EVERETT — In 2023, some people could pay nothing in monthly premiums for a Cascade Care Savings health plan.

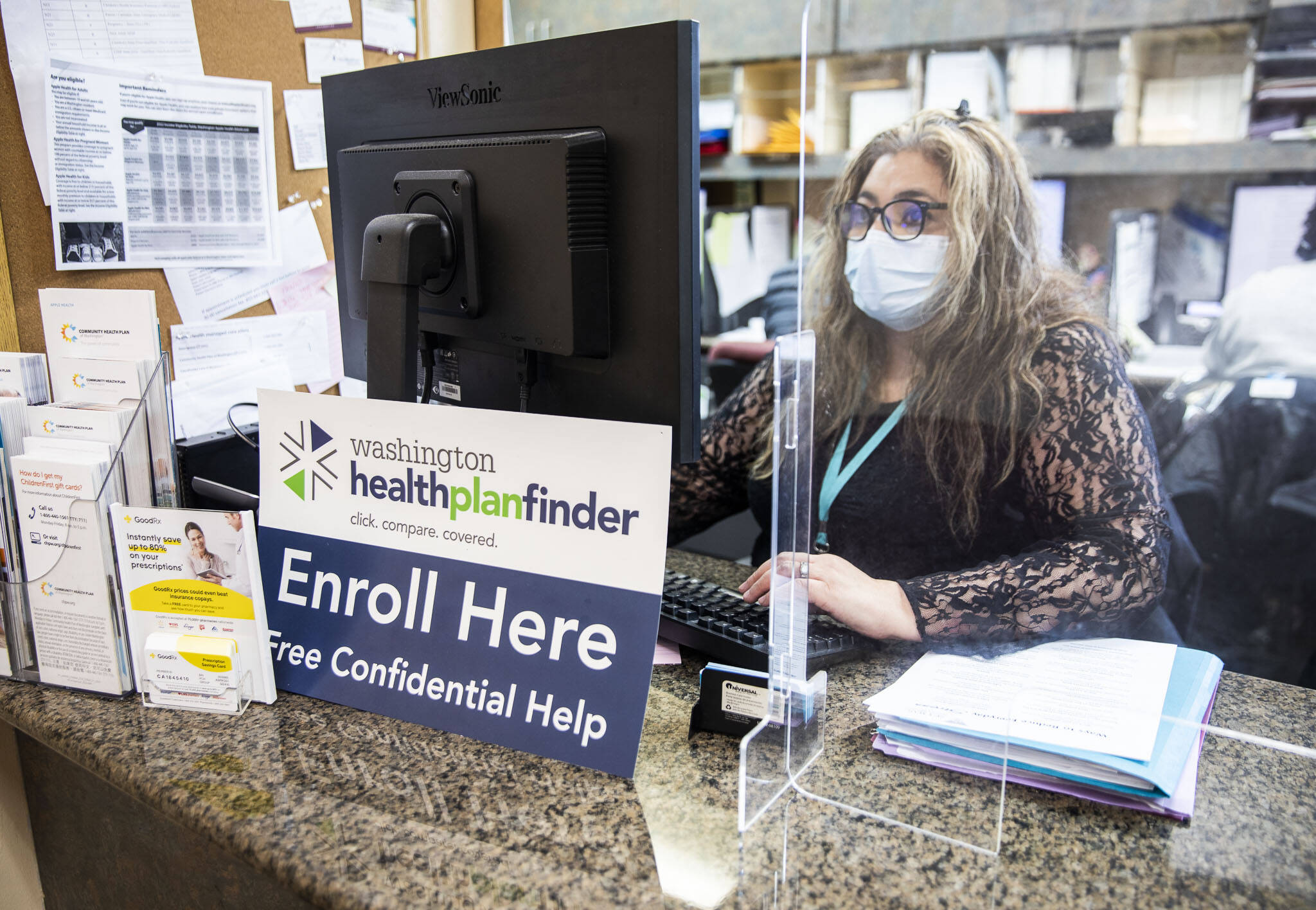

It’s not too good to be to true, confirmed Ana Howe, managed care regional coordinator for Sea Mar Community Health Center. Their health plan navigators have already signed people up for $0 on the Washington Healthplanfinder, the state’s health benefits exchange.

The enhanced state tax credits for people earning up to 250% of the federal poverty level is just one of several changes for next year for people who buy health insurance on the exchange.

Because of that change alone, Howe emphasized that folks already enrolled in an exchange plan shouldn’t auto-renew without exploring their options on Healthplanfinder. The state recently estimated that 90% of exchange customers in Snohomish County could find a cheaper plan with the same level of coverage. Other counties in the north Puget Sound region, like Island, San Juan, Skagit and Whatcom, ranged from 69% to 77%.

