By The Herald Editorial Board

Won’t somebody think about the needs of the state’s billionaires?

That seems to be the call heeded by proponents of Initiative 2109, which would repeal the capital gains tax that the state adopted in 2021 and was upheld as constitutional by the state Supreme Court in 2023.

The state’s capital gains tax levies a 7 percent tax on the sale or exchange of long-term capital assets, specifically stocks, bonds and business interests; along with other exemptions, sales of real estate are excluded from the tax. Currently the tax is applied on receipts above the tax’s $262,000 floor. (When adopted, the floor started at $250,000, but that limit is adjusted each year for inflation.) This means that the tax is applied only to capital gains realized above that $262,000 floor.

The result, said Treasure Mackley, executive director of Invest in Washington Now, which advocates for tax fairness and is urging a no vote on I-2109, is that only 2/10ths of 1 percent of state residents have gains that fall under the tax. That works out to about 3,000 to 4,000 of the state’s wealthiest residents. according to state figures.

“Most of these were extremely, extremely wealthy folks in King County, but the revenues from this benefited kids at schools and families all across the state,” said Mackley, an Edmonds resident with a third-grader in Edmonds schools.

Mackley stressed that the tax does not apply to sales of homes and real estate, nor does it apply to retirement accounts or sales of small businesses.

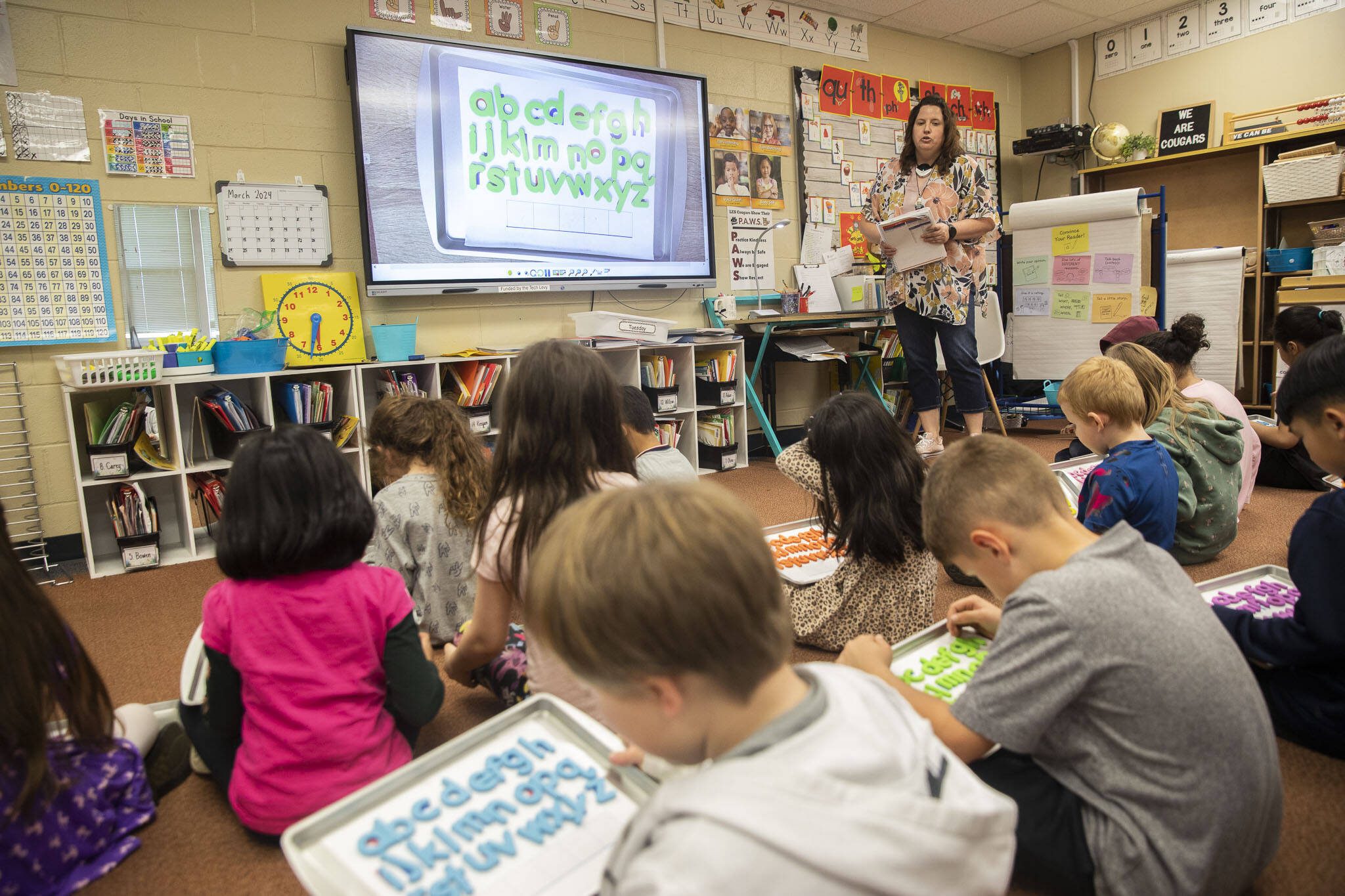

The capital gains tax, said Dr. Stephan Blanford, executive director Children’s Alliance, an advocate for children and racial justice in laws and budget policy and also opposed to the initiative, applies to “a very small segment of Washingtonians who produce enough revenue to fund incredible opportunities for us to move forward on child care in particular, but also on K-12 schools and school construction.”

