EVERETT — One Snohomish resident took the Port of Everett to court this week, after calling its campaign to enlarge its boundaries a “stealth tax.”

But on Wednesday, Snohomish County Superior Court Judge Karen Moore denied the push from Morgan Davis to disclose how the ballot measure would increase property taxes for hundreds of thousands of residents.

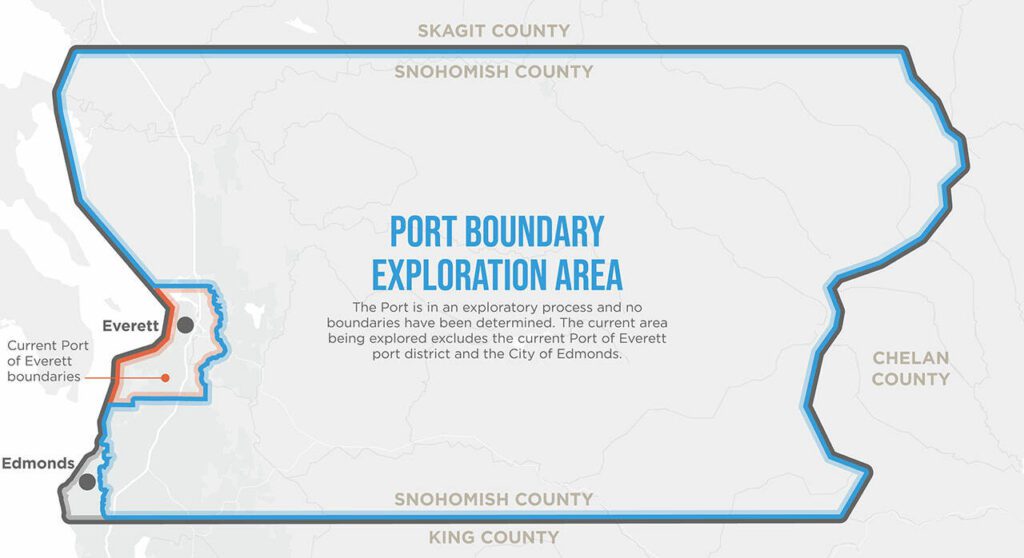

In August, the port will ask voters to approve vastly expanding its boundaries. Currently, the port covers Everett as well as parts of Mukilteo, Marysville and unincorporated Snohomish County. The port wants to extend the boundaries to include all of Snohomish County, excluding the Port of Edmonds.

Only 15% of Snohomish County is represented by the ports of Everett and Edmonds, according to a boundary expansion report from the Port of Everett. The port’s 2024 adopted budget totaled $83 million.

Davis, a landlord from Snohomish and local government gadfly, called the proposition “misleading and imprecise.” The port levies 19 cents per $1,000 of assessed property value. Homes valued at $550,000 pay about $100 in annual taxes to the port.

The ballot title reads: “Shall the Port of Everett be enlarged to include all areas of Snohomish County not currently within the Port of Everett; the Port of Edmonds; the City of Edmonds; and any areas surrounded by the Port of Edmonds or the City of Edmonds, as described in the Port of Everett Resolution No. 1220 (2023)?”

Last week, Davis petitioned a Snohomish County Superior Court judge to include two words to describe the Port of Everett in the proposition’s title: “taxing district.”

“It’s so the voters are notified if he votes for this, he will have a tax imposed,” Davis said in court Wednesday. “I think without those words, it’s a stealth tax.”

Jack Follis, an attorney for the port, said the tax isn’t mentioned because it is one of many things that will change for residents in the new boundaries. Taxes are spent on environmental cleanup, business development, job growth, transportation improvements and capital projects, according to the port.

“Taxes raised will go right back into development,” he said.

Superior Court Judge Karen Moore agreed with Follis, ruling the port’s language will remain the same.

“Identifying only the tax as something the district does and not identifying the other things the district does, we would need a ballot title that includes all those things,” Moore said.

And if the ballot title included everything the port does, it would be “excessive and confusing,” she said.

“I believe the language is fair, equally balanced for both parties,” she said.

She also noted the voters’ pamphlet sent out before ballots will have pro and con statements outlining the tax and other ramifications.

“I would agree with your argument if there wasn’t a voters’ pamphlet that is sent out to everyone,” Moore told Davis.

After the hearing, Davis said he wasn’t so surprised by the outcome.

Davis’ five properties — four single-family homes and one six unit apartment complex in Snohomish — are valued at just over $2.3 million in total. If the proposition passes, he’d pay an extra $430 in property taxes, he said.

“According to the state law covering the port taxing districts, the port district has the capability to raise that 19 cents rate to 45 cents per $1,000 (of assessed value),” Davis wrote in an email.

If the port lifted the levy rate to 45 cents, it would cost him $1,000 in taxes each year, Davis said.

The port conducted various surveys over the past few years to gauge interest in boundary enlargement. Responses came back largely positive, with many residents hoping the port would invest in their neighborhoods, according to the port.

The proposition will appear on the primary ballot for all voters, excluding those in the current Port of Everett and Port of Edmonds boundaries.

Jenelle Baumbach: 360-352-8623; jenelle.baumbach@heraldnet.com; Twitter: @jenelleclar.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.