Those customers’ current plans might not qualify for the extra tax credits.

Next year, a household of three earning less than $54,900 per year would qualify for some assistance with a Cascade Care plan. The state said in a press release that “Cascade Care Savings enables most eligible customers to get a high-quality plan for less than $10 a month.”

Even though the first exchange open enrollment deadline is looming — Dec. 15 for coverage beginning Jan. 1, 2023 — people can sign up as late as Jan. 15, 2023, for coverage beginning Feb. 1.

Nearly 21,000 people in Snohomish are enrolled in a qualified health plan on the exchange, and another 173,000 are enrolled in Apple Health, the state’s Medicaid program, according to fall 2022 data from the Washington Health Benefit Exchange.

Apple Health is always open for enrollment. Children under 18 and pregnant women can get coverage through Apple Health, regardless of their immigration status. And automatic renewals remain in effect for as long as the federal COVID public health emergency continues.

Howe and other navigators have been out at community events, ready with their laptops to help people enroll in health coverage on the spot. Howe was at the Evergreen branch of the Everett Public Library on Wednesday and the Everett Goodwill job and training center on Thursday.

Sea Mar can connect folks with navigators and brokers in many languages, such as Russian, Punjabi and Spanish. The Healthplanfinder also provides contact information for navigators in dozens of languages.

Neil Angst is an insurance broker whose Everett business, Health Insurance Solutions NW, LLC, serves as an “enrollment center” for the health benefit exchange. Like navigators, brokers also offer free advice for everyone, but they have more expertise on the nuances of shopping for plans. Brokers are paid commissions by insurance companies when people sign up for those plans.

Angst said when the state set up the exchange, it wanted some “brick and mortar” locations where people could go for help, especially in communities with significant uninsured populations. Angst continues to have a number of folks contact him because of that listing on the Healthplanfinder site. He educates them about their health insurance options: “I really enjoy making sure that the client has correct information in order to make that decision.”

Angst said that the Cascade Care Savings plan is the biggest change this year. Those extra state subsidies will allow lower-income households “to have more accessible care by keeping the cost down.” Just pay attention to which providers are in-network.

Another change in 2023 is the fix of the “family glitch.” This was a “big hole” in the original Affordable Care Act, Angst said. It made families ineligible for premium subsidies on the exchange if an employer offered dependent coverage, even if that coverage was not affordable for them.

Nationally, the Kaiser Family Foundation estimated that 5.1 million people fell into the family glitch in 2021.

The Inflation Reduction Act, passed in August, fixes that. If the cheapest employer health plan would cost more than 9.12% of household income to cover dependents, then those family members can apply for exchange health plans with financial assistance.

Angst is advising his business clients to make sure their employees know about the changes and check out their options. But employer-based plans can offer more value than exchange plans for people with complicated health conditions. Angst also suggested employees should do the math on any savings if they pay for employer-based coverage on a pre-tax basis.

Obviously, some folks will still pay full price for health insurance, something they are no longer required to have. And it can be a lot of money.

Angst sees clients who are reluctant to pay for health insurance. Some young people tend to think they are “Superman or Superwoman,” and for them the risk of no insurance feels worth the gamble. “There’s probably not much I can say to that person to justify a $350/month premium for catastrophic coverage,” he said.

But for older folks, Angst urges caution: “You might be the healthiest 55-year-old person on the planet, but you need to have some measure of protection so that if something bad does happen, they’re not coming for your house.”

Adults who lacked health insurance for more than half the year were significantly more likely to have medical debt of at least $250, according to Kaiser Family Foundation’s analysis. Debt collectors for medical providers can sue patients, leading to garnished wages and liens on homes.

For her part, Howe emphasized the importance of insurance as a gateway to preventive care for clients and patients.

“Our goal, especially because we are a clinic,” she said, “is really to do those preventive care services, and to make sure that they they do have other options than going to the ER and then having to deal with those bills.”

Resources:

Find health plans and help for understanding the options: wahealthplanfinder.org/

Employees of licensed child care facilities might be eligible for $0 monthly premiums again in 2023: wahealthplanfinder.org/us/en/health-coverage/who-can-sign-up/child-care-learn-more.html

Joy Borkholder is the health and wellness reporter for The Daily Herald. Her work is supported by the Health Reporting Initiative, which is sponsored in part by Premera Blue Cross. The Daily Herald maintains editorial control over content produced through this initiative.

Joy Borkholder: 425-339-3430; joy.borkholder@heraldnet.com; Twitter: @jlbinvestigates.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.