By The Herald Editorial Board

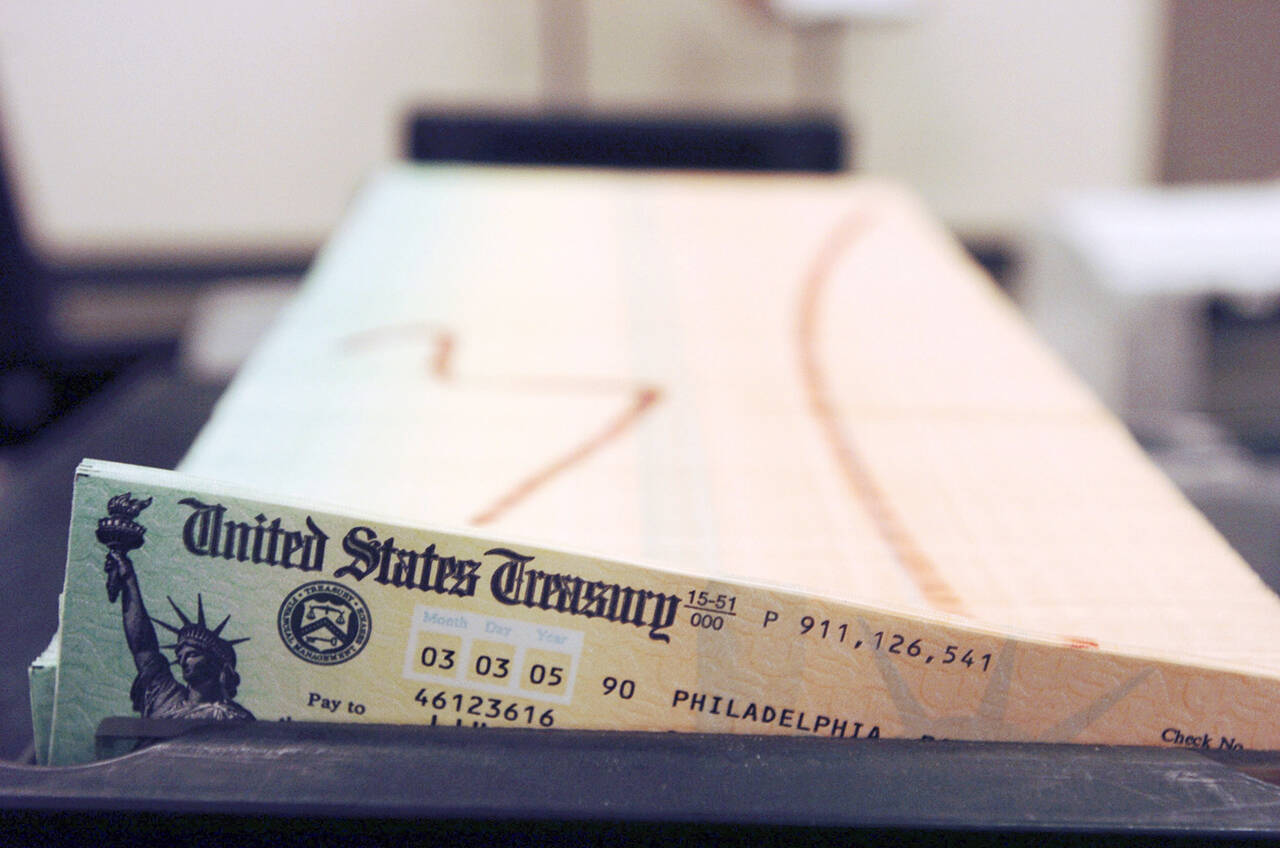

The coronavirus pandemic has left many of us and our financial outlooks looking a little worse for wear. The same is true for Social Security’s and Medicare’s trust funds — the pools of money that workers pay into, then expect to draw from after retirement.

Because of the pandemic and its hit to jobs and the economy, the latest annual report by the Social Security Board of Trustees wasn’t expected to be good. And while it wasn’t as bad as some had feared, the pandemic has still shaved about a year off last year’s estimate for when Social Security’s trust funds for Old-Age and Survivors Insurance (OASI) and Disability Insurance programs would be depleted and benefits would have to be reduced.