A fiscal impact statement for the initiative, prepared by the state’s Office of Financial Management, concludes that passage of I-2109 would result in a revenue loss of $2.2 billion over the next five fiscal years, either reducing funding for K-12 education, early learning and child care, K-12 school construction and higher education or forcing the state to seek replacement tax revenue elsewhere.

Among the knocks from supporters of the initiative, including its main proponent hedge fund manager Brian Heywood of Let’s Go Washington — with his clients if not himself likely among some of those 3,000 to 4,000 paying the tax — is that capital gains are volatile, prone to fluctuations and to low returns during an economic downturn.

True enough; the tax collected about $786 million in 2023, but as of May of this year, its receipts dropped to $433 million. Those fluctuations bedevil budget writers, state Sen. June Robinson, D-Everett, chair of the Senate’s Ways and Means Committee, told the Washington State Standard in May.

“As a budget writer you don’t like to see that, but I’m really not that surprised,” she said.

But the legislation that enabled the tax, Blanford said, took those expected fluctuations into account. On average, the tax is forecast to generate about $500 million each year, with each year’s first $500 million deposited into a specific account for K-12 education, early learning, childcare and higher education. Annual revenue over $500 million from the tax is allocated to an account for school construction.

There’s also reason to believe that some of the state’s wealthiest resident have recently held off on sales of assets, pending the results of the election, in hopes of its passage.

“I don’t travel in those circles. Those aren’t parties that I’m invited to,” Blanford said. “But with the market doing as well as it is now, I imagine that there are a fair number of sales and transactions that are taking place” that could boost the tax’s revenue in coming years.

Despite its fluctuations, Robinson also told the Standard that the initiative’s passage would “blow a big hole in the budget.”

More to the point: “If I-2109 passes,” said Mackley, “it will take way that $2.2 billion from kids and schools and families.”

There also is a matter of tax equity to consider. Before passage of the capital gains tax, Washington was rated as having the most regressive state tax system of all 50 states, according to the Institute of Taxation and Economic Policy, a nonprofit economic policy group, in its regular state-by-state tax policy report, “Who Pays?”

The capital gains tax improved the state’s standing enough that it’s now No. 2 among states — after No. 1 Florida — with the most regressive state and local tax systems, meaning that lower income families pay a higher percentage of their income as taxes than do higher income residents. Washington families in the lower 20 percent for income pay 13.8 percent of their income as taxes, while the top 20 percent pay less than 8 percent of their income as taxes; the top 1 percent — from which that 2/10ths of 1 percent paying the capital gains tax are drawn — still pay only 4.1 percent of their income in state and local taxes.

Nor are billionaires likely to flee to other states to escape Washington’s capital gains tax.

“The largest majority of people who have that flexibility do not choose to leave because they are trying to avoid taxes,” Blanford said.

Much was made of Amazon founder Jeff Bezos’ move last year from Washington state to Florida, but Bezos cited reasons other than taxes; specifically moving closer to his fiance’s family in Miami and closer to his aerospace venture Blue Origin’s operations near Cape Canaveral.

A review of research by the Center on Budget and Policy Priorities found that state taxes have minimal impact on interstate moves.

“State tax levels have little effect on whether and where people move; certainly not to a degree that should lead state policymakers to enact unaffordable tax cuts to attract people or avoid enacting productive increases focused on the wealthy,” wrote Michael Mazerov, for the budget center.

Just the opposite, he concluded: “If deep tax cuts result in substantial deterioration in education, public safety, parks, roads and other critical services and infrastructure, these states will render themselves less — not more — desirable places to live and raise a family.”

Initiative 2109 amounts to a cynical play to the state’s voters — 80 percent of whom are paying a far higher share of their income as taxes — to save a sliver of the state’s wealthiest individuals from paying a fairer percentage of their gains, and only those profits above $262,000. As the state confronts a growing need for child care that would allow more parents to pursue education and employment, as well as helping resolve persistant difficulties in funding K-12 education and school construction, passage of I-2109 represents charity to the state’s wealthiest that its residents cannot afford.

Voters must soundly reject Initiative 2109.

“We can talk all day about the economics of it, but I believe there is a moral imperative in the investment that Washington state made in resolving some of the opportunity gaps that exist in schools and in society,” Blanford said. “This initiative would take us backwards on that.”

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.