By Will Thomas / For The Conversation

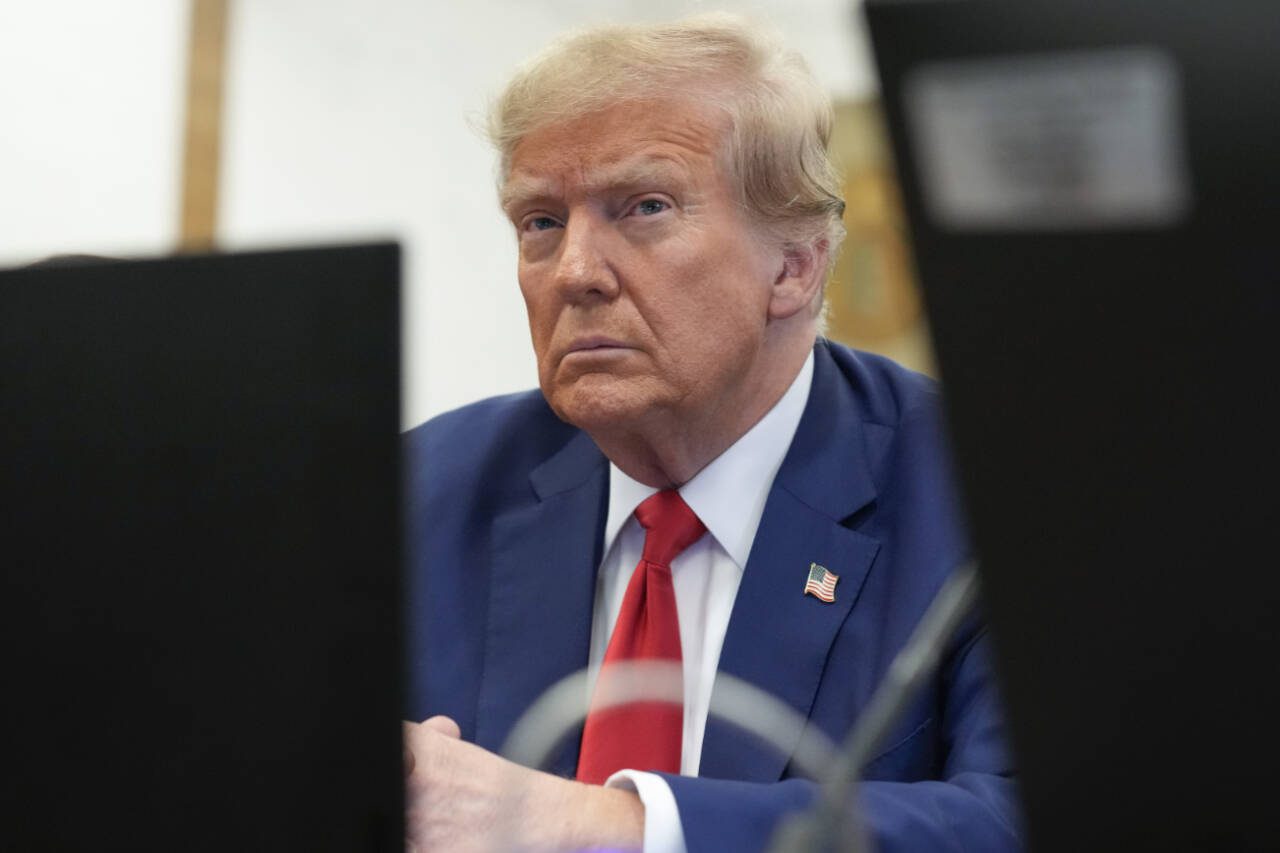

Lawyers for Donald Trump on March 18, told a New York court that the former president has been unable to secure a $454 million bond as he appeals a New York civil fraud ruling against him.

Their “diligent efforts” reportedly involved approaching about 30 bond companies, all of which said “no.”

Time is running out for Trump, who has until Monday to either secure the bond, known as an appeal bond, or pay that amount himself in cash.

The Conversation asked Will Thomas, a business law professor at the University of Michigan, to explain why Trump needs an appeal bond and what happens if he doesn’t get it by the deadline.

What’s an appeal bond?

An appeal bond, sometimes referred to by the Latin supersedeas, meaning “you shall desist,” is a guarantee that the party appealing a ruling against them can and will pay the judgment if their appeal is ultimately unsuccessful. The person appealing the ruling is known as the appellant.

Appeal bonds are offered by licensed providers such as insurance companies and bondsmen who specialize in offering these kinds of guarantees. It’s common in civil cases for the appellant to get an appeal bond.

In order to convince a bondsman to give you an appeal bond, you need to offer them collateral, such as real estate or other assets, in exchange. That way, in case they end up on the hook for the appellant’s judgment, they can sell the collateral to pay it.