In the latest reports by trustees, the OASI fund will not be able to pay full benefits as of 2033, a year earlier than the previous year’s report; the disability fund wouldn’t be able to pay full benefits as of 2057, a longer time frame, but eight years shorter than last year’s report.

At the same time, for Medicare’s trust fund, the depletion date is unchanged from last year’s report, but comes much sooner — in 2026 — than for Social Security. When its reserves are depleted, Medicare Part A’s Hospital Insurance fund would have only enough income to cover about 91 percent of expected benefits that year, declining to 78 percent by 2045.

What that means for retirees, current and future — unless Congress takes action sometime in the next 11 years — is that retirees as of 2033 can expect a significant reduction in benefits. As of July, the average monthly Social Security payment for retired workers was about $1,550; with its trust fund depleted by 2033, the program — essentially supported only by those currently employed — would have to reduce benefits by about 24 percent, to about $1,180 a month.

What’s significant in this year’s report is that 2021 is the first year that the retiree benefits being paid out exceed what is being collected in payroll taxes, more quickly depleting the trust fund.

The trust funds for Social Security and Medicare had faced this uncertainty long before covid; the result of an aging baby boom generation entering retirement, declining birth rates and reduced FICA payroll tax contributions by workers. Income for Social Security’s trust funds are expected to be flat through 2090, but its costs are projected to continue increasing through 2075.

Congress has no shortage of proposals it can consider to increase revenue for the trust funds and/or find savings in what the programs pay out. At the same time, other legislation has paired such proposals with increases in benefits for some.

Among the more significant proposals has been an increase or removal of the cap at which income is taxed. Currently, workers and their employers each pay a 6.2 percent payroll tax for Social Security and 1.45 percent each for Medicare, but that tax is capped at $142,800 in annual income. Make more than that and you don’t pay tax on the difference.

Legislation proposed in 2019, the Social Security 2100 Act, would have kept the current cap, but would have removed it for those making more than $400,000. It also sought a modest increase in the payroll tax over time. That legislation has not been reintroduced in the current Congress.

Other proposals have suggested slowing the growth of benefits, depending on income; raising the retirement age, while still allowing a benefit for those 62 and older who can no longer work; and automatically enrolling workers in supplemental retirement accounts, allowing those enrolled in 401(k) or IRA investments to opt out.

One of the difficulties in building support for reform of Social Security has been the attitude that there’s plenty of time to fix this later; that’s especially true for those whose retirements are still decades away; rather than years counted in single digits.

One bill that has been introduced in Congress this year could shake that complacency. Introduced by Sen. Ron Wyden, D-Ore., and cosponsored by Sen. Patty Murray, D-Wash., the Know Your Social Security Act would require the Social Security Administration to mail annual statements to workers 25 and older, reporting what they can expect in benefits when they retire. Since 2011, the SSA has provided those statements, but only to a limited group of workers, those 60 and older who have not registered for an online account with SSA.

An annual reminder of what workers can expect at retirement — especially one that reflects a significant drop in benefits as of 2033 — would help workers plan for their own retirement investments and could also push them to push Congress on solutions.

Organizations, notably the Center for Budget and Policy Priorities, are correct that Social Security and Medicare are not — as some critics have claimed — bankrupt, nor are the programs facing an imminent financial crisis. Still, timely action is necessary.

“Acting sooner rather than later to improve the programs’ ability to provide the full benefits upon which beneficiaries rely would cool overheated rhetoric and bolster public confidence,” it noted in a statement following the release of the trustees’ report. As well, changes as soon as possible will only add to the time available to begin building back the trust funds’ reserves.

Congress, as it works through a budget reconciliation process this year, has the opportunity to take one or more steps — perhaps starting with removal of the payroll tax cap for higher-income earners — that can buy itself, workers and employers more time to consider further reforms.

Social Security will celebrate its centennial in 2035; that milestone shouldn’t be marked two years before with a reduction in the benefits to those who have paid into the system their entire working lives.

Talk to us

> Give us your news tips.

> Send us a letter to the editor.

> More Herald contact information.