OLYMPIA — If you lost count of how many new and higher taxes state lawmakers passed this year, it was 12.

And voters will get a chance this fall to offer their opinions on every one, though what they say won’t change anything.

Yep, it’s time once again to talk about tax advisory measures which are so numerous this year that they will consume most of the front side of general election ballots in Washington.

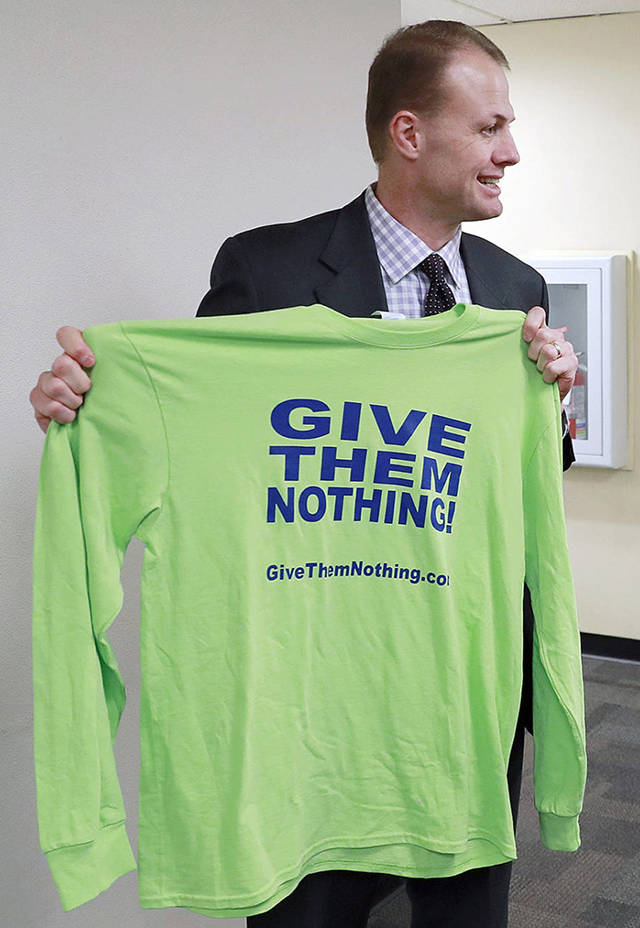

If you recall, these are nonbinding on legislators. They’re showing up due to a provision in Initiative 960 dreamed up by Tim Eyman, and approved by voters in 2007.

It said if lawmakers enact a tax increase without putting it to a vote then the electorate gets to offer its opinion after the fact. They do so by checking a box to repeal or maintain the increase. With this year’s dozen, voters will have weighed in on 31 tax increases since 2012.

“It’s a tax increase report card and the Legislature this year gets an ‘F’,” Eyman said.

We wouldn’t be talking about advisory votes and providing Eyman a platform for politicial ministering had Democratic lawmakers gotten rid of them by passing Senate Bill 5224.

Democrats are in the majority in both chambers. They did in the Senate but not the House. That’s because Speaker Frank Chopp of Seattle kept his foot on the bill. He’s no longer the speaker and lawmakers in both chambers want to pass it in the 2020 session.

Andrew Villeneuve, founder of the Northwest Progressive Institute and an architect of the legislation, thinks 12 measures on one ballot will annoy folks enough to produce a different outcome.

“I think it helps with our momentum,” he said.

The ballot isn’t the only impact of these measures. By law, the Secretary of State’s Office must provide a smidgen of information on each tax in the voter pamphlets mailed out ahead of the election.

That content will amount to a bill number, a descriptive phrase of the tax penned by a legal mind in the Office of the Attorney General, a guesstimate of how much money will be generated from the increase in the coming 10 years and how each lawmaker voted on the legislation.

Voters will not learn who will be affected, how the money will be spent or when it will take effect. They must do a bit of sleuthing to get any of that information.

“We don’t call them advisory votes. We call them push polls,” Villeneuve said. “Taxpayers are paying for Tim Eyman to have anti-tax communication on the ballot. He thinks people will be upset with legislators. I think people will be mad that these things are on the ballot.”

Now, about those taxes. They tap into wages of workers, pockets of property owners and profits of Big Oil, Big Banks and Big Tech. Travel agents, lawyers, and accountants are hit, vaping products are targeted and Oregon residents are now supposed to pay sales tax when they shop in this state.

A few specifics:

Advisory Vote 24, one of the most celebrated increases among Democrats since no Republican voted for it, applies to the tax rate paid by those corporations and professional services. It’ll raise about $400 million for higher education in this budget and nearly $2.3 billion in the coming decade. For this budget, about half the money is for financial aid as the state pledges to pay the entire cost of tuition and fees for students of very low-income families.

Advisory Vote 29 concerns the conversion of the real estate excise tax from a flat rate to a graduated rate. Starting Jan. 1, owners of less expensive properties will pay a little lower rate when they sell than owners of more expensive properties. It will generate $245 million in this budget to keep the wheels of government spinning, an estimated $1.75 billion over 10 years.

And Advisory Vote 20 is for an increase that won’t take effect until 2022. That’s when workers will see a new deduction from their paychecks that will fund a first-in-the-nation benefit program providing folks with money to offset some costs of long-term care. For a person who makes $50,000 a year the deduction will add up to about $290 a year. Budget officials think this will bring in about a billion dollars a year.

Critics note putting 12 advisory measures in front of voters isn’t a free exercise.

In previous elections, each measure soaked up two pages in the voter pamphlet and the cost per page ranged between $12,000 and $15,000 depending on what else was in the pamphlet.

Final figures for this year won’t be known until September. If they’re in line with the past, these measures will require 24 pages at a cost of up to a half-million taxpayer dollars.

To those looking to blame him, Eyman notes: “I didn’t raise your taxes, they did.”

“They” mostly being Democrats who could have avoided this civic conversation by passing one more bill.

Jerry Cornfield: 360-352-8623; jcornfield@herald net.com. Twitter: @dospueblos.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.