The size of the appeal bond is larger than the actual judgment — in Trump’s case, the judgment is $355 million — because the appellant will be expected to pay interest on the original judgment should they lose their appeal. The bond is meant to cover whatever those estimated costs will be. So, for example, Trump recently appealed an $83 million judgment in a separate defamation case brought by columnist E. Jean Carroll. To do so, he secured an appeal bond worth $91.6 million.

Why do courts ask for them?

The point of an appeal bond is to protect the rights of the party who won at trial. The appeals process can be slow, taking months or even years, and a lot can happen during that period.

An appellant might suffer some unexpected financial hardship; or, more cynically, they might use the delay as an opportunity to sell, hide or otherwise get rid of assets that they otherwise would have to hand over to the trial winner. Securing a bond guarantees that, whatever happens to the appellant, there is someone standing ready to pay the trial judgment when the appeals process is over.

Of course, courts could accomplish the same protection by requiring the appellant to pay the entire judgment upfront before appealing. And, in fact, that’s allowed as well. In Trump’s case, New York law allows him to pay the $454 million to the state of New York today. But that approach can be hugely expensive: A bond will have the same effect at a fraction of the cost; all you have to do is put up collateral and make regular payments on the bond, much like someone would pay premiums on an insurance policy.

So really, the appeals bond is something of a compromise: It preserves the trial winner’s ability to collect a judgment down the road, and it allows the appellant to appeal without having to surrender all their assets up front.

Trump is reportedly very rich. Why is he struggling to secure a bond?

Trump’s problem is none of the major insurers or licensed bond providers apparently has been willing to issue a bond of this size without collateral that is liquid; think cash or investments like stocks that can be easily sold, as opposed to real estate that can be hard to dispose of.

And neither Trump nor the Trump Organization, both of whom are defendants in the case, has that much cash available. Trump testified earlier at trial that the organization had $400 million in liquid assets, while a New York Times analysis put the number closer to $350 million. Either way, that’s not enough to cover the bond, which would need to be $454 million to cover both the judgment and any interest that accrued during the appeal.

And let’s not forget that around $100 million of Trump’s liquid assets were already pledged to secure a different appeal bond in his other New York civil case involving Carroll.

So while it’s true that Trump and the Trump Organization have billions in assets, those assets mostly come in the form of commercial real estate like Trump Tower.

And it’s maybe not surprising that an insurer wouldn’t want to accept real estate as collateral. Yes, Trump Tower, in New York City’s Manhattan borough, is valuable, but owning and managing or even just trying to sell commercial real estate can be a huge, expensive hassle. For an insurance company not already in the real estate business, it may want to avoid a possibility where Trump ultimately doesn’t make good on his judgment payments and the insurer is forced instead to own — and then try to sell — an asset like Trump Tower.

Add onto this fact that companies might understandably be wary to do business with the Trump Organization. After all, the conclusion reached at trial was that the Trump Organization routinely lied to financial institutions about the value of Trump’s assets in order to secure favorable business loans. It’s a bit ironic, then, that Trump is now struggling to convince financial institutions to take seriously his representations about his ability to pay his debts.

What happens if he can’t get the bond?

Assuming Trump and the Trump Organization cannot secure a bond, there are a few possible paths forward; most of them ranging from bad to disastrous for Trump.

The best scenario for Trump is that the New York appellate court might decide on its own to grant Trump’s request to stop New York from collecting its judgment. Securing a bond would automatically prevent New York from collecting its judgment while the appeal process is ongoing, but the appellate court likely has the inherent power to grant that same temporary legal protection without a bond or, as the Trump team has suggested in this case, with a partial bond worth about $100 million.

If I had to guess, I suspect that something like this is the most likely outcome, if only because the other outcomes are so bad.

What are the other possibilities? First, Trump could sell assets to generate the cash he needs to secure a bond. This would be an especially expensive outcome from Trump and his businesses because, when it comes to real estate, the worst time to sell is when you are being forced to do so.

Second, either Trump or his businesses could declare bankruptcy. Bankruptcy, after all, is meant to protect people who can’t pay the debts they currently owe, which would be Trump in this situation.

We actually saw a version of this scenario playing out a few years ago when Gawker Media was unable to afford an appeal bond after losing its invasion of privacy trial to Hulk Hogan.

Third, the state of New York has the right to seize Trump properties in order to cover the judgment. Attorney General Letitia James has already stated that she is willing to do this if Trump doesn’t provide a bond. From there, the state could sell the properties it seized or, more likely, it would hold onto the properties until after the appeals process ends, in case the state loses or has its judgment amount reduced.

Will Thomas is an assistant professor of business law at University of Michigan. This article is republished from The Conversation under a Creative Commons license.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.