EVERETT — From New York-style pizzerias and aerospace firms, to tribal governments and car dealerships, to private schools and newspapers — they’re all getting checks.

Since April, between $500 million and $1.5 billion in federal loans flooded into Snohomish County through the Paycheck Protection Program, according to data released Monday by the Small Business Administration. In total, nearly 10,000 county businesses received some form of aid — with a handful getting between $5 million and $10 million. For Bluewater Distilling in Everett, like many businesses rocked by the coronavirus pandemic, the money the federal program provided was the difference between staying open and shutting down for good.

“I honestly don’t know how we would have survived without it,” said Samantha Hill, a Bluewater spokesperson. “We had to furlough all but a few people who stayed on part time to make and serve takeout orders. It wouldn’t have been enough revenue to run a sustainable business, and was a very stressful time.”

Hill was furloughed when COVID hit. The day the loan came through in April, she was back at work.

“Within a week, we were back in production and bottling spirits, offering a new summer menu with extended hours and feeling normal again,” she said. “Business has since quadrupled from what we were doing at the beginning of COVID, and even though revenue is still significantly down from what we were doing before the pandemic, we’re running a safe and sustainable business. We have a great team here and it feels so good to have everyone back together and to see all of our regulars again, too.”

In total, the loans are reportedly saving about 70,000 jobs throughout the county.

Across the country, half a trillion dollars have gone to small businesses of all sectors and sizes, according to a report from the Small Business Administration. In Washington, 100,000 businesses received a combined $12 billion.

Businesses don’t have to pay back the loan if they spend at least 75% of the aid on payroll or employee benefits. The rest can go to expenses like rent, utilities or other benefits for staff.

If a company doesn’t spend at least 60% of the money on employee payroll, it’ll become a loan that must be paid back in two years.

Congress initially allotted $349 billion to this coronavirus rescue effort and began accepting loan applications on a first-come, first-served basis April 3. Two weeks later, the money ran out.

Lawmakers approved another $310 billion in funding and about $132 billion remained available as of June 30. This past week, President Donald Trump signed legislation extending the deadline to apply for a loan to Aug. 8.

Democratic U.S. Rep. Rick Larsen of Everett supported both rounds of funding to help workers stay on the payroll and small businesses stay in business during the COVID-19 shutdown. He pushed for tweaking the rules in the second go-round to give borrowers more freedom and time to spend loan funds, according to his spokesman.

U.S. Rep. Suzan DelBene of Medina, who also voted for both rounds, said the program has been a “lifeline” for tens of thousands of businesses “struggling to keep their doors open during the COVID-19 recession. I’ve heard from recipients of the program in my district and they couldn’t have kept going this long without these resources.”

But she voiced concern that some funds did not go to Main Street businesses, which are the program’s intended targets.

Nationally, many loans went to celebrity-owned brands or organizations.

Kanye West’s clothing company Yeezy received between $2 million and $5 million in federal dollars. Touring companies for the Eagles, Pearl Jam and the Head and the Heart also received loans.

“It’s wrong that professional sports teams, political organizations, and luxury clothing brands had easier access to this program than many of the rural, women-, and people of color-owned businesses in my district,” she said. “It is clear that we need stronger guardrails around what entities can use this program.”

