000.

Pattison: We remain optimistic that the housing market is strong and can sustain moderately higher interest rates. The concern is that as rates rise, the income needed to afford a home increases as well, making housing less attainable for buyers.

At the same time, as buyers pull back in response to higher interest rates, this could slow price increases somewhat.

Young: Changes in interest rates may not have the same impact as the last time because there are fewer adjustable rate mortgages in the market. Most homes are being sold on 15 to 30 year fixed rates. That means it will be easier for existing homeowners to ride out high interest rates. Jobs are the real key in the marketplace now.

Scott: Interest rates have been historically low for many years, allowing the market to help absorb the home price increases. The current housing market is experiencing premium pricing in more affordable and mid-price ranges. So, when interest rates go up, the appreciation rate will flatten out.

There’s a lack of homes for sale. What can be done about that?

Britsch: The Puget Sound Regional Council needs to care that 75 percent or more people want to live in single-family homes. As of now the council wants people to live in apartments or other attached housing. This limits single-family homes and drives prices even higher than they should be.

Pattison: Increased buildable land supply and increased density in appropriate areas are the only realistic ways to increase housing inventory. Regulations that constrain land use should be re-evaluated.

Scott: We need mainstream or mid-priced condominiums to be built. Local government officials need to ask Washington state legislators in Olympia to pass a fix to the condominium defect liability law to allow developers the right to cure defects before lawsuits. Additionally, the economic return to investors currently favors apartments over condominiums, but it is starting to balance out.

Young: If you are talking about housing supply and construction, then the best thing might be for planners and the councils to quit changing rules on development all of the time and provide certainty to the development process. That is not to say that they need to loosen up planning. It is to say that they need to decide on the rules and stick to them so that developers can price things appropriately. Snohomish County is actually better than some places in the region in regard to that.

What happens if the stock market falters?

Britsch: Nothing, as long as we have jobs and in-migration the housing market will continue to be in demand.

Pattison: With regard to housing, employment and wage data are more important indicators. While consumer confidence can be affected by market volatility, home buying in our region is expected to remain robust due to our strong job market.

Scott: We are currently experiencing a large wealth effect from the stock market.

Young: The depends upon the interest rate response and the availability of credit. As long as credit is available for home purchase and there is job growth in the area, then house prices should continue to grow.

Are there any other economic worries on the horizon that could affect the real estate market?

Britsch: Rising interest rates have already begun to price many buyers out of the market along with non-owner-occupied foreign investors buying up real estate in an already restrictive supplied market, which causes prices to accelerate faster than they should.

Pattison: Risks for new home construction that could impact the real estate market include rising building material prices and labor shortages. Ongoing regulatory burdens and delays represent another risk factor. Master Builders Association of King and Snohomish Counties continues to be focused on promoting polices that would increase housing supply and reduce barriers to affordable housing.

Young: The biggest concern is that government officials and politicians actually try and do something to control the market. Rent control and other political risk is the greatest problem for this area.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.