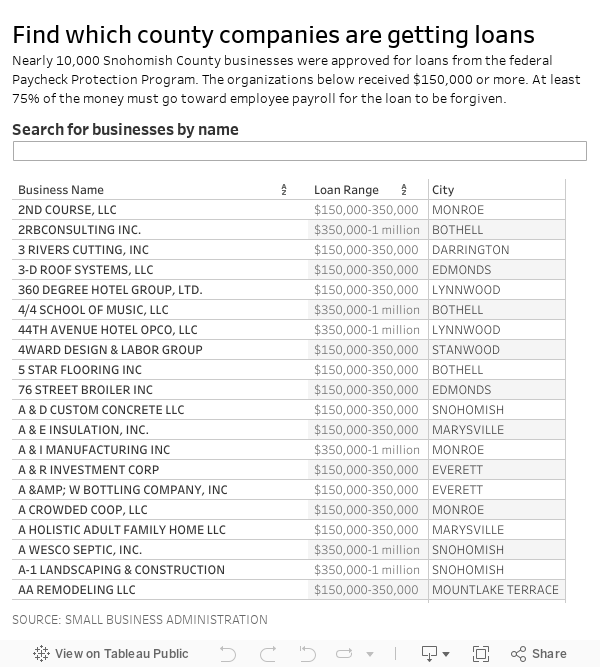

On Monday, the Small Business Administration released names, addresses and other information for businesses that received more than $150,000 from the federal agency. The data doesn’t give exact loan amounts. Instead it offers ranges like $150,000 to $350,000 or $5 million to $10 million. Those organizations account for about 15% of all businesses approved through the program.

The remaining 85% got less than $150,000.

Monday’s data release did not include names or identifiers for those businesses. Several news organizations are suing the government agency for access to that information.

Across Snohomish County, 10 companies received between $5 million and $10 million — Everett’s Compass Health, National Food Corporation, Sunrise Services and Western Washington Medical Group, Mukilteo’s Electroimpact, Emerald City Pizza, KLB Construction and University Medical Contractors, Bothell’s Romac Industries and Marysville’s Central Welding Supply Co.

EvergreenHealth Monroe, a 72-bed hospital serving east Snohomish County, received $4.52 million in the last week of April. Its income, like other small hospitals in Washington, plunged early in the pandemic after the governor halted elective surgeries to preserve supplies of personal protective equipment and ensure adequate capacity of hospital beds.

“The funding received has been allocated to support payroll and employee benefits, allowing us to further negate any financial impacts on staff as a result of COVID-19,” said John Green, the public hospital’s financial officer.

Sound Publishing, which owns the Daily Herald got $4.1 million, Publisher Josh O’Connor said.

“The funding is being used to support Sound operations in accordance with the SBA and PPP guidelines,” he said. “Due to unfortunate layoffs, which reduce loan forgiveness, and parent company financing restrictions, Sound will be repaying upwards of 80% of the funding received by the end of this year.”

The Seattle Times also received a loan.

So did the Tulalips and Stillaguamish Tribes, reportedly saving hundreds of jobs.

One of the first loan recipients was ChildStrive, formerly known as Little Red School House, which has served families in Snohomish County since 1963. The Everett-based nonprofit offers services for children with a developmental delay or disability, and first-time pregnant mothers, as well as in-home parenting support programs.

ChildStrive received a roughly $1.2 million loan within two days of the federal funds becoming available, said Jim Welsh, the chief executive officer. Getting it fast was important to offset a precipitous drop in revenue due to a decline in demand for some programs and an inability to hold its annual major fundraiser, he explained.

Because all of it went into salaries, he’s confident it will be converted into a grant that won’t need to be repaid.

“We made a commitment to maintain our payroll and keep our employees which the program allowed us to do,” he said.

The Snohomish County Public Defenders Association, a private, nonprofit law firm, is among a smattering of legal outfits on the list.

With the federal funds, clients could be ensured access to attorneys, investigators, social workers and other professionals that work on their cases, said Kathleen Kyle, the association’s executive director.

The loan, listed in the range of $1 million to $2 million, covered a little less than two months of payroll for the 108-person association, she said.

Monday’s data release also included which banks passed the money from the federal government to businesses.

The banks collect interest on loans that aren’t forgiven and lending fees from the government.

Everett-based Coastal Community Bank acted as a lender for 2,700 loans, with more than 1,300 going to Snohomish County businesses.

“Obviously, we were happy to take part in the program, help our local small businesses and keep the money in our community,” CEO Eric Sprink said.

For information on how to apply for the program, visit www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program.

Correction: A previous version cited an earlier rule for the percent of the federal loan that must be spent on payroll to be forgiven. The Paycheck Protection Program loan forgiveness payroll threshold is 60%.

Joey Thompson: 425-339-3449; jthompson@heraldnet.com. Twitter: @byjoeythompson.

To see a list of all Snohomish County companies that received more than $150,000 from the federal program, find this story on www.heraldnet.com.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.